Get the free petition for summery administration forms for fl

Get, Create, Make and Sign summary administration florida forms

Editing petition for summary administration form online

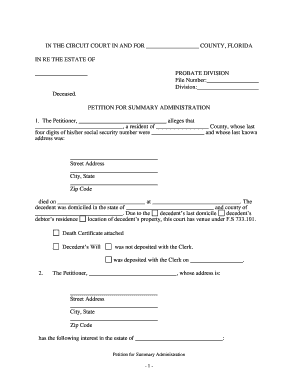

How to fill out summary administration florida form

How to fill out FL Summary Administration Checklist

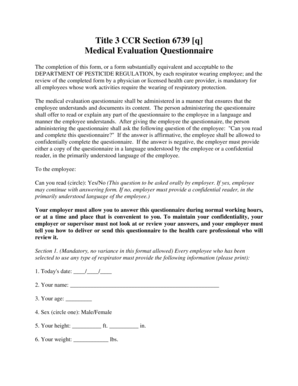

Who needs FL Summary Administration Checklist?

Video instructions and help with filling out and completing petition for summery administration forms for fl

Instructions and Help about florida petition for administration form

What is a summary administration this is the simpler of two types of probate administration and is used when the estate qualifies the qualifying guidelines for the estate are one of the death occurred over two years ago from the date of the administration or to the value of the property that has to be probated non-probate items are excluded does not exceed 75000 the Florida probate is started by the designated personal representative or a family member who may be inheriting the property who files with the probate court what is known as a petition for summary administration the petition states that the estate qualifies for this type of administration states the assets that are to be probated and lists known beneficiaries who must each sign the petition if there is a surviving spouse this individual must sign the petition the court doesn't appoint a personal representative but instead if the probate qualifies for the summary administration the court issues a court order that releases the probate property to the individuals or entities that are listed in the original petition the beneficiary will then use this court order to transfer the remaining assets to the heirs subscribe to our channel for more informational videos on Florida probate we can help you with your probate or inherited Florida property call us today five six one three seven zero eight three five get your free step-by-step Florida probate guide and checklist by going to our website probate solutions FL com click the link below this video

People Also Ask about florida summary administration form printable

What is a Florida order of summary administration intestate?

How much does an attorney charge for summary administration in Florida?

How to file summary administration in Florida without a lawyer?

What is the summary administration process in Florida?

How long does summary administration take in Florida?

How long does it take to get letters of administration in Florida?

How do I file a petition for summary administration in Florida?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is the purpose of florida summary administration form?

What information must be reported on florida summary administration form?

What is florida summary administration form?

Who is required to file florida summary administration form?

How to fill out florida summary administration form?

Can I create an eSignature for the florida order of summary form in Gmail?

How do I fill out petition for summary administration florida form using my mobile device?

Can I edit florida summary administration on an Android device?

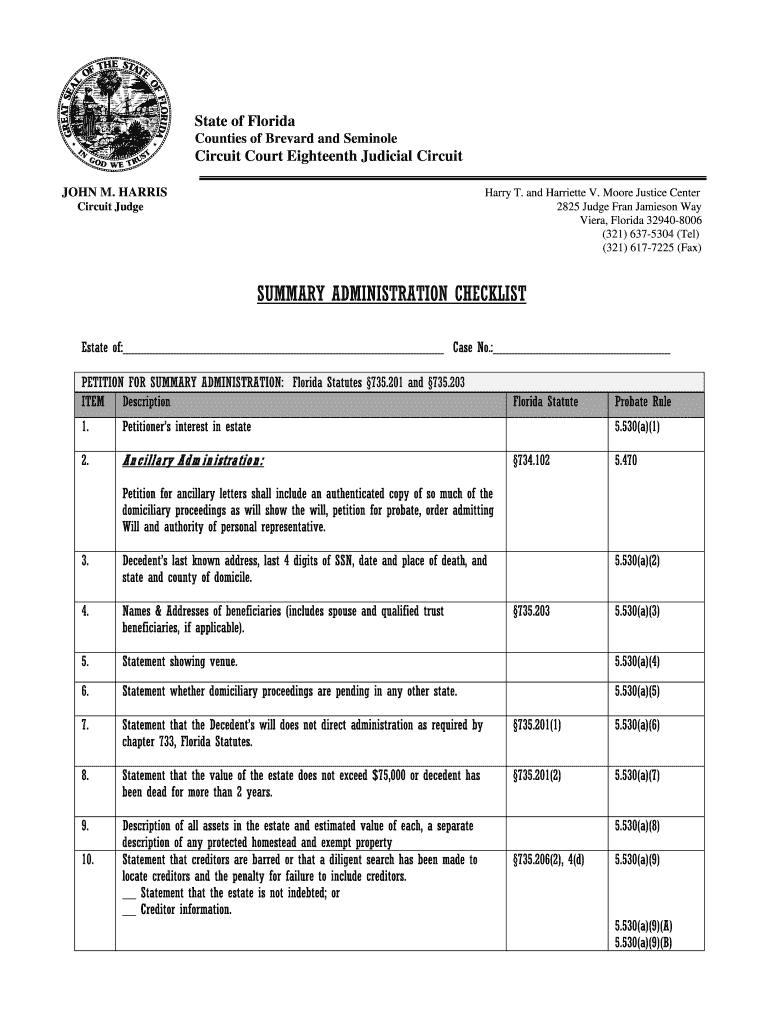

What is FL Summary Administration Checklist?

Who is required to file FL Summary Administration Checklist?

How to fill out FL Summary Administration Checklist?

What is the purpose of FL Summary Administration Checklist?

What information must be reported on FL Summary Administration Checklist?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.