Get the free reading a pay stub answer key

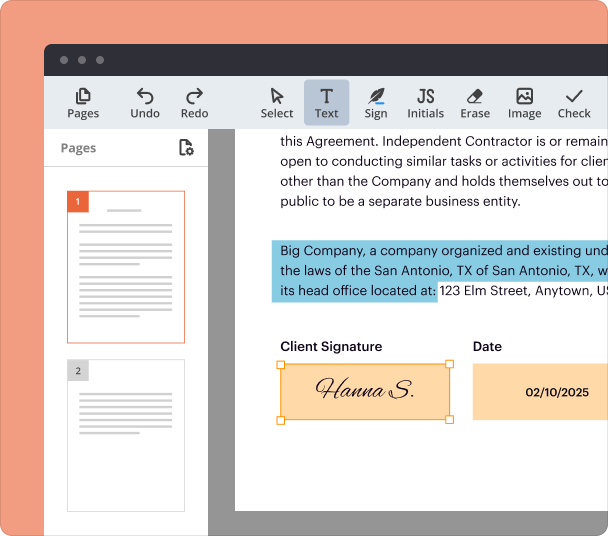

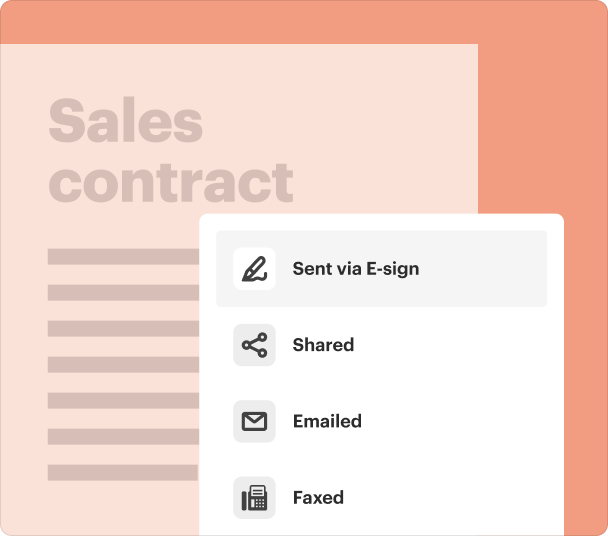

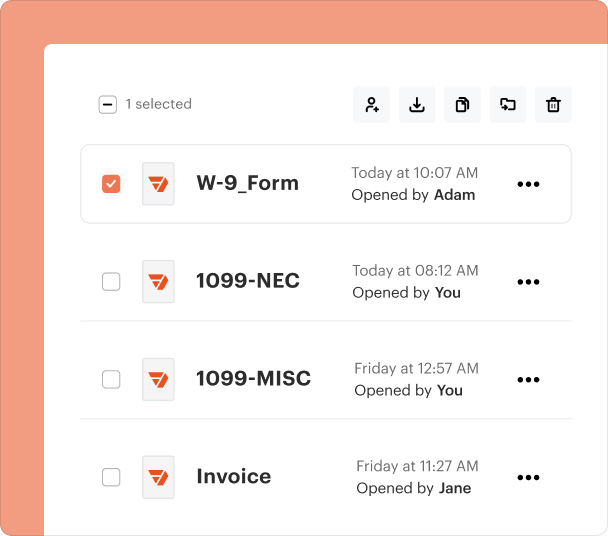

Fill out, sign, and share forms from a single PDF platform

Edit and sign in one place

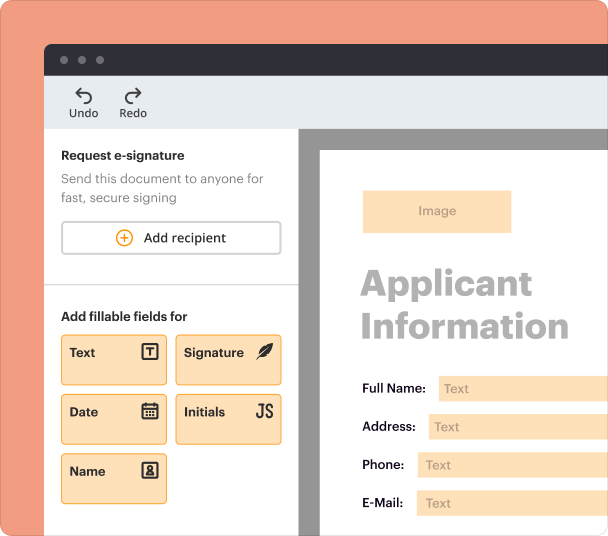

Create professional forms

Simplify data collection

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

Understanding the Reading a Pay Stub Form

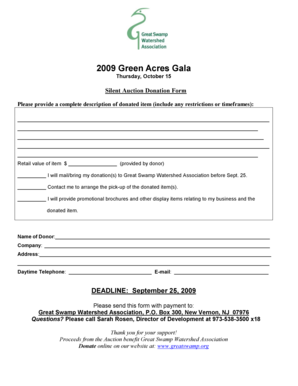

What is the reading a pay stub form

The reading a pay stub form is a document that provides detailed information about an employee's earnings, tax deductions, and other financial details related to their paycheck. This form is essential for both employees and employers, as it offers a clear breakdown of gross pay, net pay, and withholdings for taxes and benefits. Understanding this form can help employees manage their finances better and ensure that they are being compensated correctly for their work.

Key Features of the reading a pay stub form

The reading a pay stub form typically includes several key features such as gross pay, net pay, various deductions like federal and state taxes, Social Security, Medicare, and retirement contributions. Employees can also find information about pay period dates and year-to-date totals for each category. These features provide transparency in compensation, making it easier for employees to verify their earnings.

When to Use the reading a pay stub form

The reading a pay stub form is utilized whenever employees receive a paycheck. It is important for employees to review this form each pay period to ensure accuracy in their earnings and deductions. This form is also useful for various financial situations such as applying for loans, tax preparation, and personal financial planning.

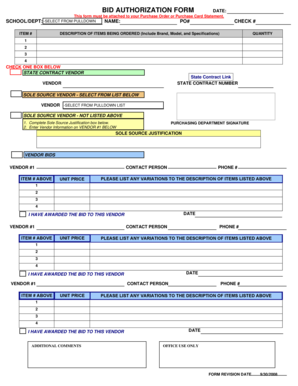

How to Fill the reading a pay stub form

Filling out the reading a pay stub form involves entering accurate information about earnings and deductions. Start by inputting the gross pay, followed by listing any deductions for federal and state taxes, Social Security, and Medicare. Ensure that the net pay reflects the total amount the employee takes home after all deductions. It’s essential to be thorough and precise to avoid errors.

Review and Validation Checklist

To ensure accuracy when completing the reading a pay stub form, follow a review and validation checklist. Confirm that gross pay matches the amounts stated in employment records. Check each deduction against the company’s payroll guidelines and verify the net pay. It is also advisable to compare these figures to previous pay stubs to detect any discrepancies.

Common Errors and Troubleshooting

Common errors when using the reading a pay stub form include miscalculating deductions, omitting essential information, or entering incorrect amounts. If discrepancies are noted, it is recommended to consult with the payroll department for clarification. Keeping records of previous pay stubs can assist in identifying patterns and catching mistakes early.

Benefits of Using the reading a pay stub form

Utilizing the reading a pay stub form offers multiple benefits, including enhanced financial awareness for employees. It enables individuals to better track their earnings, understand their tax obligations, and plan for future expenses. Having a clear picture of financial health can aid in budgeting and financial decision-making.

Frequently Asked Questions about reading a pay stub chapter 10 lesson 2 answer key form

What information is typically found on a pay stub?

A pay stub usually contains gross pay, net pay, tax deductions, contributions to retirement plans, and details of the pay period.

Why is it important to review my pay stub?

Reviewing your pay stub is crucial to ensure that your earnings and deductions are accurate, as it affects your take-home pay and tax obligations.

pdfFiller scores top ratings on review platforms