Get the free Taxes And Preventative Roof Maintenance.pdf - GreenProducts.net

Show details

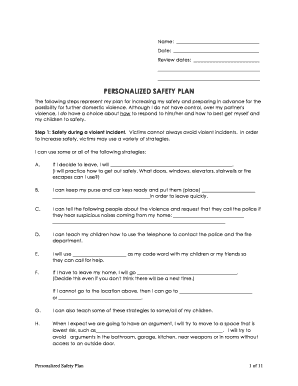

Taxes and Preventative Roof Maintenance

There are so many roofing materials, procedure and concepts offered today it is little wonder

that contractors, building owners, architects, and anyone else

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign taxes and preventative roof

Edit your taxes and preventative roof form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your taxes and preventative roof form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing taxes and preventative roof online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit taxes and preventative roof. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out taxes and preventative roof

How to fill out taxes and preventative roof:

01

Gather necessary documentation: Start by collecting all relevant financial documents such as W-2 forms, 1099 forms, and receipts for deductions. For the preventative roof, assess the current condition of your roof and determine if any repairs or maintenance are needed.

02

Organize your paperwork: Create a system to organize your tax documents. Keep records of any expenses related to your roof maintenance or repairs as well. This will help streamline the process when preparing your taxes and assessing the needs for your preventative roof.

03

Determine your filing status: Understand which filing status applies to you and your household (e.g., single, married filing jointly, etc.). This will impact the tax brackets and deductions available to you. Similarly, consider the type of roofing system you have and the specific maintenance requirements it may need to prevent future issues.

04

Complete the necessary tax forms: Depending on your situation, you may need to fill out forms such as the 1040, Schedule A for itemized deductions, or Schedule C for business income. Consult with a tax professional or utilize tax software to ensure accurate completion of the forms. When considering preventative roofing measures, consider the type of roof you have (e.g., asphalt shingles, metal roofing, etc.) and research the best practices for maintenance.

05

Deductible expenses: Identify any expenses that can be deducted on your taxes, such as mortgage interest, property taxes, or eligible business expenses. These deductions can help reduce your taxable income. Similarly, consider if any expenses related to your roof maintenance or repairs can be claimed as a deduction.

Who needs taxes and preventative roof?

01

Individuals and businesses: Everyone with taxable income needs to file taxes. Whether you are a salaried employee, a self-employed individual, or a business owner, properly filing taxes is necessary to comply with the law. Similarly, homeowners or property owners should consider preventative roofing measures to avoid potential damage and maintain the structural integrity of their properties.

02

Those eligible for deductions: Taxpayers who can claim deductions, such as homeowners with mortgage interest or self-employed individuals with business expenses, can benefit from properly filling out their taxes. Additionally, anyone who owns property and wants to secure their investment through a preventative roof should consider its importance.

03

Individuals seeking financial stability and security: Filing taxes accurately can help individuals maintain their financial stability by ensuring compliance with tax laws and potentially receiving refunds. Similarly, investing in preventative roof measures can provide long-term cost savings by preventing major roof damage that may require expensive repairs or replacement.

In conclusion, anyone with taxable income, eligibility for deductions, and concerns for property maintenance should prioritize properly filling out taxes and considering preventative roof measures.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send taxes and preventative roof to be eSigned by others?

Once you are ready to share your taxes and preventative roof, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I edit taxes and preventative roof straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing taxes and preventative roof.

How do I edit taxes and preventative roof on an iOS device?

Use the pdfFiller mobile app to create, edit, and share taxes and preventative roof from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is taxes and preventative roof?

Taxes are mandatory financial charges imposed by the government on individuals or businesses based on their income or profits. Preventative roof refers to the measures taken to maintain and protect the integrity of a building's roof to prevent damage or leaks.

Who is required to file taxes and preventative roof?

Individuals and businesses with income or property ownership are required to file taxes. Property owners or managers are responsible for preventative roof maintenance.

How to fill out taxes and preventative roof?

Taxes can be filled out online or through tax software, while preventative roof maintenance should be done regularly by checking for damages and fixing them as needed.

What is the purpose of taxes and preventative roof?

Taxes fund public services and infrastructure, while preventative roof maintenance helps protect the building from costly roof repairs or replacement.

What information must be reported on taxes and preventative roof?

Taxes require details of income, expenses, deductions, and credits, while preventative roof reports should include roof condition, maintenance history, and any repairs done.

Fill out your taxes and preventative roof online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Taxes And Preventative Roof is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.