BD NBR IT-11GA free printable template

Fill out, sign, and share forms from a single PDF platform

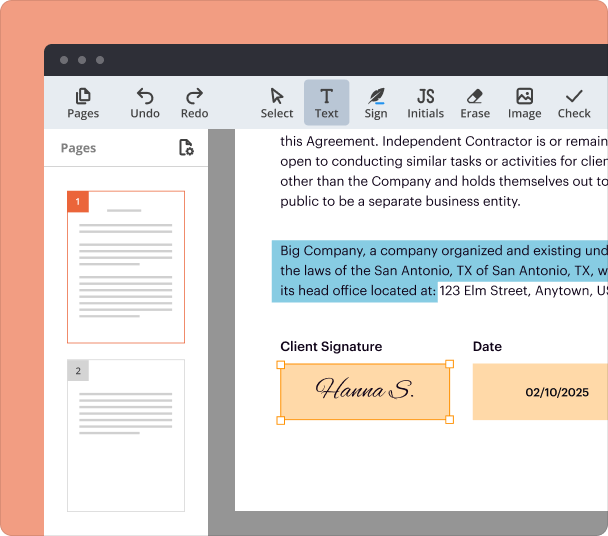

Edit and sign in one place

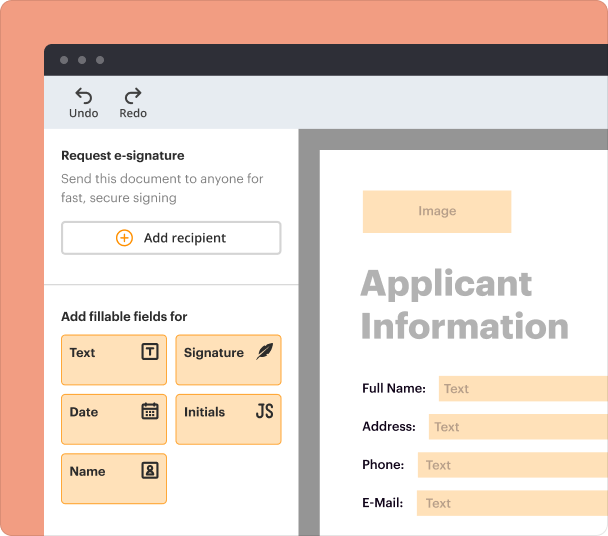

Create professional forms

Simplify data collection

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

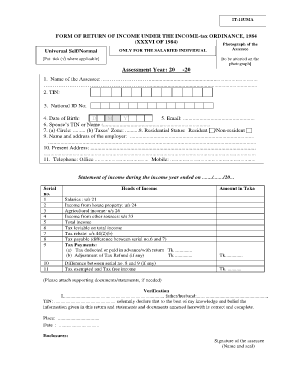

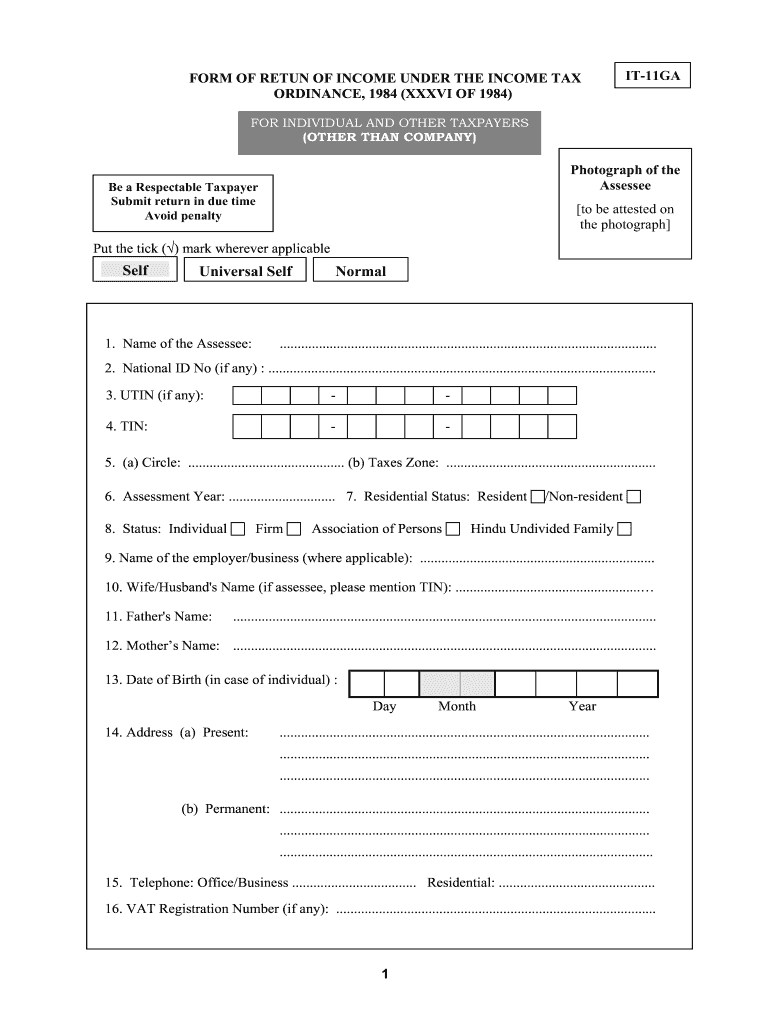

Understanding the bd nbr it-11ga Printable Form

What is the bd nbr it-11ga printable form?

The bd nbr it-11ga printable form is a specific income tax return form used in Bangladesh for individuals and entities required to report their income to the government. This form allows taxpayers to detail their income sources, claim deductions, and calculate their tax liabilities for a particular assessment year.

Eligibility Criteria for the bd nbr it-11ga printable form

Eligibility for using the bd nbr it-11ga form generally includes individuals and business entities that generate taxable income. Additional criteria may apply based on income thresholds and specific classifications, such as resident or non-resident taxpayer status. Generally, any taxpayer who earns above the exemption limit established by tax authorities must file this form.

Required Documents and Information

When completing the bd nbr it-11ga form, taxpayers must gather various documents to provide accurate information. Required documents typically include proof of identity, income statements, TIN (Tax Identification Number), and any certificates for tax rebate claims. Additional supporting documents may encompass bank statements and additional forms related to business income or investment earnings.

How to Fill the bd nbr it-11ga printable form

Filling out the bd nbr it-11ga form requires careful attention to detail. Taxpayers should start by entering personal information at the top of the form, followed by income details from various sources. Each section has specific headings where taxpayers must categorize their income, such as salaries, business earnings, or investments. Ensure that all figures match the supporting documentation to avoid discrepancies.

Common Errors and Troubleshooting

Errors in the bd nbr it-11ga form can lead to delays in processing tax returns or even penalties. Common mistakes include incorrect personal information, miscalculating total income, and overlooking required signatures. Taxpayers should double-check all entries for accuracy and ensure that all necessary attachments are included before submission.

Best Practices for Accurate Completion

To ensure the bd nbr it-11ga form is accurately completed, taxpayers should follow best practices such as carefully reading the instructions associated with each section, keeping thorough records of all income, and seeking assistance if needed. Utilizing tax preparation software may also help minimize errors and streamline the process of filling out the form.

Frequently Asked Questions about it 11ga 2023 excel form

Who needs to file the bd nbr it-11ga form?

Individuals and entities earning taxable income in Bangladesh need to file the bd nbr it-11ga form.

What supporting documents are necessary for the bd nbr it-11ga form?

Necessary supporting documents include proof of identity, income statements, and a Tax Identification Number (TIN).

pdfFiller scores top ratings on review platforms