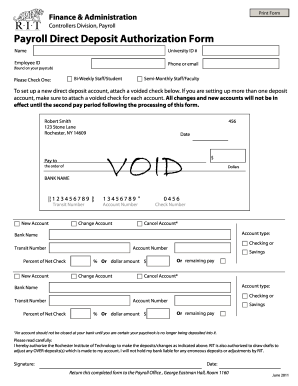

Get the free payoff mortgage form

Show details

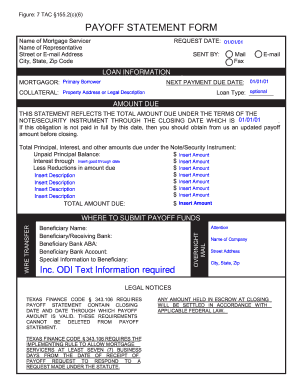

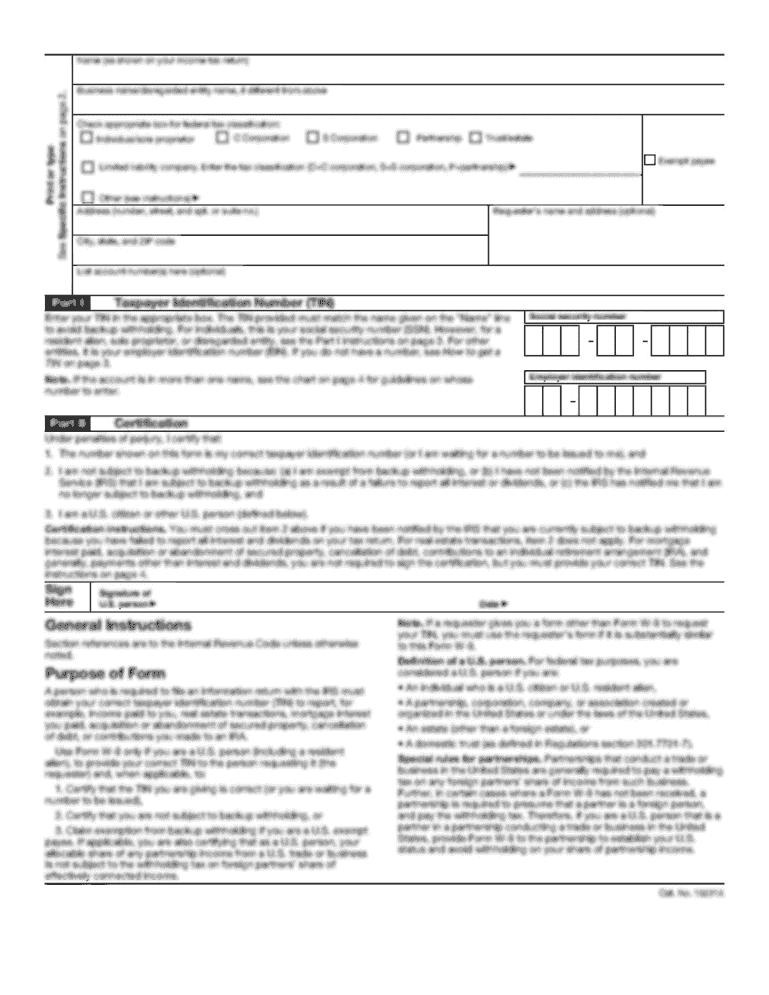

Title New Hampshire, LLC Phone (603) 620-9978 Fax (603) 218-6861 PROPERTY ADDRESS: MORTGAGE INFORMATION Effective on December 15, 1989, federally chartered savings and loan associations and savings

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign payoff statement template form

Edit your sample loan payoff letter form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your payoff mortgage form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing payoff mortgage form online

Follow the steps down below to use a professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit payoff mortgage form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out payoff mortgage form

To fill out a mortgage payoff statement template, follow these steps:

01

Retrieve the necessary information: Gather all relevant details about your mortgage, including the loan number, the current balance, and the payoff date.

02

Enter the borrower's information: Fill in the section that asks for the borrower's name, address, and contact information. Ensure accuracy and consistency with the details provided in the mortgage agreement.

03

Provide the lender's information: Input the lender's name, address, and contact details. This information can typically be found on your monthly mortgage statements or in the original loan documents.

04

Include the loan details: Specify the loan amount, the interest rate, and the term of the mortgage. These details can usually be found in your mortgage agreement or by contacting your lender.

05

Calculate the payoff amount: Determine the total amount required to fully pay off the mortgage. This includes the remaining principal balance, accrued interest, and any applicable fees or penalties. Double-check your calculations to ensure accuracy.

06

Include payment instructions: Provide instructions on how the payoff amount should be paid. This can include specifying the payment method (e.g., certified check, wire transfer) and any additional details or requirements.

07

Specify the payoff date: Indicate the date on which you intend to make the final payment to satisfy the mortgage. Ensure the date aligns with the terms outlined in your loan agreement.

Who needs a mortgage payoff statement template?

01

Homeowners: Individuals who have obtained a mortgage loan to purchase a home may require a mortgage payoff statement template when they are ready to settle their outstanding balance and fully repay their mortgage.

02

Selling homeowners: When selling a property, homeowners may need a mortgage payoff statement template to provide to the buyer or their representative, ensuring transparency regarding the remaining mortgage balance and facilitating a smooth closing process.

03

Refinancers: Individuals who plan to refinance their existing mortgage with a new loan will often need a mortgage payoff statement to determine the amount required to pay off the original loan and establish a fresh financial arrangement.

Overall, anyone involved in the process of paying off or finalizing a mortgage may require a mortgage payoff statement template to appropriately document and communicate the necessary information.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my payoff mortgage form in Gmail?

payoff mortgage form and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

Where do I find payoff mortgage form?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific payoff mortgage form and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

Can I edit payoff mortgage form on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign payoff mortgage form. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

What is payoff statement template word?

A payoff statement template is a document used to outline the total amount required to pay off a loan or debt, including principal, interest, and any fees.

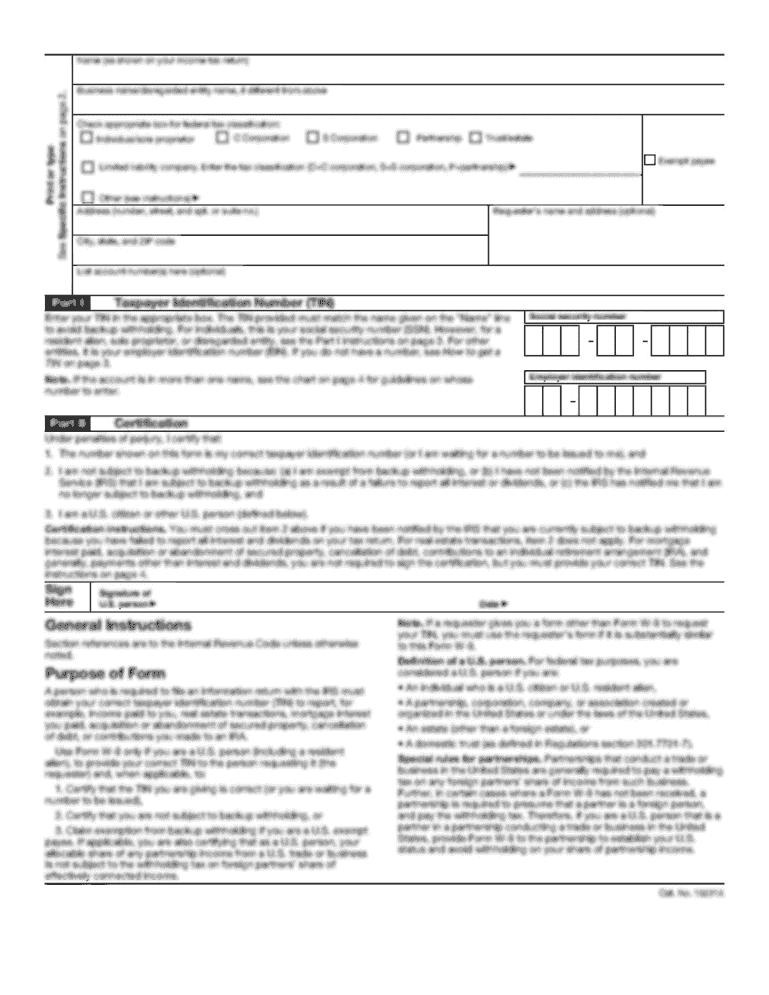

Who is required to file payoff statement template word?

Typically, the borrower or the lender is required to fill out and provide a payoff statement. It is commonly used in real estate transactions or for settling debts.

How to fill out payoff statement template word?

To fill out a payoff statement template, provide the loan details including the borrower's information, loan number, the payoff amount, the date of the payoff, and any other required terms and conditions.

What is the purpose of payoff statement template word?

The purpose of a payoff statement template is to provide a clear and formal summary of the total debt owed, ensuring transparency and clarity between parties involved in a financial transaction.

What information must be reported on payoff statement template word?

Information that must be reported includes the borrower’s name, loan number, current balance, interest rate, payoff amount, date, and any applicable fees or penalties.

Fill out your payoff mortgage form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Payoff Mortgage Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.