Get the free 80 106

Show details

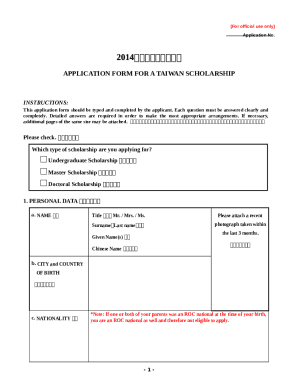

Form 80-106-12-8-1-000 (Rev. 05/12) Mississippi Individual / Fiduciary Income Tax Voucher Instructions Who Must File Estimates Every individual taxpayer who does not have at least eighty percent (80%)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 80 106

Edit your 80 106 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 80 106 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 80 106 online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 80 106. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 80 106

How to fill out 80 106:

01

Begin by gathering all the necessary information required for filling out 80 106. This may include personal details, financial information, or any other relevant documentation.

02

Carefully read and understand the instructions provided on the 80 106 form. Make sure you comprehend the purpose of the form and the specific sections that need to be completed.

03

Start filling out the form by accurately entering your personal information in the designated fields. This may include your full name, address, contact details, and any other required identification information.

04

Proceed to fill out the remaining sections of the form, following the provided guidelines. Ensure that all information provided is correct and up-to-date.

05

Double-check your entries for any errors or missing information. It is essential to be thorough and accurate when filling out the form to avoid any delays or complications.

06

Once you have completed filling out the 80 106 form, review it one last time to ensure everything is accurate and complete. Make any necessary corrections or additions as needed.

07

If required, attach any supporting documents or additional information that may be requested along with the 80 106 form.

08

Finally, submit the filled-out 80 106 form as per the instructions provided. This may involve mailing it to a specific address or submitting it electronically through an online platform.

Who needs 80 106:

01

Independent contractors or self-employed individuals who receive income in the form of dividends, rents, or nonemployee compensation may need to fill out the 80 106 form.

02

Those who have received income from the sale of stocks, bonds, or other financial assets may be required to complete this form.

03

Individuals who have received income from a partnership, estate, trust, or rental property might need to fill out the 80 106 form.

04

If you have received income from any other sources that are not categorized as regular wages, you may need to consult with a tax professional or refer to IRS guidelines to determine if the 80 106 form is necessary.

05

It is important to note that the need for the 80 106 form can vary depending on individual circumstances. It is advisable to consult with a tax advisor or refer to official IRS guidelines to determine your specific requirements.

Fill

form

: Try Risk Free

People Also Ask about

What income is not taxable in Mississippi?

Mississippi Income Taxes Starting in 2023, there is no tax on the first $10,000 of taxable income. The tax rate on taxable income above $10,000 will also be reduced to 4.7% in 2024, 4.4% in 2025, and 4% in 2026 and thereafter. Social Security benefits are not taxed by the state.

What is form 80-105?

80-105 | Resident Return. 80-106 | Individual/Fiduciary Income Tax Voucher. 80-107 | Income/Withholding Tax Schedule.

What is form 80 105?

80-105 | Resident Return. 80-106 | Individual/Fiduciary Income Tax Voucher. 80-107 | Income/Withholding Tax Schedule.

Who must file Mississippi income tax return?

Individuals must file a MS tax return if they have had any state taxes withheld from their wages. Nonresidents and partial-year residents must file Mississippi state taxes if they have income that was taxed by the state.

What is form 80 108?

Itemized Deductions. Individual taxpayers may elect to either itemize their individual nonbusiness deductions or claim a standard deduction.

What is the Mississippi tax extension form?

Mississippi Tax Extension Form: To request a Mississippi extension, file Form 80-106 by the original due date of your return and pay any income tax due. If you have an approved Federal tax extension (IRS Form 4868), you will automatically receive a Mississippi tax extension.

What is IRS form 80 107?

This form is for income earned in tax year 2022, with tax returns due in April 2023.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit 80 106 from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like 80 106, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How can I send 80 106 for eSignature?

When your 80 106 is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How can I get 80 106?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the 80 106 in a matter of seconds. Open it right away and start customizing it using advanced editing features.

What is 80 106?

80 106 is the form number used by the IRS for reporting contributions to political organizations.

Who is required to file 80 106?

Individuals or entities who make contributions to political organizations totaling $200 or more in a calendar year are required to file 80 106.

How to fill out 80 106?

Individuals can fill out 80 106 by providing their name, address, occupation, and the amount contributed to political organizations.

What is the purpose of 80 106?

The purpose of 80 106 is to provide transparency and accountability regarding contributions to political organizations.

What information must be reported on 80 106?

On form 80 106, individuals must report the name and address of the recipient political organization, as well as the total amount of contributions made.

Fill out your 80 106 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

80 106 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.