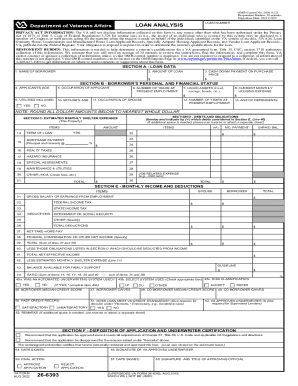

VA 26-6393 2012 free printable template

Show details

OMB Control No. 29000523

Respondent Burden: 30 minutes

Expiration Date: 06/30/2019

LOAN CUMBERLAND ANALYSISPRIVACY ACT INFORMATION: The VA will not disclose information collected on this form to any

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign VA 26-6393

Edit your VA 26-6393 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your VA 26-6393 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing VA 26-6393 online

Follow the guidelines below to use a professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit VA 26-6393. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

VA 26-6393 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out VA 26-6393

How to fill out VA 26-6393

01

Obtain a copy of VA Form 26-6393, either online or from your local VA office.

02

Begin filling out the applicant's personal information at the top of the form, including name, social security number, and contact information.

03

Provide details about the property you are seeking financing for, including address, type of property, and intended use.

04

Fill in information regarding your military service, including branch, service dates, and discharge status.

05

Indicate your desired loan amount and any other relevant financial information, including income and debts.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form before submitting it to the appropriate VA office or lender.

Who needs VA 26-6393?

01

Veterans looking to apply for a VA-backed home loan.

02

Active-duty service members seeking mortgage assistance.

03

Certain qualifying members of the National Guard and Reserves.

04

Surviving spouses of veterans who have not remarried and are eligible for benefits.

Fill

form

: Try Risk Free

People Also Ask about

Does VA require reserves on a manual underwrite?

A large down payment is a compensating factor. Three months reserves. Manual underwriting requires one-month reserves. Part-time or other documented income that is not used as qualified income.

What is the VA cash-out rule?

For all Type 1 cash-out refinances paying off an existing VA loan the fee recoupment period is required and it must be between 0 and 36 (months), or the guaranty will not be issued. Note: The fee recoupment period must be between 0 and 36.

Do lenders look at cash reserves?

If you plan to take out a mortgage to buy a home, your lender may also want to see a healthy savings account or some other type of assets that you can use as mortgage reserves. Having financial reserves shows lenders you will be able cover your mortgage should there be any changes in your income or an emergency.

Does VA require reserves on a 2 unit property?

The VA has specific cash-reserve requirements for multifamily borrowers. You'll need to have at least six months' worth of monthly mortgage payments as well as associated taxes and insurance available in cash assets to qualify for a VA multifamily loan.

What are the VA cash reserve requirements?

The VA requires reserves totaling three months of principal, interest, tax, and insurance (PITI) payments for the rental property(ies). For example, say the mortgage on your rental property is $1,500/month, which includes all the PITI elements (as most residential mortgages do).

What is VA loan analysis?

The purpose of this Circular is to announce updates to VA Form 26-6393, VA Loan Analysis. 2. Background. VA Form 26-6393 is used to determine the ability of a borrower to qualify for a VA-guaranteed loan. The form is required for all loans subject to VA underwriting requirements under 38 CFR § 36.4340.

How does a VA appraiser determine value?

The first purpose of the VA appraisal is to establish a “fair market value” for the property. A lender is going to finance whichever is less between the appraised value and the purchase price of the home. Appraisers will look at recent comparable home sales, or “comps,” to help determine the property's value.

How to make VA loan offer stand out?

Here are some tips to make your offer stand out: Add a personalized letter. Offer above the asking price if you can. Put down more earnest money. Ask your loan officer to vouch for you. Be flexible. Get creative. Have your agent contact the seller's listing agent.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my VA 26-6393 directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your VA 26-6393 as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

Can I create an electronic signature for signing my VA 26-6393 in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your VA 26-6393 right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I fill out the VA 26-6393 form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign VA 26-6393 and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is VA 26-6393?

VA Form 26-6393 is a document used by the U.S. Department of Veterans Affairs to provide information related to the financial aspects of a veterans' housing loan.

Who is required to file VA 26-6393?

Veterans, service members, and eligible dependents applying for a VA home loan guarantee are required to file VA Form 26-6393.

How to fill out VA 26-6393?

To fill out VA Form 26-6393, applicants should gather necessary personal and financial information and follow the instructions provided on the form to complete sections such as identification, financial details, and housing loan information.

What is the purpose of VA 26-6393?

The purpose of VA Form 26-6393 is to collect relevant financial information from veterans and other eligible individuals to evaluate their eligibility for a VA-backed home loan.

What information must be reported on VA 26-6393?

Information that must be reported on VA Form 26-6393 includes personal identification details, income, debts, assets, and other financial obligations related to the housing loan application.

Fill out your VA 26-6393 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

VA 26-6393 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.