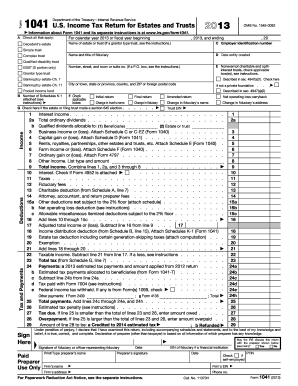

IRS 1041-ES 2013 free printable template

Instructions and Help about IRS 1041-ES

How to edit IRS 1041-ES

How to fill out IRS 1041-ES

About IRS 1041-ES 2013 previous version

What is IRS 1041-ES?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1041-ES

What should I do if I made a mistake on my filed 2013 form 1041-es?

If you discover an error on your filed 2013 form 1041-es, you can submit an amended return using Form 1041-X. It is important to include any new or corrected information and file it as soon as possible to minimize penalties or interest.

How can I track the status of my 2013 form 1041-es submission?

To verify the status of your submitted 2013 form 1041-es, you can utilize the IRS 'Where's My Refund?' tool if expecting a refund, or contact the IRS directly. Common e-file rejection codes can inform you about any issues that need attention.

Are electronic signatures acceptable when filing a 2013 form 1041-es?

Yes, electronic signatures are acceptable for the 2013 form 1041-es, provided they comply with IRS standards. Ensure that the software used for e-filing supports e-signatures to maintain validity.

What should I do if I receive a notice regarding my filed 2013 form 1041-es?

If you receive a notice from the IRS about your filed 2013 form 1041-es, read it carefully to understand the issue. Gather necessary documentation and consider consulting a tax professional to assist with your response and resolution.