Get the free Offer of Additional Uninsured Motorists Coverage and Optional Underinsured Motorists...

Show details

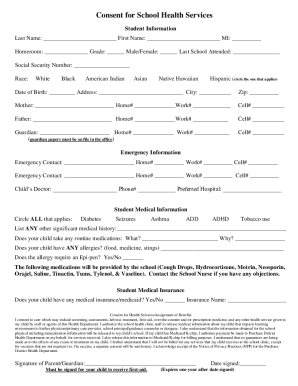

This form outlines the options for uninsured and underinsured motorists coverage in accordance with South Carolina insurance laws, requiring the insured to select their desired coverage limits and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign offer of additional uninsured

Edit your offer of additional uninsured form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your offer of additional uninsured form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit offer of additional uninsured online

Follow the guidelines below to use a professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit offer of additional uninsured. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out offer of additional uninsured

How to fill out Offer of Additional Uninsured Motorists Coverage and Optional Underinsured Motorists Coverage

01

Begin by obtaining the Offer of Additional Uninsured Motorists Coverage form from your insurance provider.

02

Read through the form carefully to understand the coverage options available.

03

Provide your personal information, including your name, address, and policy number.

04

Indicate the amount of additional uninsured motorists coverage you wish to add by selecting your preferences on the form.

05

Review the optional underinsured motorists coverage section and choose an amount that suits your needs.

06

Sign and date the form to confirm your acceptance of the coverage options.

07

Submit the completed form to your insurance provider for processing.

Who needs Offer of Additional Uninsured Motorists Coverage and Optional Underinsured Motorists Coverage?

01

Anyone who drives a vehicle and wants extra protection in case they are involved in an accident with an uninsured or underinsured driver.

02

Individuals residing in areas with a high number of uninsured motorists.

03

Drivers who frequently commute or travel may benefit added peace of mind from this coverage.

Fill

form

: Try Risk Free

People Also Ask about

Will my insurance go up if I use an underinsured motorist claim Progressive?

California Law Forbids Insurers to Raise Rates That means your rates cannot legally go up when you try to get the compensation you need and deserve after an auto accident.

What is excess uninsured and underinsured motorist?

In layman's terms, UM/UIM coverage is insurance that pays for the client's injuries from an accident caused by the owner or operator of an uninsured or underinsured vehicle. Excess UM/UIM from a personal umbrella policy pays after the auto policy's UM/UIM limits have been exhausted.

What does $100 k /$ 300k /$ 100k mean?

The numbers in the coverage refer to the maximum amount your insurer will pay out for each type of claim. So, in a 100/300/100 policy, you would have $100,000 coverage per person, $300,000 in bodily injury coverage per accident, and $100,000 in property damage coverage per accident.

What is uninsured underinsured motorist coverage?

Uninsured motorist coverage protects you if you're hit by a driver who has no auto insurance. Underinsured motorist coverage, which is usually offered alongside uninsured motorist coverage, protects you if you're hit by a driver who doesn't have enough coverage to pay for the damages or injuries they caused.

What are the disadvantages of uninsured motorist coverage?

Policy limits: Uninsured motorist coverage comes with limits, just like other insurance coverages. Severe accidents might exceed these limits, leaving you with uncovered expenses. Claim disputes: There might be disputes over the extent of your coverage and the amount you can claim, leading to potential legal battles.

Should I get stacked or unstacked insurance?

The main advantage of an unstacked policy over a stacked one is that it can reduce your premium. However, due to the lower bodily injury coverage limits, you may have to cover your medical costs out of your own pocket if you are injured in a car accident with an uninsured at-fault driver.

Will my insurance go up if I use an underinsured motorist claim Progressive?

California Law Forbids Insurers to Raise Rates That means your rates cannot legally go up when you try to get the compensation you need and deserve after an auto accident.

What's the difference between UM and UIM?

Key Differences Between UIM and UM Coverage UM Coverage: Protects you when the at-fault driver has no insurance at all. UIM Coverage: Protects you when the at-fault driver has insufficient insurance to cover the full cost of your damages.

Which of the following would not be covered by uninsured motorist coverage?

The insured causes a head-on collision with the car of an uninsured motorist. This is the only listed scenario that uninsured motorist coverage would NOT apply to, as the insured is the one at fault in this accident.

Do I need uninsured motorist and underinsured motorist coverage?

California law does not require you to carry uninsured motorist (UM) or underinsured motorist (UIM) coverage—so, legally, you don't need either one. However, UM/UIM is an important and commonsense coverage to carry.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Offer of Additional Uninsured Motorists Coverage and Optional Underinsured Motorists Coverage?

The Offer of Additional Uninsured Motorists Coverage and Optional Underinsured Motorists Coverage is a provision provided by insurers that allows policyholders to purchase additional coverage beyond the required minimum limits for uninsured and underinsured motorists. This coverage protects drivers in the event they are in an accident with a driver who lacks enough insurance to cover damages.

Who is required to file Offer of Additional Uninsured Motorists Coverage and Optional Underinsured Motorists Coverage?

Insurance companies are required to file the Offer of Additional Uninsured Motorists Coverage and Optional Underinsured Motorists Coverage with state regulators. They must present these options to consumers when issuing or renewing auto insurance policies.

How to fill out Offer of Additional Uninsured Motorists Coverage and Optional Underinsured Motorists Coverage?

To fill out this offer, the policyholder should provide their personal information, including name and address, select the desired levels of coverage for both additional uninsured motorists and optional underinsured motorists, and acknowledge receipt of the offer by signing and dating the document.

What is the purpose of Offer of Additional Uninsured Motorists Coverage and Optional Underinsured Motorists Coverage?

The purpose of this offer is to provide consumers with choices for additional financial protection against the risk of accidents involving uninsured or underinsured motorists, thereby ensuring that victims can recover damages for injuries and losses.

What information must be reported on Offer of Additional Uninsured Motorists Coverage and Optional Underinsured Motorists Coverage?

The information that must be reported includes the names of the policyholder and insurance company, the coverage limits offered, any applicable premiums for the coverage options, as well as a clear explanation of the benefits of having this additional coverage.

Fill out your offer of additional uninsured online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Offer Of Additional Uninsured is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.