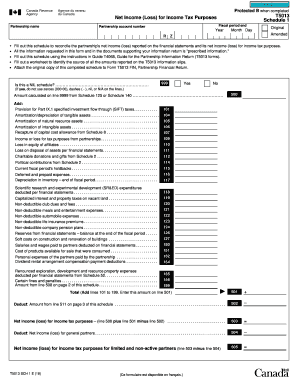

Canada T5013 SCH 1 E 2011 free printable template

Get, Create, Make and Sign Canada T5013 SCH 1 E

How to edit Canada T5013 SCH 1 E online

Uncompromising security for your PDF editing and eSignature needs

Canada T5013 SCH 1 E Form Versions

How to fill out Canada T5013 SCH 1 E

How to fill out Canada T5013 SCH 1 E

Who needs Canada T5013 SCH 1 E?

Instructions and Help about Canada T5013 SCH 1 E

Hello this is Jeffrey, and I'm one of the senior software tech specialist for enjoyed profile in this video we'll talk about the t-50 13 in the FX module the flow through which schedules and forms need to be filled out and what information within those schedules and forms are necessary to successfully create 8050 13 so let's get started so let's start out with the t-50 13 schedule 125 now a lot of this information such as the partnership name the partnership account number the fiscal period end will be populated from the info page if you filled it out partnership account number here a legal name I believe goes into the partnership name you just have to fill out the operating name description of the operation the sequence number will be filled out now a trick or tip here is if you notice that there are blue tax or blue amounts that will either come from another form or another schedule the black text is where you can fill out information or fill in the fields with an amount or some texts okay same applies down to the income statement information below, so you have your farming income your farming expenses other comprehensive income you would go according to your Giphy codes then you would fill out you also fill out your information up here non-farming income non-farming expenses cost of sales non-farming expenses operating expenses, so the key here is just to fill out this form here the t-50 13 schedule 125 if you have the information just fill it in here okay so now let's move on to the t 53 schedule 100 so when the schedule 100 is where the balance sheet information is being filled in according to your assets liabilities your member equity retained earnings I'll just make sure you fill out this form with the partnership name partnership account fiscal period end again whether it's original or amended so again as I mentioned in the other video the black text or black amounts are to be filled in and then the blue text or blue amounts come from a form or schedule so with the t-50 13 schedule 1 41 which is the financial statement notes checklist you would just go through each part and fill it out appropriately whether it's a yes or no whether it's a financial statements type of involvement with the financial statements in part to reservations part 4 is other information so anything that applies to I think that applies to this partnership then you would fill in the information appropriately whether it's amounts whether it's yes or no whether it's just answering the question go ahead and fill that out if it applies to okay let's move on to the schedule 1 t 5013 schedule 1 so with the t-50 13 schedule 1 you just want to fill in all the amounts that you have available whether its assets expenses any amounts that you do have available that you need to fill in into the schedule 1 just do so of course it would have to be with the block section any blue section such as 107 108 112 114 they're coming from schedules also the 155 is coming from a schedule 52...

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send Canada T5013 SCH 1 E to be eSigned by others?

How do I make edits in Canada T5013 SCH 1 E without leaving Chrome?

Can I sign the Canada T5013 SCH 1 E electronically in Chrome?

What is Canada T5013 SCH 1 E?

Who is required to file Canada T5013 SCH 1 E?

How to fill out Canada T5013 SCH 1 E?

What is the purpose of Canada T5013 SCH 1 E?

What information must be reported on Canada T5013 SCH 1 E?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.