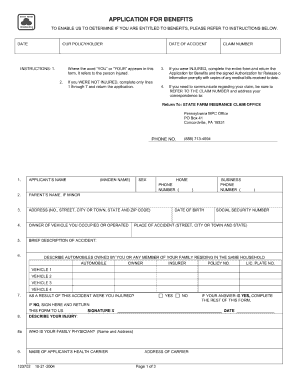

Get the free extract of accounts 2012 form

Show details

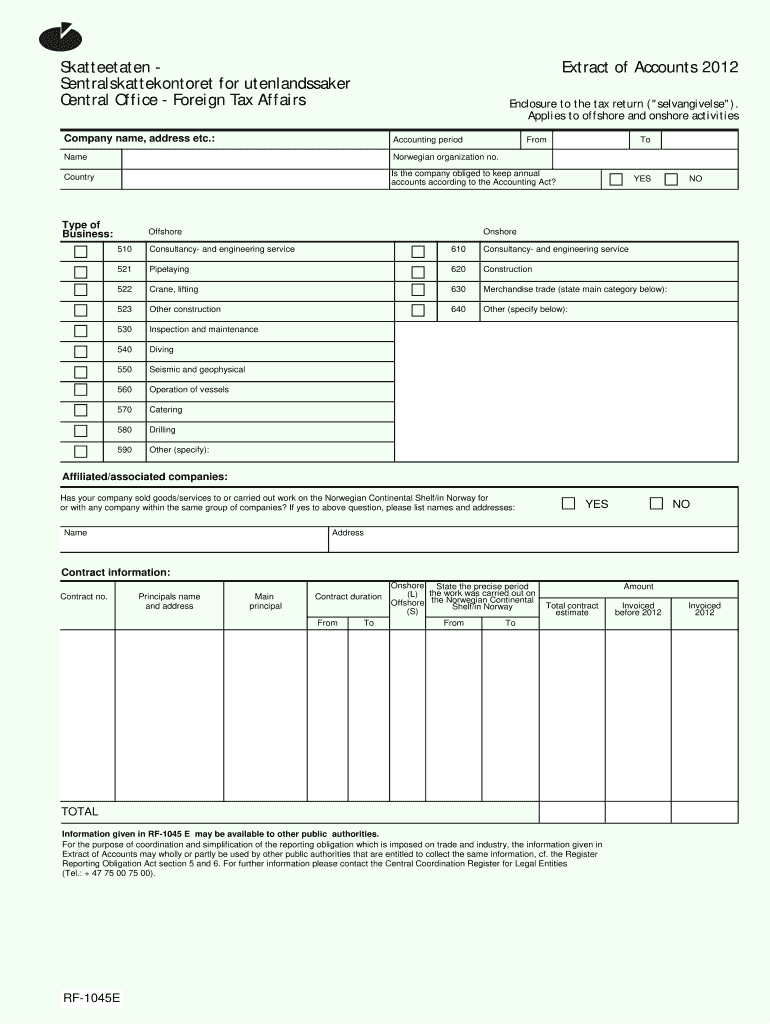

Skatteetaten Sentralskattekontoret for utenlandssaker C entral Office - Foreign Tax Affairs Extract of Accounts 2012 Enclosure to the tax return selvangivelse. Applies to offshore and onshore activities Company name address etc* Accounting period Name Norwegian organization no. Country Is the company obliged to keep annual accounts according to the Accounting Act Type of Business Offshore From To YES NO Onshore Consultancy- and engineering service Pipelaying Construction Crane lifting...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign extract of accounts 2012

Edit your extract of accounts 2012 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your extract of accounts 2012 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing extract of accounts 2012 online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit extract of accounts 2012. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out extract of accounts 2012

How to fill out extract of accounts 2012:

01

Begin by collecting all relevant financial documents for the year 2012, such as bank statements, invoices, receipts, and income and expense records.

02

Divide the financial records into different categories, such as income, expenses, assets, liabilities, and equity.

03

Start with the income section and list all sources of income received during 2012. Include details such as the name of the income source, amount received, and any relevant dates.

04

Move on to the expenses section and list all expenses incurred during 2012. Categorize expenses into different categories, such as operating expenses, payroll expenses, or any other relevant categories. Include details such as the name of the expense, amount spent, and any relevant dates.

05

Next, include any assets that were acquired or disposed of during 2012. This may include property, equipment, vehicles, or other assets. Provide details such as the description of the asset, the date of acquisition or disposal, and the value.

06

Similarly, include any liabilities or debts that were incurred or paid off during 2012. Provide details such as the name of the creditor, the date of the liability, and the amount owed.

07

Finally, calculate the equity section by subtracting the total liabilities from the total assets. This represents the net worth or equity of the company as of the end of 2012.

08

Review the completed extract of accounts 2012 for accuracy and consistency. Make any necessary corrections or adjustments before finalizing the document.

Who needs extract of accounts 2012?

01

Businesses and companies often require an extract of accounts for their internal financial management and decision-making processes. The extract provides a comprehensive overview of the financial transactions and performance of the business during the specified year, allowing stakeholders to evaluate the company's financial health.

02

Investors and shareholders may also need the extract of accounts 2012 to assess the company's financial position and make informed investment decisions. The document provides valuable insights into the company's revenue, expenses, assets, liabilities, and equity.

03

External auditors or accountants may require the extract of accounts 2012 to conduct an audit of the company's financial statements. The extract serves as a basis for verifying the accuracy and completeness of the financial records and ensuring compliance with accounting standards and regulations.

04

Government authorities or regulatory bodies may request the extract of accounts 2012 as part of their oversight or regulatory functions. This can include tax authorities, financial regulators, or other agencies responsible for monitoring and enforcing financial reporting requirements.

05

Individuals or professionals, such as consultants or analysts, may refer to the extract of accounts 2012 to conduct financial analysis, benchmarking, or financial planning. The document provides valuable data and insights that can be used to assess the company's performance, identify trends, and make informed financial decisions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my extract of accounts 2012 in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your extract of accounts 2012 and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How do I edit extract of accounts 2012 straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing extract of accounts 2012 right away.

How do I edit extract of accounts 2012 on an Android device?

With the pdfFiller Android app, you can edit, sign, and share extract of accounts 2012 on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is extract of accounts form?

Extract of accounts form is a document that summarizes key financial information from company's full accounts.

Who is required to file extract of accounts form?

Companies and businesses are required to file extract of accounts form.

How to fill out extract of accounts form?

Extract of accounts form can be filled out by providing accurate financial information as per the guidelines.

What is the purpose of extract of accounts form?

The purpose of extract of accounts form is to provide a summary of financial information for regulatory and compliance purposes.

What information must be reported on extract of accounts form?

Key financial information such as revenue, expenses, profit, and balance sheet details must be reported on extract of accounts form.

Fill out your extract of accounts 2012 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Extract Of Accounts 2012 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.