Get the free Time for Filing Employment Tax Returns and Modifications to the Deposit Rules - irs

Show details

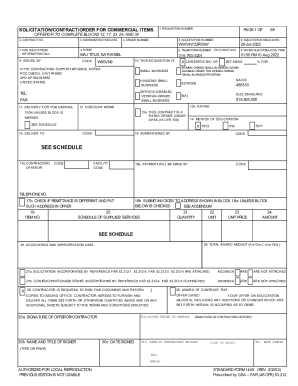

This document establishes temporary regulations regarding the Employers’ Annual Federal Tax Program (Form 944), detailing requirements for employers on filing employment tax returns and making deposits

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign time for filing employment

Edit your time for filing employment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your time for filing employment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing time for filing employment online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit time for filing employment. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out time for filing employment

How to fill out Time for Filing Employment Tax Returns and Modifications to the Deposit Rules

01

Review the specific IRS form required for filing employment tax returns, such as Form 941 or Form 944.

02

Gather all necessary payroll information, including employee wages, tips, and withheld taxes.

03

Calculate the total employment taxes owed based on the payroll data collected.

04

Determine the correct filing deadlines based on the form you are using and your business's deposit schedule.

05

Complete the form accurately, ensuring all information is filled out and calculated correctly.

06

If necessary, make modifications to prior filings according to IRS guidelines and included instructions.

07

Submit the completed form to the IRS by the deadline, either electronically or via mail.

Who needs Time for Filing Employment Tax Returns and Modifications to the Deposit Rules?

01

Employers who have employees and are required to withhold payroll taxes.

02

Businesses that need to report employment taxes accurately to avoid penalties and interest.

03

Tax professionals who manage payroll taxes for their clients.

04

Any entity that has a change in employee status or payroll that affects tax liabilities.

Fill

form

: Try Risk Free

People Also Ask about

What is the 3 day rule for payroll tax deposit?

Semiweekly schedule depositors have at least 3 business days following the close of the semiweekly period to make a deposit. If any of the 3 weekdays after the end of a semiweekly period is a legal holiday in the District of Columbia, you'll have an additional day for each of those days to make the required deposit.

What is a deposit rule?

Deposit Rules provide a way to manage the deposit requirements for reservations, blocks, and related events. They specify deposit amounts or percentages and when deposits must be paid.

What is the next day deposit rule for 941?

Next-day deposit rule If you accumulate $100,000 or more in taxes on any day during a monthly or semiweekly deposit period, then you must deposit the tax by the next business day.

What is the IRS 100k deposit rule?

$100,000 next-day deposit rule - Regardless of whether you're a monthly schedule depositor or a semiweekly schedule depositor, if you accumulate taxes of $100,000 or more on any day during a deposit period, you must deposit the taxes by the next business day after you accumulate the $100,000.

What are the new IRS rules for cash deposits?

The limit for lump sum cash payments and deposits for related transactions is $10,000 within a 12-month period before reporting is required. There is no specific monthly limit. However, if the amount exceeds $10,000, you must report it to the IRS.

What is the IRS deposit rule?

Monthly schedule depositors should deposit taxes from all of their paydays in a month by the 15th of the next month, even if they pay wages every week. Employers with prior payrolls and taxes of $2,500 or more per quarter must determine if they make either monthly schedule deposits, or semiweekly schedule deposits.

How long do you have to amend a payroll tax return?

Generally, you may correct overreported taxes on a previously filed Form 941 if you file Form 941-X within 3 years of the date Form 941 was filed or 2 years from the date you paid the tax reported on Form 941, whichever is later.

How much money can you deposit without getting flagged by the IRS?

Depositing $10,000 or more in cash means your bank or credit union will report it to the federal government. The $10,000 threshold was created as part of the Bank Secrecy Act, passed by Congress in 1970, and adjusted with the Patriot Act in 2002.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Time for Filing Employment Tax Returns and Modifications to the Deposit Rules?

The Time for Filing Employment Tax Returns refers to the deadlines by which employers must report and submit their employment taxes to the IRS. Modifications to the Deposit Rules pertain to changes in the way employers are required to deposit employment taxes, including adjustments to schedules and methods of payment.

Who is required to file Time for Filing Employment Tax Returns and Modifications to the Deposit Rules?

All employers who pay wages to employees are required to file Employment Tax Returns and comply with the Deposit Rules. This includes businesses of all sizes, non-profit organizations, and governmental entities that have employees subject to payroll taxes.

How to fill out Time for Filing Employment Tax Returns and Modifications to the Deposit Rules?

To fill out the Employment Tax Returns, employers must complete the appropriate IRS forms (e.g., Form 941, Form 940, etc.) with accurate information regarding wages paid, taxes withheld, and deposits made. They need to follow detailed instructions provided by the IRS to ensure compliance with the regulations.

What is the purpose of Time for Filing Employment Tax Returns and Modifications to the Deposit Rules?

The purpose is to ensure that employers accurately report income and payroll taxes to the IRS in a timely manner. This helps in the proper funding of social insurance programs and provides the government with vital revenue for public services.

What information must be reported on Time for Filing Employment Tax Returns and Modifications to the Deposit Rules?

Employers must report total wages paid, the amount of federal income tax withheld, social security and Medicare taxes collected, and any adjustments due to overpayment or errors. Additionally, employers must report their tax deposit schedules and any modifications to their filing or deposit requirements as stipulated by the IRS.

Fill out your time for filing employment online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Time For Filing Employment is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.