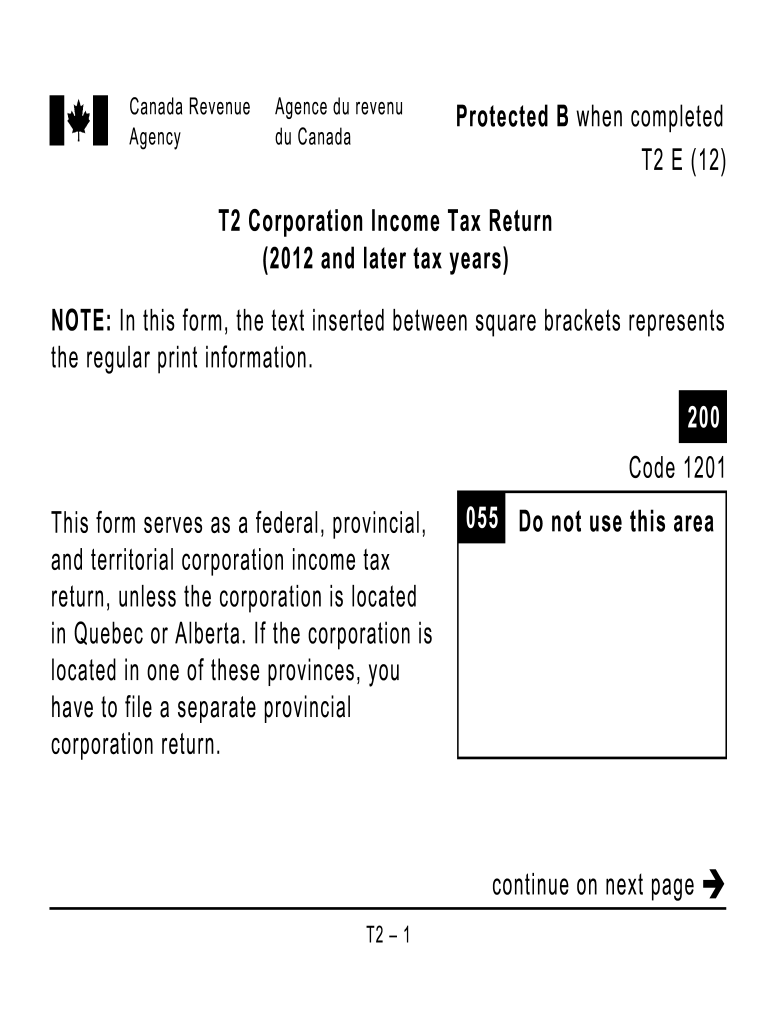

Get the free from t2 for 2012 and later form - cra-arc gc

Show details

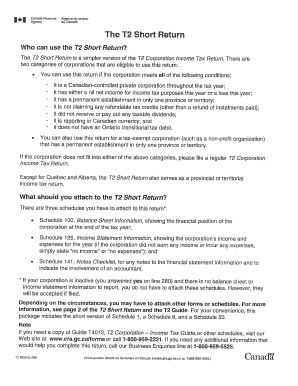

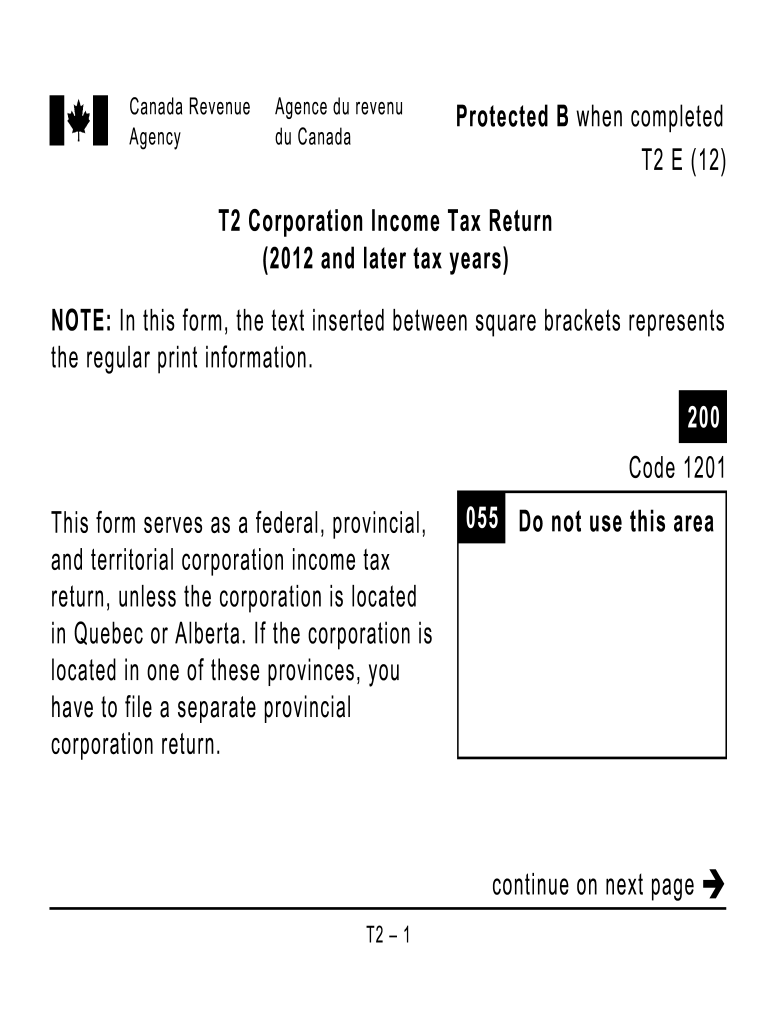

Canada Revenue Agency Agence du revenu du Canada Protected B when completed T2 E 12 T2 Corporation Income Tax Return 2012 and later tax years NOTE In this form the text inserted between square brackets represents the regular print information. Code 1201 This form serves as a federal provincial and territorial corporation income tax return unless the corporation is located in Quebec or Alberta. If the corporation is located in one of these provinces you have to file a separate provincial...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign from t2 for 2012

Edit your from t2 for 2012 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your from t2 for 2012 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit from t2 for 2012 online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit from t2 for 2012. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out from t2 for 2012

How to fill out form T2 for 2012?

01

Start by gathering all the necessary information and documents. This includes your company's financial statements, income and expense records, and relevant supporting documentation such as receipts and invoices.

02

Ensure that you have the correct version of form T2 for the year 2012. The form can be downloaded from the official website of the Canada Revenue Agency (CRA).

03

Begin filling out the form by carefully following the instructions provided. Pay attention to each section and provide accurate information. Some key sections to focus on include:

3.1

Part 1: Identifying Information - Fill out your company's business number, legal name, and address.

3.2

Part 3: Accounting Method - Indicate the accounting method used by your company. You can choose either the cash method or the accrual method.

3.3

Part 4: Balance Sheet Information - Report the value of your company's assets, liabilities, and equity as per your financial statements.

3.4

Part 6: Income - Provide details about your company's income, including revenue, gains, and other sources of income.

3.5

Part 7: Expenses - Itemize your company's expenses, including costs of goods sold, wages, utilities, and other relevant operating expenses.

3.6

Part 9: Corporate Tax Calculation - Calculate your company's taxable income and determine the amount of tax owed based on the applicable tax rates.

04

Once you have completed the form, review it carefully to ensure accuracy and completeness. Double-check all the information provided, and make any necessary corrections before submitting.

Who needs form T2 for 2012?

01

Canadian corporations - Form T2 is specifically designed for Canadian corporations to report their income, expenses, and taxes owed to the CRA.

02

Corporations with a fiscal year ending in 2012 - If your corporation's fiscal year ended in 2012, you are required to file form T2 for that year.

03

Corporations subject to Canadian corporate income tax - Corporations that are subject to Canadian corporate income tax must complete and file form T2 to report their financial and tax information to the CRA.

It is important for corporations to accurately fill out form T2 for 2012 as failure to do so or providing incorrect information may result in penalties or legal consequences. To ensure compliance, it is recommended to seek professional advice or consult the CRA's guidelines for specific instructions and requirements.

Fill

form

: Try Risk Free

People Also Ask about

What is a T2 form mean?

Form T-2 shall be used for statements of eligibility of individuals designated to act as trustees under trust indentures to be qualified pursuant to Sections 305 or 307 of the Trust Indenture Act of 1939.

What is T 2 2023 benefit?

The T 2 benefit information form is not a government issue form. This form comes from insurance agencies to gather information from seniors and sell them final expense life insurance.

What is a T2 form in Florida?

Form T-2 Statement Of Eligibility Under The Trust Indenture Act-An Individual Designated To Act As Trustee (SEC1849) Form. This is a Official Federal Forms form and can be use in Securities And Exchange Commission.

Why did I get a T2 form?

This particular T-2 form does not come from a government agency and is not a tax form of any kind. It actually comes from insurance agents or marketing companies hoping to gather your personal information. Some seniors think their personal information comes from a state's database.

What is a T 2 form used for?

Form T-2 shall be used for applications to determine the eligibility of an individual trustee pursuant to Section 305(b)(2) of the Act. B. Obligations Deemed To Be in Default. Item 9 requires disclosure of defaults by the obligor on securities issued under indentures under which the applicant is trustee.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit from t2 for 2012 from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like from t2 for 2012, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

Can I create an electronic signature for the from t2 for 2012 in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your from t2 for 2012.

How do I edit from t2 for 2012 straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing from t2 for 2012.

What is from t2 for and?

From T2 is a tax form used in Canada to report business income and expenses.

Who is required to file from t2 for and?

Corporations and certain other entities in Canada are required to file the T2 tax form.

How to fill out from t2 for and?

The T2 form must be filled out with information about the corporation's income, expenses, and other financial details.

What is the purpose of from t2 for and?

The purpose of the T2 form is to calculate the amount of tax owed by the corporation based on its income and expenses.

What information must be reported on from t2 for and?

The T2 form requires information such as the corporation's income, expenses, assets, liabilities, and tax credits.

Fill out your from t2 for 2012 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

From t2 For 2012 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.