Canada CRA T3012A 2012 free printable template

Show details

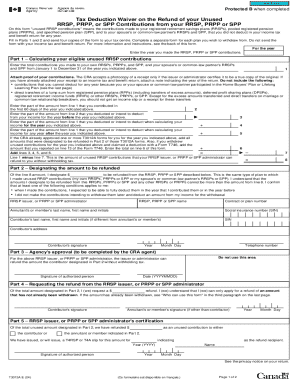

Protected B Tax Deduction Waiver on the Refund of your Unused RESP Contributions made in when completed (year) Use this form for contributions you made after 1990. Use a separate form for each registered

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Canada CRA T3012A

Edit your Canada CRA T3012A form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada CRA T3012A form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit Canada CRA T3012A online

In order to make advantage of the professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit Canada CRA T3012A. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada CRA T3012A Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada CRA T3012A

How to fill out Canada CRA T3012A

01

Obtain the T3012A form from the Canada Revenue Agency (CRA) website or your local tax office.

02

Fill out your personal information at the top of the form, including your name, address, and social insurance number (SIN).

03

Provide details regarding your disability if applicable; include any medical information required.

04

Indicate the type and purpose of the amount you are requesting to be exempt from tax.

05

Complete the section related to your income and any deductions that are relevant to your situation.

06

Sign and date the form to certify that the information provided is accurate.

07

Submit the T3012A form to the CRA for processing either by mail or electronically based on CRA guidelines.

Who needs Canada CRA T3012A?

01

Individuals with a disability seeking a tax exemption on certain amounts.

02

Taxpayers who have received a disability-related benefit and want to ensure it is not taxable.

03

Individuals wanting to apply for a refund for excess tax withheld on disability payments.

Fill

form

: Try Risk Free

People Also Ask about

What is the form T3012A for RRSP over contribution?

What is the Tax Deduction Waiver on the Refund of Your Unused RRSP, PRPP or SPP? This form, called form T3012A allows you to withdraw unused RRSP contributions, without taxes being withheld.

What happens if I went over my TFSA contribution limit?

This tax of 1% per month is based on the highest excess TFSA amount in your account for each month in which an excess remains. This means that the 1% tax applies for a particular month even if an excess TFSA amount was contributed and withdrawn later during the same month.

How do I resolve RRSP over contribution?

You can ask the CRA in writing to consider cancelling or waiving the tax if the following two conditions are met: your excess contributions on which the tax is based arose due to a reasonable error; and. you are taking, or have taken, reasonable steps to eliminate the excess contributions.

Is there a penalty if you made an Overcontribution of exactly $2000 for TFSA?

Where an individual exceeds their TFSA contribution limit for the year, the excess amount, referred to as a “TFSA excess amount”, is subject to a penalty tax of 1% per month. The tax is calculated based on the highest excess amount for the month and, unlike RRSPs, the TFSA does not allow for a $2,000 “grace” amount.

How much trading is too much in TFSA?

Read this previous question to learn more. Trades within your TFSA can be made as often as you like, without having to pay a capital gains tax. However, note that conversely you cannot use capital losses on investments in your TFSA to offset the gains.

What happens if I exceed my RRSP contribution limit?

There is a 1% monthly penalty for overcontributions greater than $2,000, until the amount is withdrawn or your limit covers the excess contribution. For more information, consult our page on maximum RRSP contributions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find Canada CRA T3012A?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific Canada CRA T3012A and other forms. Find the template you need and change it using powerful tools.

How do I complete Canada CRA T3012A online?

pdfFiller has made filling out and eSigning Canada CRA T3012A easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I fill out Canada CRA T3012A on an Android device?

Use the pdfFiller Android app to finish your Canada CRA T3012A and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is Canada CRA T3012A?

Canada CRA T3012A is a form used to apply for a tax exemption on certain income received by individuals with disabilities, under the Canadian Income Tax Act.

Who is required to file Canada CRA T3012A?

Individuals with disabilities who receive specific types of income, such as social assistance payments or certain disability benefits, are required to file the Canada CRA T3012A.

How to fill out Canada CRA T3012A?

To fill out Canada CRA T3012A, individuals should gather required information such as their personal details, income specifics, and any supporting documents, and then accurately complete each section of the form according to the instructions provided by the CRA.

What is the purpose of Canada CRA T3012A?

The purpose of Canada CRA T3012A is to determine the eligibility of individuals with disabilities for tax exemptions on certain types of income, ultimately reducing their tax burden.

What information must be reported on Canada CRA T3012A?

Information that must be reported on Canada CRA T3012A includes personal identification details, the types of income being reported, and any relevant tax-related information such as deductions or exemptions claimed.

Fill out your Canada CRA T3012A online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada CRA t3012a is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.