TX Non-Homestead Affidavit and Designation of Homestead - Randall County 2009-2026 free printable template

Show details

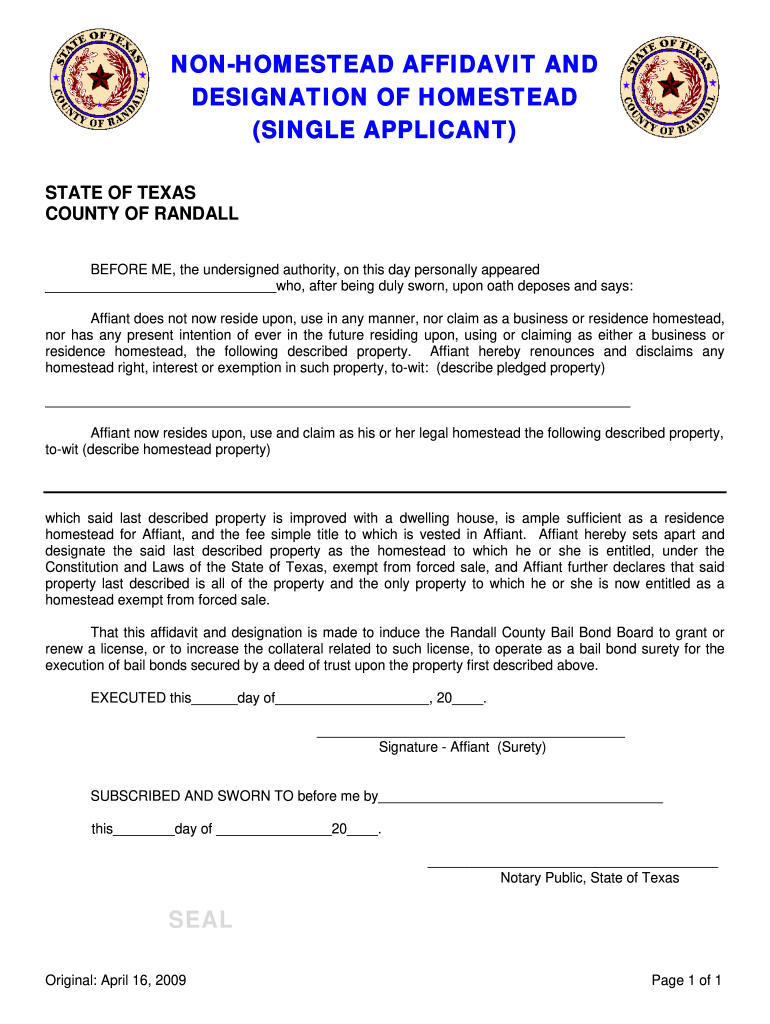

NON-HOMESTEAD AFFIDAVIT AND DESIGNATION OF HOMESTEAD SINGLE APPLICANT STATE OF TEXAS COUNTY OF RANDALL BEFORE ME the undersigned authority on this day personally appeared who after being duly sworn upon oath deposes and says Affiant does not now reside upon use in any manner nor claim as a business or residence homestead nor has any present intention of ever in the future residing upon using or claiming as either a business or residence homestead the following described property. Affiant...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign pdffiller form

Edit your non homestead affidavit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your non homestead affidavit texas form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing TX Non-Homestead Affidavit and Designation of Homestead online

To use the professional PDF editor, follow these steps:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit TX Non-Homestead Affidavit and Designation of Homestead. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out TX Non-Homestead Affidavit and Designation of Homestead

How to fill out TX Non-Homestead Affidavit and Designation of Homestead

01

Obtain the TX Non-Homestead Affidavit and Designation of Homestead form from the Texas Comptroller's website or your local appraisal district.

02

Carefully read the instructions provided on the form to understand the requirements.

03

Fill in your name and contact information in the designated sections.

04

Provide details about the property, including the legal description and the address.

05

Indicate the reason for designating the property as non-homestead, providing any necessary documentation.

06

Sign and date the affidavit in the presence of a notary public.

07

Submit the completed form to your local appraisal district office.

Who needs TX Non-Homestead Affidavit and Designation of Homestead?

01

Homeowners who wish to declare a property as a non-homestead for tax purposes.

02

Individuals who have recently acquired a second property and need to designate it appropriately.

03

Landlords or property owners operating rental properties that do not qualify for homestead exemptions.

04

Those who want to clarify their property tax status to avoid misunderstandings with the appraisal district.

Fill

form

: Try Risk Free

People Also Ask about

What is property tax form 50-114 in Texas?

This application is for claiming residence homestead exemptions pursuant to Tax Code Sections 11.13, 11.131, 11.132, 11.133, 11.134 and 11.432. Certain exemptions may also require Form 50-114-A. The exemptions apply only to property that you own and occupy as your principal place of residence.

What is 50-114 homestead exemption for Texas?

Homestead Application: Form 50-114 Property owners may qualify for a general residence homestead exemption, for the applicable portion of that tax year, immediately upon owning and occupying the property as their principal residence, if the preceding owner did not receive the exemption that tax year.

What happens when you file for homestead exemption Texas?

A homestead exemption in Texas is a tax break applied to your primary residence. It can lower your property taxes by exempting a portion of the value of your home from taxation. The amount of the exemption varies depending on the county in which you live, but it can be up to 20% of the appraised value of your home.

How do I claim homestead in Texas?

How do I apply for a homestead exemption? You must apply with your county appraisal district to apply for a homestead exemption. Applying is free and only needs to be filed once. The application can be found on your appraisal district website or using Texas Comptroller Form 50-114.

How much do you get back for homestead exemption in Texas?

As of May 22, 2022, the Texas residential homestead exemption entitles the homeowner to a $40,000 reduction in value for school tax purposes. Counties, cities, and special taxing districts may offer homestead exemptions up to 20% of the total value. Most counties in North Texas do offer this 20% reduction.

When can you claim homestead in Texas?

The completed application and required documentation are due no later than April 30 of the tax year for which you are applying. A late residence homestead exemption application, however, may be filed up to two years after the delinquency date, which is usually Feb. 1.

Is Texas homestead exemption worth it?

It's one of the many perks of buying and owning a home in the Lone Star State. A homestead exemption allows you to “write down” your property value, so you don't get taxed as much. As you probably know, residential property taxes are a major revenue source for the state of Texas.

How much does homestead exemption save you in Texas?

As of May 22, 2022, the Texas residential homestead exemption entitles the homeowner to a $40,000 reduction in value for school tax purposes. Counties, cities, and special taxing districts may offer homestead exemptions up to 20% of the total value. Most counties in North Texas do offer this 20% reduction.

How much does homesteading reduce taxes in Texas?

As of May 22, 2022, the Texas residential homestead exemption entitles the homeowner to a $40,000 reduction in value for school tax purposes. Counties, cities, and special taxing districts may offer homestead exemptions up to 20% of the total value. Most counties in North Texas do offer this 20% reduction.

What are the requirements to claim homestead in Texas?

To qualify for the general residence homestead exemption an individual must have an ownership interest in the property and use the property as the individual's principal residence. An applicant is required to state that he or she does not claim an exemption on another residence homestead in or outside of Texas.

What happens when you file for homestead exemption Texas?

Homestead exemptions remove part of your home's value from taxation, so they lower your taxes. For example, your home is appraised at $300,000, and you qualify for a $40,000 exemption (this is the amount mandated for school districts), you will pay school taxes on the home as if it was worth only $260,000.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send TX Non-Homestead Affidavit and Designation of Homestead to be eSigned by others?

TX Non-Homestead Affidavit and Designation of Homestead is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I fill out the TX Non-Homestead Affidavit and Designation of Homestead form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign TX Non-Homestead Affidavit and Designation of Homestead and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

Can I edit TX Non-Homestead Affidavit and Designation of Homestead on an iOS device?

You certainly can. You can quickly edit, distribute, and sign TX Non-Homestead Affidavit and Designation of Homestead on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

What is TX Non-Homestead Affidavit and Designation of Homestead?

The TX Non-Homestead Affidavit and Designation of Homestead is a legal document used in Texas to declare that a property is not intended to be used as a primary residence for homestead exemption purposes.

Who is required to file TX Non-Homestead Affidavit and Designation of Homestead?

Property owners who do not use their property as a primary residence and wish to confirm its non-homestead status must file the TX Non-Homestead Affidavit and Designation of Homestead.

How to fill out TX Non-Homestead Affidavit and Designation of Homestead?

To fill out the form, provide the property owner's name, property address, and detailed information about the property use. Sign and date the affidavit before submitting it to the appropriate local appraisal district.

What is the purpose of TX Non-Homestead Affidavit and Designation of Homestead?

The purpose of the affidavit is to formally declare that a property will not be utilized for homestead exemption, affecting the property tax assessment and liabilities for the owner.

What information must be reported on TX Non-Homestead Affidavit and Designation of Homestead?

The information required includes the owner's name, property address, an affirmation of the non-homestead status, and any additional specifics regarding the property's usage.

Fill out your TX Non-Homestead Affidavit and Designation of Homestead online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TX Non-Homestead Affidavit And Designation Of Homestead is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.