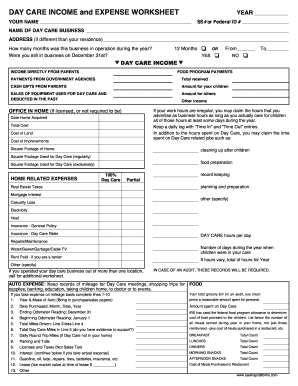

Get the free daycare profit and loss statement template

Show details

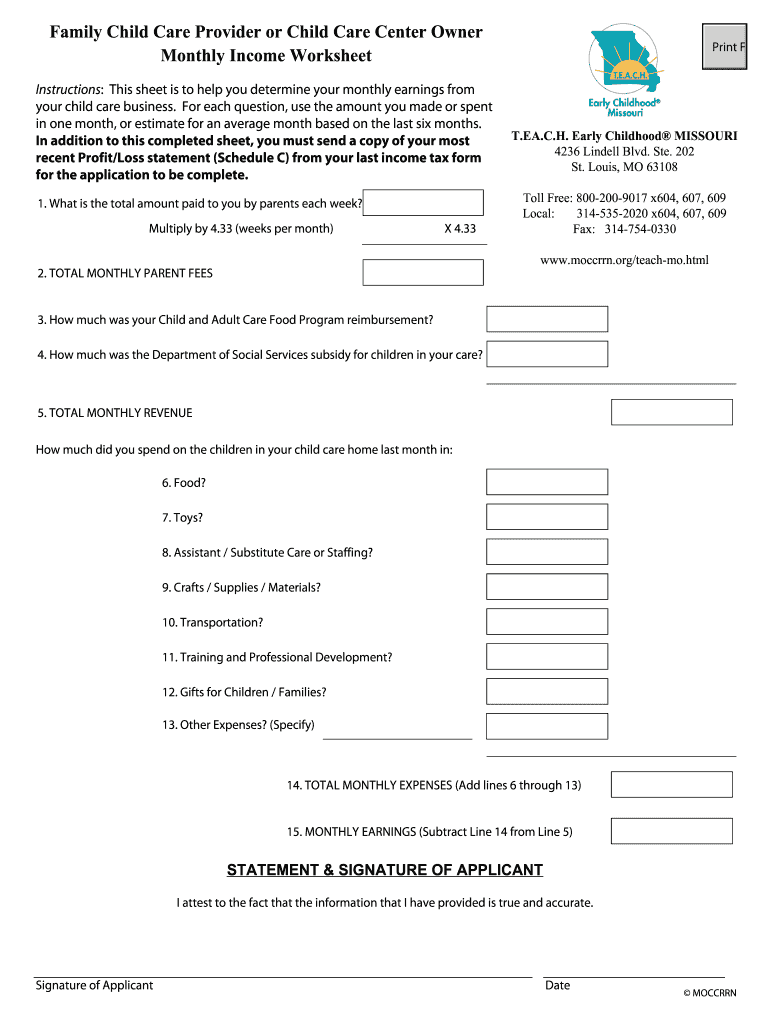

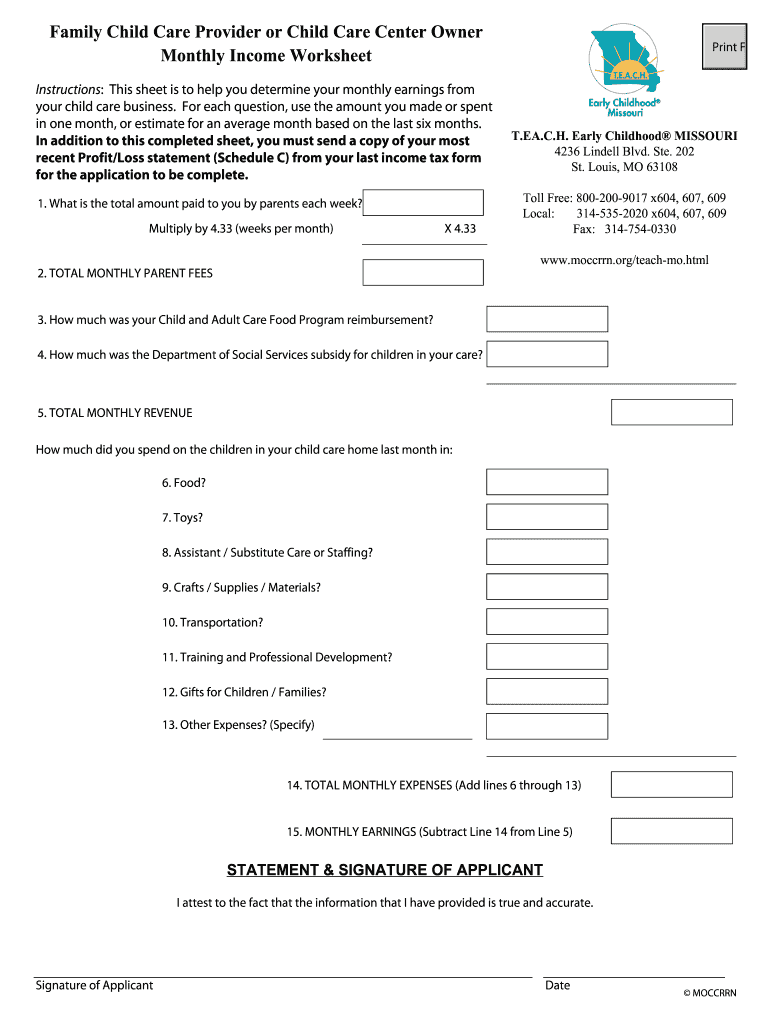

Family Child Care Provider or Child Care Center Owner

Monthly Income Worksheet

Instructions: This sheet is to help you determine your monthly earnings from

your child care business. For each question,

We are not affiliated with any brand or entity on this form

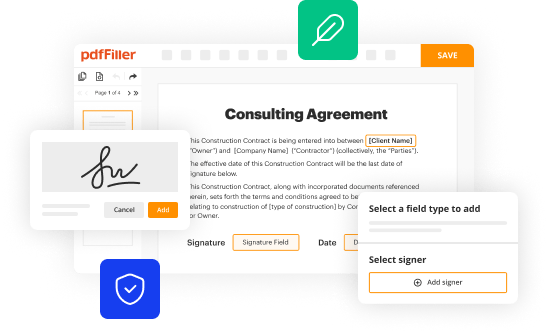

Get, Create, Make and Sign daycare income statement form

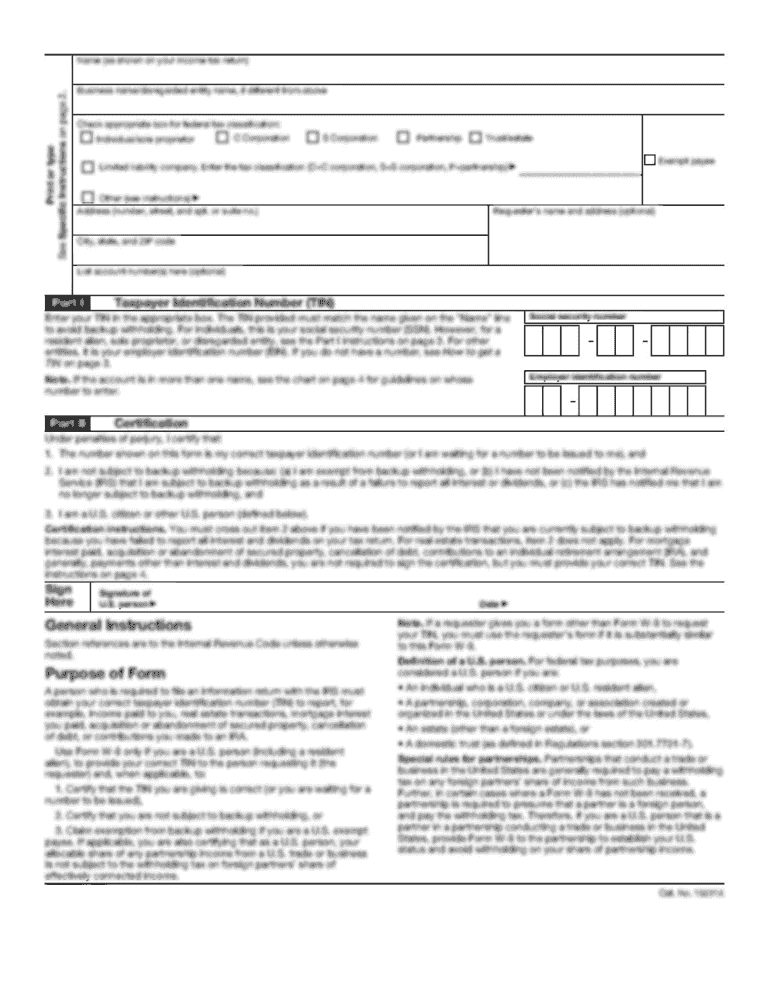

Edit your child care daycare profit and loss statement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your daycare income statement example form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing daycare financial projections template online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit daycare income and expense worksheet form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out the statement should also include information about and loss depends on your tax jurisdiction

How to fill out daycare profit and loss:

01

Gather all financial records, including income and expenses related to the daycare business.

02

Use accounting software or create a spreadsheet to organize the financial data.

03

Calculate the total income by adding up all sources of revenue, such as fees and subsidies.

04

Determine the total expenses by categorizing and adding up all costs, including rent, salaries, supplies, and utilities.

05

Subtract the total expenses from the total income to calculate the net profit or loss.

06

Analyze the profit and loss statement to identify areas of improvement or potential savings.

07

Review and compare the profit and loss statement with previous periods to track the daycare's financial performance.

Who needs daycare profit and loss:

01

Daycare owners or operators who want to assess the financial health of their business and make informed decisions.

02

Accountants or bookkeepers responsible for maintaining accurate financial records and preparing financial statements for the daycare.

03

Investors or lenders who require financial statements to evaluate the profitability and stability of the daycare before providing funding.

Fill

daycare accounting forms

: Try Risk Free

People Also Ask about childcare statement

Who should prepare profit and loss statement?

A profit and loss (P&L) statement is one of the three types of financial statements prepared by companies. The other two are the balance sheet and the cash flow statement. The purpose of the P&L statement is to show a company's revenues and expenditures over a specified period of time, usually over one fiscal year.

Who can complete a profit and loss statement?

You can ask your accountant to prepare a profit and loss statement for your company or you can build one yourself using the steps below.

How do I prepare a profit and loss statement?

To prepare your profit and loss statement, you will need to collect all financial transactions during that time period, including: All sources of revenue; including sales, interest income, rental income and fees for services and any reductions to sales, both returns and discounts.

What is a profit and loss statement for a preschool?

For a preschool, a profit and loss statement would show the income that the preschool generates from tuition and other sources, as well as the expenses associated with running the preschool, such as staff salaries, supplies, and rent.

Can I fill out my own profit and loss statement?

If you use accounting software like QuickBooks, Peachtree or the like, the program will generate a P&L statement for you after you enter your sales and expense figures, but you can easily create your own using a basic spreadsheet and easy calculations, following the steps below.

What do you put on a profit and loss statement?

The P & L statement contains uniform categories of sales and expenses. The categories include net sales, costs of goods sold, gross margin, selling and administrative expense (or operating expense), and net profit. These are categories that you, too, will use when constructing a P & L statement.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit daycare accounting spreadsheet online?

The editing procedure is simple with pdfFiller. Open your monthly daycare expense spreadsheet in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I edit daycare rate sheet template in Chrome?

daycare business profit can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How can I edit daycare expenses list template on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing daycare expense spreadsheet right away.

What is daycare income statement example?

A daycare income statement example is a financial report that summarizes the revenues, expenses, and profits of a daycare business over a specific period, typically showcasing the income generated from tuition, fees, and other services against the costs incurred, such as salaries, supplies, and utilities.

Who is required to file daycare income statement example?

Daycare providers who operate as sole proprietors, partnerships, or corporations and earn income from their daycare business are required to file a daycare income statement, especially for tax reporting purposes.

How to fill out daycare income statement example?

To fill out a daycare income statement example, collect all revenue figures from fees and services, list all operating expenses such as salaries, rent, supplies, and utilities, and calculate the net profit by subtracting total expenses from total revenues.

What is the purpose of daycare income statement example?

The purpose of a daycare income statement example is to provide a clear overview of the financial performance of the daycare, helping owners analyze profitability, make informed decisions, attract investors, and ensure compliance with tax regulations.

What information must be reported on daycare income statement example?

A daycare income statement example must report total revenue, various categories of expenses (such as staff salaries, operational costs, and materials), and the net income or loss for the reporting period.

Fill out your daycare profit and loss online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Daycare Expense is not the form you're looking for?Search for another form here.

Keywords relevant to day care business profit

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.