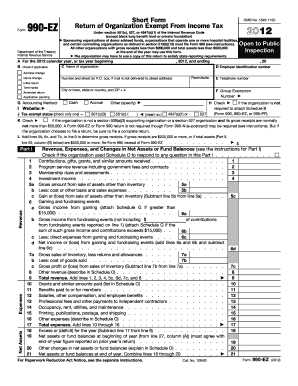

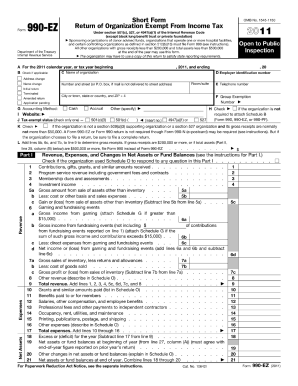

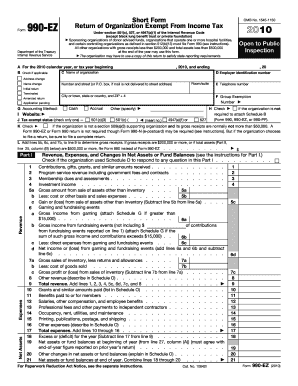

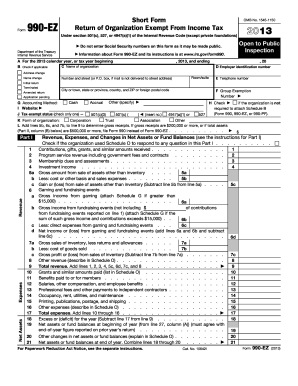

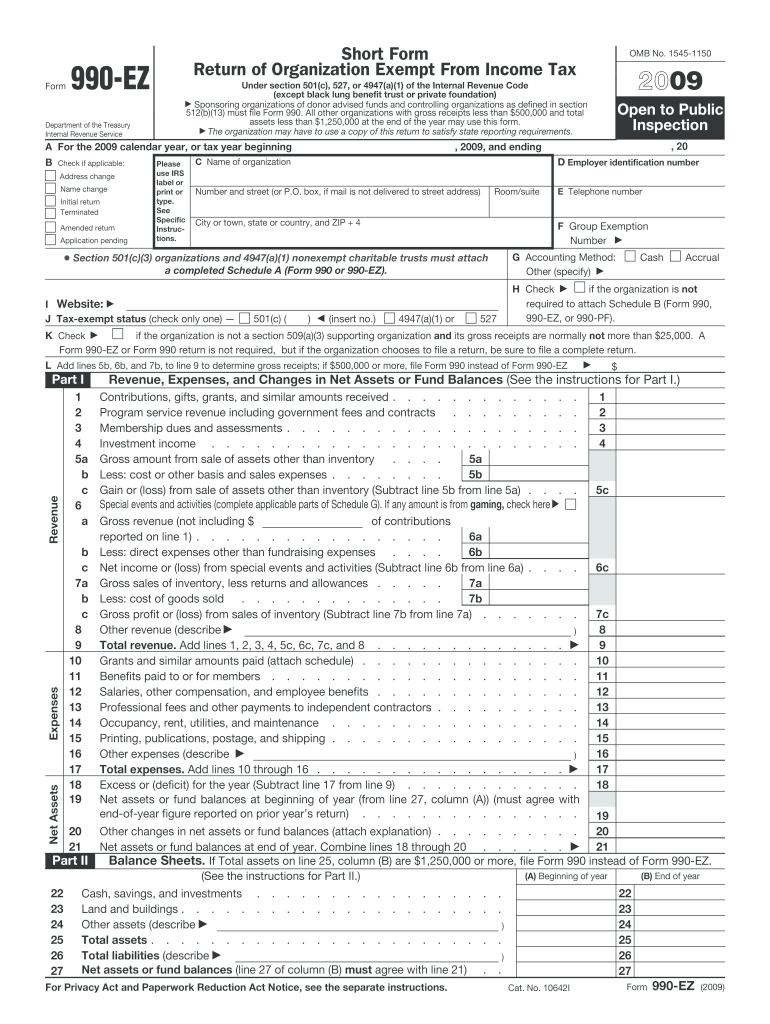

IRS 990-EZ 2009 free printable template

Instructions and Help about IRS 990-EZ

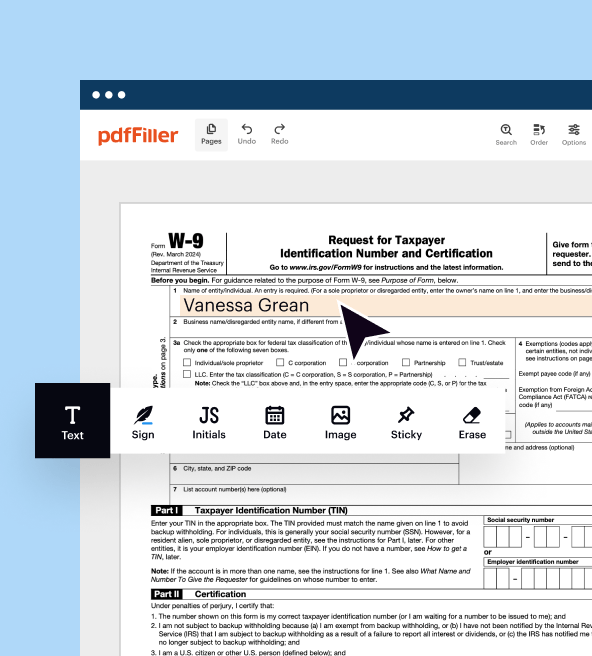

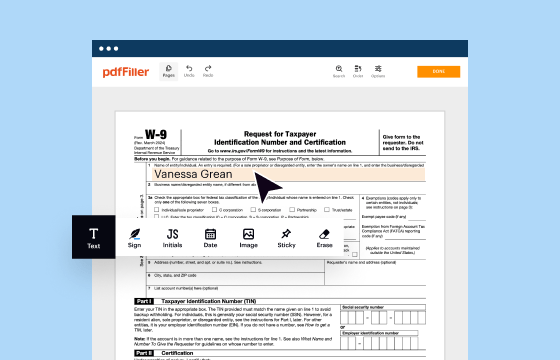

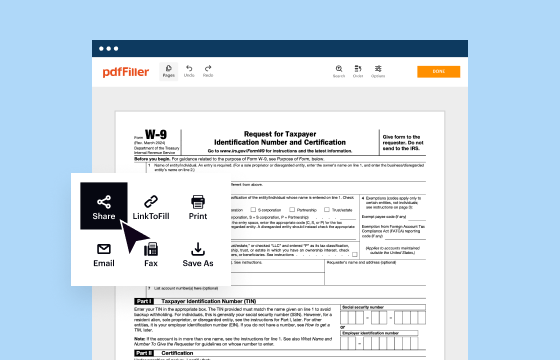

How to edit IRS 990-EZ

How to fill out IRS 990-EZ

About IRS 990-EZ 2009 previous version

What is IRS 990-EZ?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What payments and purchases are reported?

How many copies of the form should I complete?

What are the penalties for not issuing the form?

What information do you need when you file the form?

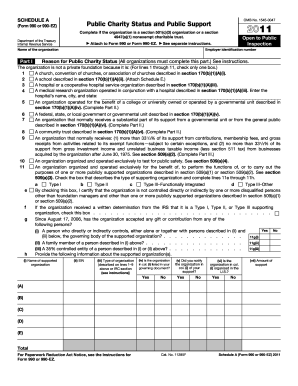

Is the form accompanied by other forms?

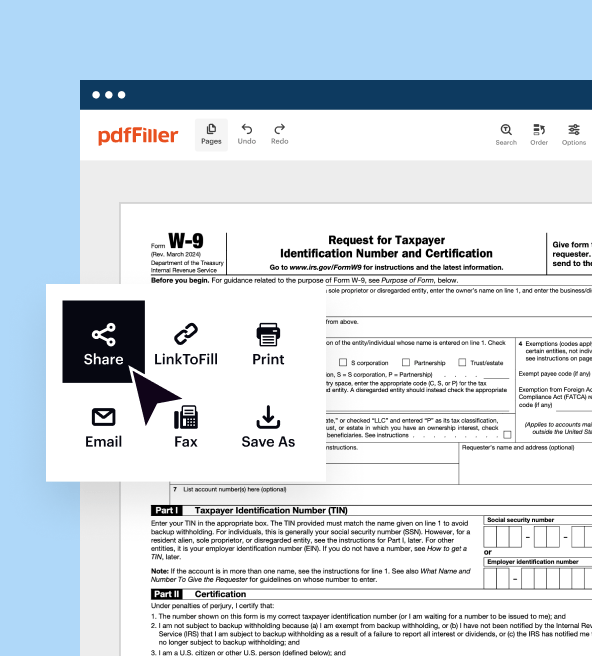

Where do I send the form?

FAQ about IRS 990-EZ

What should I do if I discover an error on my already submitted IRS 990-EZ?

If you find an error on your submitted IRS 990-EZ, you should file an amended return as soon as possible. The amendment process generally involves using Form 990-EZ again, indicating the corrections made. This ensures that your records are accurate and compliant, which is essential for maintaining your organization's tax-exempt status.

How can I verify if my IRS 990-EZ was received by the IRS?

To confirm receipt of your IRS 990-EZ, you can wait for an acknowledgment from the IRS, which typically takes a few weeks for e-filed returns. For those submitted by mail, you may consider using a traceable mailing method. Additionally, you can check the status by contacting the IRS directly if there are any delays or issues.

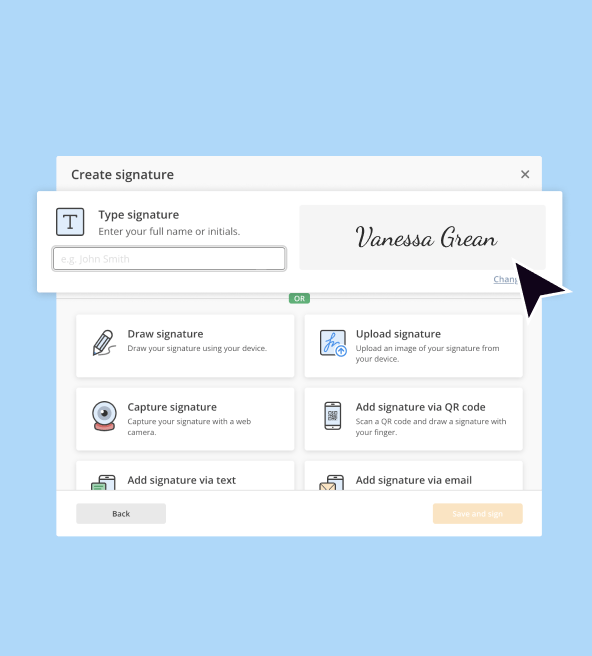

Are e-signatures accepted for the IRS 990-EZ?

Yes, e-signatures are accepted for IRS 990-EZ when filed electronically. It's essential to ensure that the e-signature process complies with IRS regulations, verifying the identity of the signer. This streamlines the filing process and enhances security while meeting legal requirements.

What are common mistakes to avoid when filing IRS 990-EZ?

Common mistakes when filing IRS 990-EZ include incorrect data entries, failing to report all revenue, and overlooking required disclosures. It's crucial to thoroughly review the form for accuracy before submission, as errors can lead to penalties or delays in processing. Utilizing software can help minimize these risks.

What should I do if my IRS 990-EZ submission is rejected?

If your IRS 990-EZ submission is rejected, you will typically receive a notice that outlines the reasons for the rejection. You should correct the identified issues promptly and resubmit the form, ensuring all guidelines are met to avoid further complications. Keep documentation of any communications with the IRS regarding the rejection.

See what our users say