Canada T1013 E 2012 free printable template

Show details

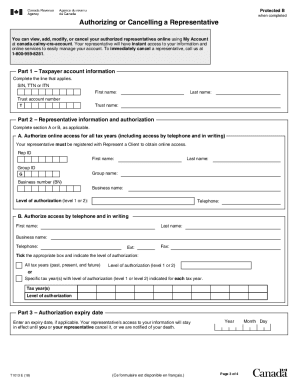

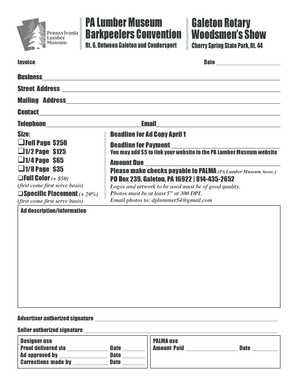

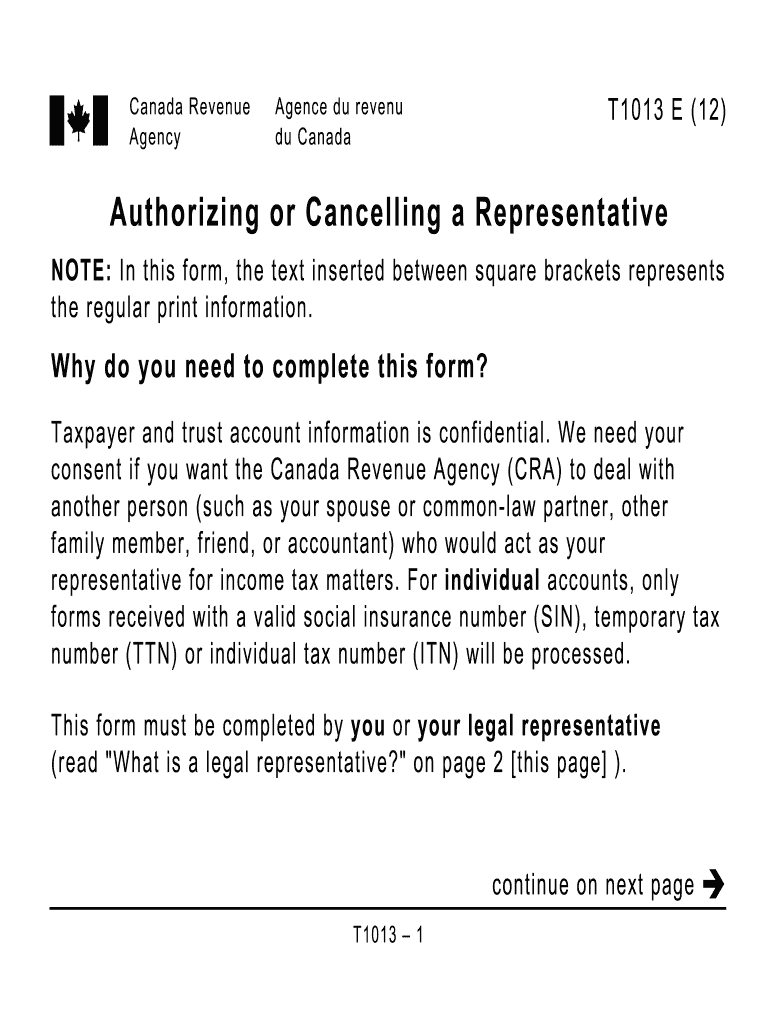

Canada Revenue Agency Agence du revenu du Canada T1013 E 12 Authorizing or Cancelling a Representative NOTE In this form the text inserted between square brackets represents the regular print information. Why do you need to complete this form Taxpayer and trust account information is confidential. We need your consent if you want the Canada Revenue Agency CRA to deal with another person such as your spouse or common-law partner other family member friend or accountant who would act as your...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Canada T1013 E

Edit your Canada T1013 E form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada T1013 E form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit Canada T1013 E online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit Canada T1013 E. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada T1013 E Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada T1013 E

How to fill out Canada T1013 E

01

Obtain the Canada T1013 E form from the Canada Revenue Agency (CRA) website or your tax professional.

02

Fill in the 'Taxpayer Information' section, including your name, address, and social insurance number (SIN).

03

Complete the 'Representative Information' section with the representative's details, including their name, address, and professional designation.

04

Indicate the type of authorization required, such as communication or full access to tax information.

05

Sign and date the form to certify that the information provided is accurate.

06

Submit the completed T1013 E form to the CRA either by mail or through your tax representative.

Who needs Canada T1013 E?

01

Individuals who wish to authorize a representative, such as a tax advisor or accountant, to deal with the Canada Revenue Agency on their behalf.

02

Taxpayers who need assistance with their tax affairs and require someone to access their personal tax information.

03

People who are unable to manage their tax matters due to time constraints or lack of knowledge and want to have professional guidance.

Fill

form

: Try Risk Free

People Also Ask about

What is a CRA authorization form?

By signing Form AUT-01, Authorize a Representative for Offline Access, you are authorizing the representative to have access to information regarding trust accounts. Send the form to the appropriate CRA tax centre listed on the form within six months of the date it is signed.

What is error code W101 on CRA efile?

W101 - The Canada Revenue Agency (CRA) requires additional time to process your request. Do not re-submit the request electronically or on paper.

What is error code T901?

Error T901 means that the controller malfunctioned and the water heater was disabled. The way to fix this issue is to replace the control board. Zwell is dedicated to getting homes closer to net zero through the installation of new energy-efficient hybrid water heaters.

What is error code t1013?

The transmitter's EFILE number or password is not entered or is invalid. the transmitter's EFILE number and password were entered correctly, contact your EFILE Helpdesk.

What is a CRA result code 30?

It just says that the information sent to CRA doesn't match the information currently on record, which was provided by Service Canada.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send Canada T1013 E to be eSigned by others?

When you're ready to share your Canada T1013 E, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How can I get Canada T1013 E?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific Canada T1013 E and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I complete Canada T1013 E on an Android device?

Complete your Canada T1013 E and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is Canada T1013 E?

Canada T1013 E is a form that allows a taxpayer to authorize another individual to act on their behalf when dealing with the Canada Revenue Agency (CRA).

Who is required to file Canada T1013 E?

Any taxpayer who wants to authorize someone else, such as a family member, accountant, or tax professional, to access their tax information or conduct business with CRA must file Canada T1013 E.

How to fill out Canada T1013 E?

To fill out Canada T1013 E, you need to provide the taxpayer's personal information, details of the representative being authorized, and specific authorization for the representative to access tax information or manage tax affairs.

What is the purpose of Canada T1013 E?

The purpose of Canada T1013 E is to grant permission to a designated representative to access a taxpayer's information and communicate with CRA on their behalf.

What information must be reported on Canada T1013 E?

Information that must be reported on Canada T1013 E includes the taxpayer's name, social insurance number, address, the representative's name and contact details, and the specific authorizations being granted.

Fill out your Canada T1013 E online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada t1013 E is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.