CA Form P-25 2003 free printable template

Show details

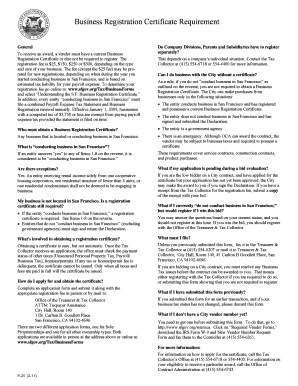

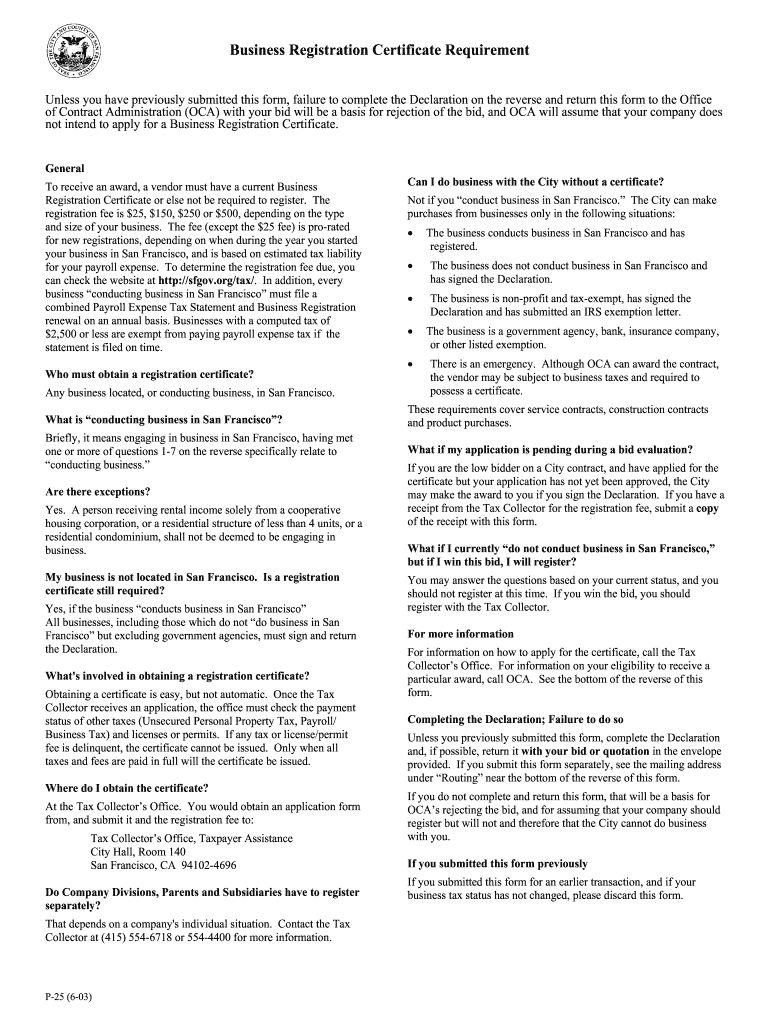

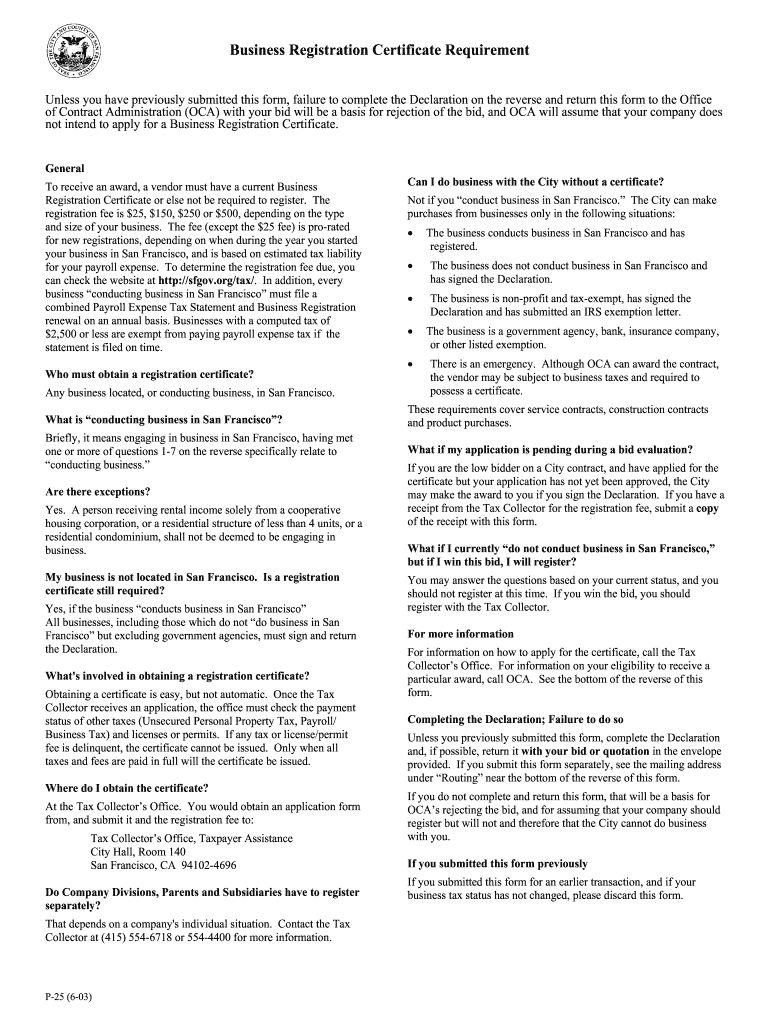

You would obtain an application form from and submit it and the registration fee to Tax Collector s Office Taxpayer Assistance City Hall Room 140 San Francisco CA 94102-4696 Do Company Divisions Parents and Subsidiaries have to register separately That depends on a company s individual situation. Contact the Tax Collector at 415 554-6718 or 554-4400 for more information. P-25 6-03 If you are the low bidder on a City contract and have applied for ...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA Form P-25

Edit your CA Form P-25 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA Form P-25 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit CA Form P-25 online

Follow the steps below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit CA Form P-25. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA Form P-25 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CA Form P-25

How to fill out CA Form P-25

01

Obtain a copy of CA Form P-25 from the relevant authority or website.

02

Fill in your personal information at the top section, including your name, address, and contact details.

03

Indicate the purpose of filling out the form by selecting the appropriate box or writing a brief description.

04

Provide any required identification numbers, such as Social Security Number or Tax ID.

05

Complete any additional sections as instructed, ensuring that all required information is accurately filled in.

06

Review the completed form for any errors or omissions.

07

Sign and date the form in the designated section.

08

Submit the form as instructed, either by mail or electronically.

Who needs CA Form P-25?

01

Individuals or entities who are looking to report specific information or requests to the California Department of Tax and Fee Administration.

02

Taxpayers who need to correct prior submissions or register for certain tax-related purposes.

03

Businesses that need to comply with state regulations regarding their operations.

Fill

form

: Try Risk Free

People Also Ask about

Who has to file Nevada Modified Business Tax?

Every employer who is subject to Nevada Unemployment Compensation Law (NRS 612) is also subject to the Modified Business Tax on total gross wages less employee health care benefits paid by the employer.

What is the tax form for an LLC in NC?

To choose corporate tax treatment for your LLC, file IRS Form 2553. This requires the LLC to file a separate federal income tax return each year. Corporations are also taxed by North Carolina at a rate of 5 percent of annual income and must pay a franchise tax each year. File Form CD-405 with the Department of Revenue.

What is a modified business tax return in Nevada?

Nevada Modified Business Tax: Everything You Need to Know Nevada modified business tax covers total gross wages (amount of all wages plus any tips for each calendar quarter), minus employee health care benefits paid by the business. Tax is based on gross wages paid by the employer during a calendar quarter.

Who needs to file Nevada Commerce tax return?

Business entities with Nevada gross revenue over $4,000,000 during the taxable year are required to file the Commerce Tax return. Refer to Filing Requirements FAQs for more information.

What is a business tax form?

Use Schedule C (Form 1040) to report income or loss from a business you operated or a profession you practiced as a sole proprietor. An activity qualifies as a business if: Your primary purpose for engaging in the activity is for income or profit.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my CA Form P-25 directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your CA Form P-25 and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I edit CA Form P-25 from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including CA Form P-25, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How do I execute CA Form P-25 online?

pdfFiller has made it easy to fill out and sign CA Form P-25. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

What is CA Form P-25?

CA Form P-25 is a tax form used in California for reporting and remitting personal income tax payments to the state.

Who is required to file CA Form P-25?

Individuals and entities that have a tax liability based on their income and are required to make estimated tax payments must file CA Form P-25.

How to fill out CA Form P-25?

To fill out CA Form P-25, taxpayers must provide their personal information, such as name, address, social security number, and the amount of estimated tax payment for the reporting period.

What is the purpose of CA Form P-25?

The purpose of CA Form P-25 is to allow taxpayers to submit their estimated personal income tax payments on a quarterly basis to avoid underpayment penalties.

What information must be reported on CA Form P-25?

CA Form P-25 requires reporting of the taxpayer's name, address, social security number, the amount of estimated tax due, and the periods covered for the payments.

Fill out your CA Form P-25 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA Form P-25 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.