Canada T1-ADJ E 2012 free printable template

Show details

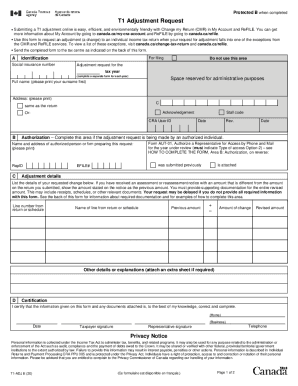

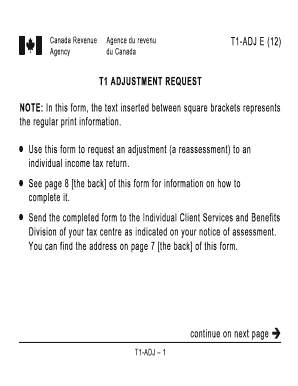

T1 ADJUSTMENT REQUEST Use this form to request an adjustment a reassessment to an individual income tax return. See the back of this form for information on how to complete it. Send the completed form to the Individual Client Services and Benefits Division of your tax centre as indicated on your notice of assessment. You can find the address on the back of this form* A For filing Identification Social insurance number Adjustment request for the PSN DO NOT USE THIS AREA tax year complete a...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Canada T1-ADJ E

Edit your Canada T1-ADJ E form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada T1-ADJ E form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Canada T1-ADJ E online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit Canada T1-ADJ E. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada T1-ADJ E Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada T1-ADJ E

How to fill out Canada T1-ADJ E

01

Obtain the T1-ADJ E form from the Canada Revenue Agency (CRA) website or your local tax office.

02

Fill in your personal information, including your name, address, and Social Insurance Number (SIN).

03

Indicate the tax year for which you are filing the adjustment.

04

In the 'Adjusted Information' section, provide the details of the original claim that you wish to change.

05

Include any new documents or information that supports your adjustment request.

06

Calculate your revised total and adjust any applicable credits or deductions.

07

Sign and date the form to certify that the information provided is correct.

08

Send the completed form to the address specified for your jurisdiction on the CRA website.

Who needs Canada T1-ADJ E?

01

Individuals who need to correct errors on their previously filed T1 tax returns.

02

Anyone who has received new information that affects their tax situation after filing.

03

Taxpayers who want to claim additional deductions or credits not included in the original return.

04

Individuals who believe they've been assessed incorrectly and need to adjust their tax assessments.

Fill

form

: Try Risk Free

People Also Ask about

How long does a tax adjustment take?

Your amended return will take up to 3 weeks after you mailed it to show up on our system. Processing it can take up to 16 weeks.

How many years back can you request a T1 adjustment?

Select the year Generally, you can request a change only to a tax return from any of the 10 previous calendar years. For example, if you make a request in 2022, it must relate to the 2012 or later tax returns.

How do you complete a T1 Adjustment?

By mail a completed Form T1-ADJ, T1 Adjustment Request. all supporting documents for the change, including those for the original assessment, unless you have already sent them to the CRA.

How do I submit a T1 adjustment?

By mail a completed Form T1-ADJ, T1 Adjustment Request. all supporting documents for the change, including those for the original assessment, unless you have already sent them to the CRA.

What is a T1 adj form?

T1-ADJ E (08) Use this form to request an adjustment (a reassessment) to an individual income tax return. See the back of this form for information on how to complete it. Send the completed form to the Individual Client Services and Benefits Division of your tax centre as indicated on your notice of assessment.

What is a T1 form?

The T1 General form is the primary document used to file personal income taxes in Canada. It captures everything from total income to net income to taxable income and lets you know whether you'll have a balance owing on your taxes or be due to receive a refund.

Can I do T1 adjustment online?

If you did not file your return online, you can use Change my return (CMR) which is a secure My Account service that allows you to make an online adjustment. Otherwise, you will have to mail a paper Form T1-ADJ, T1 Adjustment Request, to the Canada Revenue Agency (CRA).

Where can I get a T1 form?

If you have a CRA My Account, you can find your T1 for the current year, as well as the past 11 years that you filed, by looking under the \u201ctax returns view\u201d section. If you look for anything older, you will need to contact the CRA directly at 1-800-959-8281 to request a copy.

What is a T1 adjustment request?

If you are an individual taxpayer, what you need to do is file a T1 Adjustment Request. The CRA allows individual taxpayers to adjust tax returns filed going back up to 10 years. This is a relatively simple procedure in most cases. You can obtain the T1 ADJ form from the CRA website.

Can I submit my T1 online?

Log in to My Account and select Change my return. Adjust a T1 tax return online with certified EFILE or NETFILE software.

How long does a T1 adjustment take?

Our goal is to issue your notice of reassessment or a letter within 20 weeks of receiving your adjustment request. Note: COVID-19: Expect the normal timeframe to be extended to 10 to 12 weeks in most cases for processing T1 adjustments submitted by paper.

What is a T1 adjustment form?

T1-ADJ E (08) Use this form to request an adjustment (a reassessment) to an individual income tax return. See the back of this form for information on how to complete it. Send the completed form to the Individual Client Services and Benefits Division of your tax centre as indicated on your notice of assessment.

How long does it take the IRS to make an adjustment?

When filing an amended or corrected return: Include copies of any forms and/or schedules that you're changing or didn't include with your original return. To avoid delays, file Form 1040-X only after you've filed your original return. Allow the IRS up to 16 weeks to process the amended return.

Where can I get a T1 Adjustment form?

If you are an individual taxpayer, what you need to do is file a T1 Adjustment Request. The CRA allows individual taxpayers to adjust tax returns filed going back up to 10 years. This is a relatively simple procedure in most cases. You can obtain the T1 ADJ form from the CRA website.

Can I do T1 Adjustment online?

If you did not file your return online, you can use Change my return (CMR) which is a secure My Account service that allows you to make an online adjustment. Otherwise, you will have to mail a paper Form T1-ADJ, T1 Adjustment Request, to the Canada Revenue Agency (CRA).

How do I file a T1 Adjustment Request?

By mail a completed Form T1-ADJ, T1 Adjustment Request. all supporting documents for the change, including those for the original assessment, unless you have already sent them to the CRA.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit Canada T1-ADJ E online?

With pdfFiller, the editing process is straightforward. Open your Canada T1-ADJ E in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I fill out Canada T1-ADJ E using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign Canada T1-ADJ E and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

How do I complete Canada T1-ADJ E on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your Canada T1-ADJ E from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is Canada T1-ADJ E?

Canada T1-ADJ E is a tax form used by Canadian residents to request a change or adjustment to a previously filed income tax return (T1).

Who is required to file Canada T1-ADJ E?

Individuals who need to correct mistakes or omissions on their filed T1 income tax return are required to file the Canada T1-ADJ E form.

How to fill out Canada T1-ADJ E?

To fill out Canada T1-ADJ E, one should obtain the form from the Canada Revenue Agency (CRA) website, provide the necessary details from the original return, indicate the adjustments being requested, and submit the completed form to the CRA.

What is the purpose of Canada T1-ADJ E?

The purpose of the Canada T1-ADJ E is to allow taxpayers to correct errors or make changes to their tax returns, ensuring accurate reporting and proper assessment of taxes owed or refunds due.

What information must be reported on Canada T1-ADJ E?

The information that must be reported on Canada T1-ADJ E includes personal identification details, the tax year in question, a summary of the changes being requested, and any relevant supporting documents.

Fill out your Canada T1-ADJ E online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada t1-ADJ E is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.