Get the free 140nr

Get, Create, Make and Sign 140nr

How to edit 140nr online

Uncompromising security for your PDF editing and eSignature needs

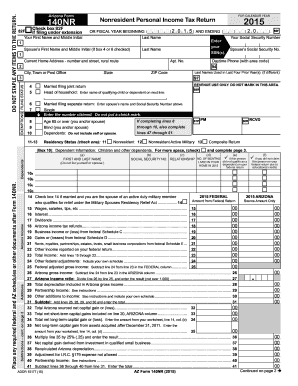

How to fill out 140nr

How to fill out az 140nr:

Who needs az 140nr:

Instructions and Help about 140nr

It's the tax helper back assisting you when looking for printable tax forms to file at the state and federal level, and today I'm going to go into Arizona and look for income tax forms in Arizona that are completely free so the first thing we need to do is go to google com and type in Arizona income tax forms and hit enter and the first listing you're going to see is AZ do our govt this is obviously the government website for Arizona go ahead and click that link and this is going to take you to the website that offers the printable tax forms for Arizona residents now it's important to note that we're still in late 2012 so the 2012 tax forms have not been released for the AZ 140 V which is one of the most common that people are going to use this is the electronic filing system also the 140 is not out as well which the 140 is going to be the one pretty much everybody uses in the state of California, or I'm sorry in the state of Arizona whether it be the electronic one or the printable one but that being said the 2011 still out, so you can click on any of these links here, and it will take you to the form from last year and the form from last year is going to be very similar to this year but do not fill out this form because it obviously says 2011 you want to wait for the 2012 one to come out and by the time you're watching this video it's highly likely that the 2012 will already be out so as you scroll down you know it gives you all the information about how you need to fill this out you know you're not going to have to read over all this stuff, but it never hurts to read it will tell you your standard deduction stuff like that but as you continue to scroll down you're going to actually get to the tax form down here now a lot of times there will be options to fill in this tax form this particular one does not allow you to fill it in this is just the printable version but recognize that there will be a there will be one that you can actually fill in before you print out it'll make the process much easier and as we get closer to taxi there will be plenty of websites that are helpful for Arizona residents it's not just my YouTube channel it's not just my website you know look on the AZ for gov look at the frequently asked questions stuff like that, but these are just some helpful ways to get the printable Arizona form 144 2012 if you have any questions please feel free to comment below and please like the video on YouTube if you find it helpful

People Also Ask about

What is the Arizona income tax rate for nonresident?

What is Arizona Form 140NR?

What is the federal tax rate for non residents?

Do I need to file an Arizona nonresident tax return?

Who must file 140NR?

Does Arizona have nonresident withholding?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit 140nr straight from my smartphone?

How do I fill out 140nr using my mobile device?

How can I fill out 140nr on an iOS device?

What is 140nr?

Who is required to file 140nr?

How to fill out 140nr?

What is the purpose of 140nr?

What information must be reported on 140nr?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.