Get the free Offer of Additional Uninsured Motorists Coverage and Optional Underinsured Motorists...

Show details

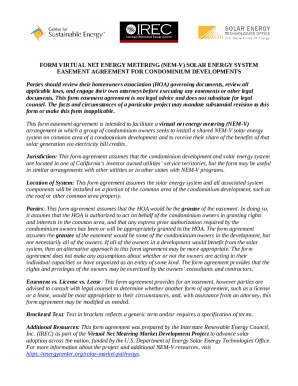

This document offers additional insurance coverage for uninsured and underinsured motorists under South Carolina law. It includes instructions for acceptance, rejection, and details on coverage limits

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign offer of additional uninsured

Edit your offer of additional uninsured form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your offer of additional uninsured form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing offer of additional uninsured online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit offer of additional uninsured. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out offer of additional uninsured

How to fill out Offer of Additional Uninsured Motorists Coverage and Optional Underinsured Motorists Coverage

01

Obtain the Offer of Additional Uninsured Motorists Coverage and Optional Underinsured Motorists Coverage form from your insurance provider.

02

Read the instructions carefully to understand the coverage options available.

03

Fill in your personal details, including your name, address, and policy number.

04

Indicate the desired limits of coverage for both uninsured and underinsured motorists.

05

Review the costs associated with the additional coverage and ensure you understand the implications for your premium.

06

Sign and date the form to acknowledge your choice regarding the additional coverage.

07

Submit the completed form to your insurance agent or directly to the insurance company.

Who needs Offer of Additional Uninsured Motorists Coverage and Optional Underinsured Motorists Coverage?

01

Individuals who drive frequently and want additional protection against uninsured or underinsured motorists.

02

People who live in areas with high rates of uninsured drivers.

03

Motorists seeking peace of mind when it comes to potential accidents with different insurance coverage levels.

04

Any driver who wants to minimize their financial exposure in the event of an accident caused by an uninsured or underinsured driver.

Fill

form

: Try Risk Free

People Also Ask about

What are the disadvantages of uninsured motorist coverage?

Policy limits: Uninsured motorist coverage comes with limits, just like other insurance coverages. Severe accidents might exceed these limits, leaving you with uncovered expenses. Claim disputes: There might be disputes over the extent of your coverage and the amount you can claim, leading to potential legal battles.

Will my insurance go up if I use an underinsured motorist claim Progressive?

California Law Forbids Insurers to Raise Rates That means your rates cannot legally go up when you try to get the compensation you need and deserve after an auto accident.

What is excess uninsured and underinsured motorist?

In layman's terms, UM/UIM coverage is insurance that pays for the client's injuries from an accident caused by the owner or operator of an uninsured or underinsured vehicle. Excess UM/UIM from a personal umbrella policy pays after the auto policy's UM/UIM limits have been exhausted.

Which of the following would not be covered by uninsured motorist coverage?

The insured causes a head-on collision with the car of an uninsured motorist. This is the only listed scenario that uninsured motorist coverage would NOT apply to, as the insured is the one at fault in this accident.

Will my insurance go up if I use an underinsured motorist claim Progressive?

California Law Forbids Insurers to Raise Rates That means your rates cannot legally go up when you try to get the compensation you need and deserve after an auto accident.

What does $100 k /$ 300k /$ 100k mean?

The numbers in the coverage refer to the maximum amount your insurer will pay out for each type of claim. So, in a 100/300/100 policy, you would have $100,000 coverage per person, $300,000 in bodily injury coverage per accident, and $100,000 in property damage coverage per accident.

What's the difference between UM and UIM?

Key Differences Between UIM and UM Coverage UM Coverage: Protects you when the at-fault driver has no insurance at all. UIM Coverage: Protects you when the at-fault driver has insufficient insurance to cover the full cost of your damages.

Do I need uninsured motorist and underinsured motorist coverage?

California law does not require you to carry uninsured motorist (UM) or underinsured motorist (UIM) coverage—so, legally, you don't need either one. However, UM/UIM is an important and commonsense coverage to carry.

Should I get stacked or unstacked insurance?

The main advantage of an unstacked policy over a stacked one is that it can reduce your premium. However, due to the lower bodily injury coverage limits, you may have to cover your medical costs out of your own pocket if you are injured in a car accident with an uninsured at-fault driver.

What is uninsured underinsured motorist coverage?

Uninsured motorist coverage protects you if you're hit by a driver who has no auto insurance. Underinsured motorist coverage, which is usually offered alongside uninsured motorist coverage, protects you if you're hit by a driver who doesn't have enough coverage to pay for the damages or injuries they caused.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Offer of Additional Uninsured Motorists Coverage and Optional Underinsured Motorists Coverage?

The Offer of Additional Uninsured Motorists Coverage provides the potential for higher coverage limits for damages caused by uninsured motorists. Optional Underinsured Motorists Coverage offers protection when the at-fault driver's insurance is insufficient to cover the damages incurred.

Who is required to file Offer of Additional Uninsured Motorists Coverage and Optional Underinsured Motorists Coverage?

Insurance companies are typically required to provide this offer to policyholders when they purchase or renew their auto insurance policy.

How to fill out Offer of Additional Uninsured Motorists Coverage and Optional Underinsured Motorists Coverage?

To fill out the offer, policyholders need to review the coverage options, select the desired limits, and sign the provided documentation to indicate their choice or declination of the coverage.

What is the purpose of Offer of Additional Uninsured Motorists Coverage and Optional Underinsured Motorists Coverage?

The purpose is to enhance the financial protection of policyholders against accidents involving uninsured or underinsured drivers, ensuring adequate coverage for medical expenses and damages.

What information must be reported on Offer of Additional Uninsured Motorists Coverage and Optional Underinsured Motorists Coverage?

The offer must report the available coverage limits, the policyholder's choices regarding acceptance or rejection of the coverage, and any relevant details regarding premiums and terms.

Fill out your offer of additional uninsured online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Offer Of Additional Uninsured is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.