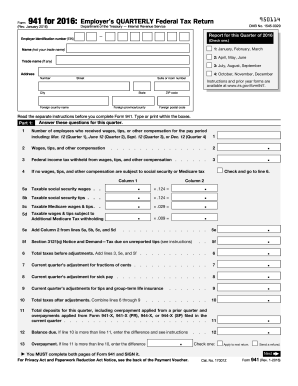

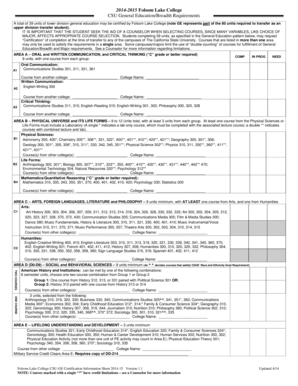

Who Must File a Modified Business Tax Return?

This form must be submitted by all employers who are liable to Unemployment Compensation Law of Nevada. Only some political subdivisions, non-profit corporations, Indian Tribes and household employees do not have to complete and submit this form.

What is the Modified Business Tax Return for?

The basic purpose of the form is to report the total gross wages. Generally the Modified Business Tax has two categories. The first one is general business. This type of tax implies 1.475%. The second type is the tax for financial institution that is 2%.

When is the Modified Business Tax Return Due?

This return is due on or before February 2d. Those who fail to file the document by the due date will face the penalties. In the instructions on the back of the form you will find the amounts of penalties for different number of days you have been late.

Is the Modified Business Tax Return Accompanied by Other Forms?

Yes, there are several documents that you must attach to this form. They are the following:

-

One copy of your original return;

-

All written documentation as adjustments to gross wages, exemption certificates, credit memos, etc.

-

Confirmation of the payment.

All copies must be certified.

What Information do I Include in the Modified Business Tax Return?

The form has 14 prompts. You must indicate the following details: total gross wages, credits, taxable wages, deductions, penalty, previous debits, paid amount. You must make some calculations and write the total amounts.

Where do I Send the Modified Business Tax Return?

Send the completed form to the Nevada Taxation Department.