Get the free Payment Upon Termination - lrc ky

Show details

337.020 Time of payment of wages -- Exception. Every employer doing business in this state shall, as often as semimonthly, pay to each of its employees all wages or salary earned to a day not more

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign payment upon termination

Edit your payment upon termination form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your payment upon termination form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit payment upon termination online

In order to make advantage of the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit payment upon termination. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out payment upon termination

How to fill out payment upon termination:

01

Gather all necessary information: Before filling out the payment upon termination form, gather all relevant information such as the employee's name, date of termination, reason for termination, and any outstanding payments or benefits owed.

02

Review employment contract: Refer to the employee's employment contract to understand the terms and conditions regarding payment upon termination. This will help ensure that you are following the agreed-upon guidelines and providing the correct amount of compensation.

03

Calculate final payment: Calculate the final payment owed to the employee upon termination. This may include salary or wages for any remaining days worked, accrued vacation or paid time off, unused sick leave, and any additional compensation or benefits as outlined in the employment contract.

04

Deduct applicable taxes and deductions: Determine any applicable taxes or deductions that need to be withheld from the final payment. This may include income taxes, social security contributions, retirement plan contributions, or any other deductions required by law or specified in the employment contract.

05

Issue payment: Once all calculations have been made and deductions have been applied, issue the final payment to the employee. This can be in the form of a check, direct deposit, or any other agreed-upon method of payment.

06

Provide documentation: Along with the payment, provide the employee with a detailed breakdown of how the final payment amount was calculated. This will help clarify any questions or concerns the employee may have and ensure transparency.

07

Keep records: Maintain a copy of the payment upon termination form and all supporting documentation for your records. This will serve as a reference in case of any future disputes or audits.

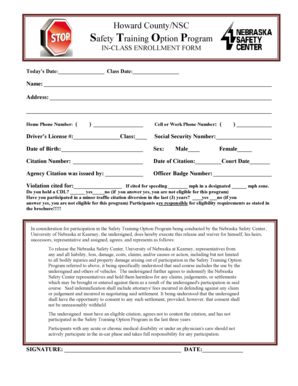

Who needs payment upon termination:

01

Employees who have been terminated: When an employee is terminated from their job, they are entitled to receive payment for any outstanding amounts owed to them. This includes their final paycheck, accrued vacation or paid time off, and any other compensation or benefits as outlined in their employment contract.

02

Contract workers or freelancers: In some cases, contract workers or freelancers may also be entitled to payment upon termination, depending on the terms specified in their contract or agreement. It is important to review the terms and conditions of the contract to determine the payment obligations upon termination.

03

Individuals with termination clauses: Certain individuals, such as executives or high-level employees with termination clauses in their employment contracts, may have specific payment obligations or severance packages in the event of termination. These clauses should be reviewed carefully to ensure compliance with the agreed-upon terms.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is payment upon termination?

Payment upon termination refers to the compensation that an employer must provide to an employee when their employment is terminated.

Who is required to file payment upon termination?

Employers are required to file payment upon termination for employees who are terminated from their job.

How to fill out payment upon termination?

Employers must document the details of the final payment and provide a breakdown of the compensation given to the terminated employee.

What is the purpose of payment upon termination?

The purpose of payment upon termination is to ensure that employees receive the appropriate compensation when their employment ends.

What information must be reported on payment upon termination?

Employers must report details such as final wages, accrued vacation pay, severance pay, and any other compensation given upon termination.

Where do I find payment upon termination?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the payment upon termination in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I execute payment upon termination online?

Completing and signing payment upon termination online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How can I fill out payment upon termination on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your payment upon termination. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

Fill out your payment upon termination online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Payment Upon Termination is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.