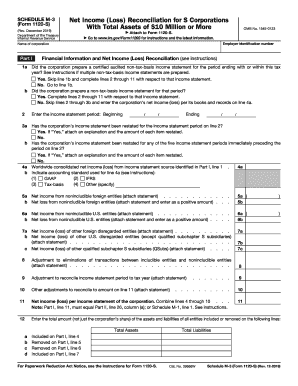

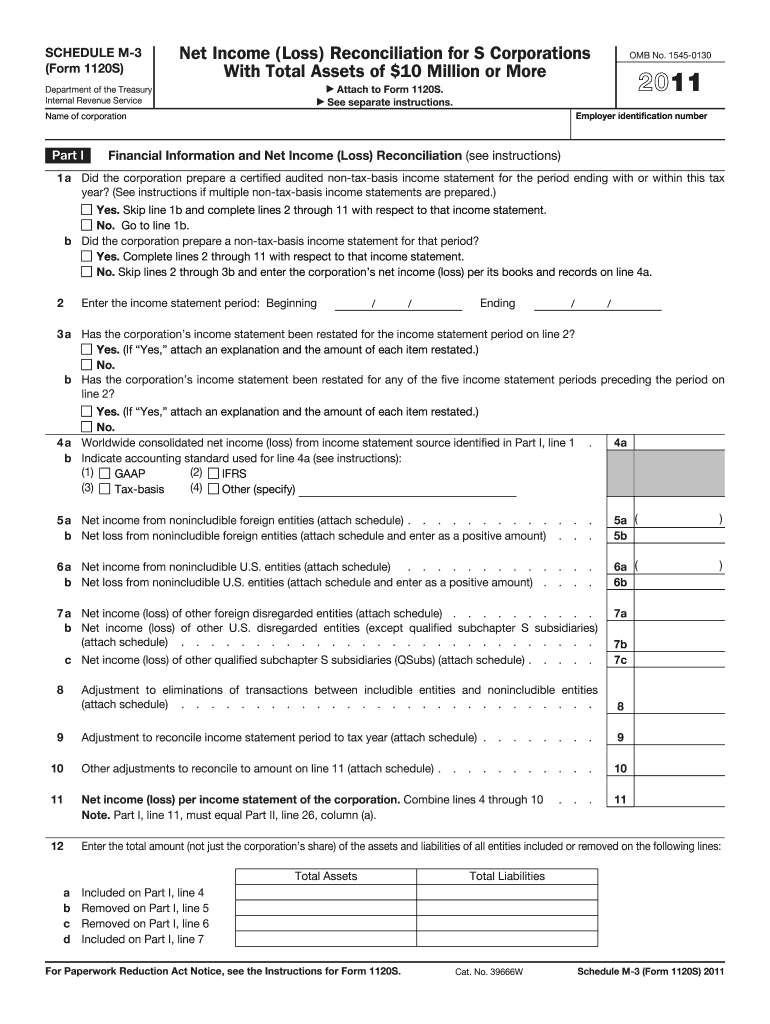

IRS 1120S - Schedule M-3 2011 free printable template

Instructions and Help about IRS 1120S - Schedule M-3

How to edit IRS 1120S - Schedule M-3

How to fill out IRS 1120S - Schedule M-3

About IRS 1120S - Schedule M-3 2011 previous version

What is IRS 1120S - Schedule M-3?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1120S - Schedule M-3

What should I do if I notice a mistake on my filed form 1120 2011?

If you recognize an error on your submitted form 1120 2011, you should file an amended return using Form 1120X. This allows you to correct any mistakes and ensure your tax information is accurate. Keep in mind that you need to explain the changes in detail and attach any necessary supporting documents.

How can I verify if my form 1120 2011 was received?

You can check the status of your submitted form 1120 2011 by contacting the IRS directly or utilizing the IRS e-File status tool if you filed electronically. It’s important to have your personal details and submission details handy for verification. Tracking your submission helps ensure that it has been processed correctly.

What are common pitfalls to avoid when filing form 1120 2011?

Common pitfalls include incorrect numerical entries, missing signatures, and not keeping adequate records for the deductions claimed. Additionally, skipping the review of potential e-file rejection codes can lead to submission issues, so ensure to double-check all entries before filing your form 1120 2011.

How long should I retain records related to form 1120 2011?

Generally, you should keep records related to form 1120 2011 for at least three years after the filing date. However, if you have unreported income or if your return is particularly complex, you may want to retain documents for longer periods. This helps safeguard against any audits or future discrepancies.