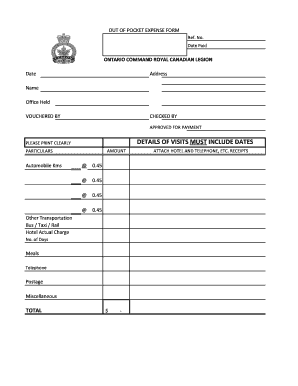

Get the free uniform securitization scheme

Show details

From Reclaim Your Securities a Yahoo Group To Members of the Group Topic The Uniform Securitization Scheme the Birth Scam The universal boilerplate securities transaction blueprint that governs your commercial life. XI REGISTRATION One of the most seemingly benign cogs in the Uniform Securitization Scam registration is the process by which a creditor registers a security interest against the owner. Following the Uniform Securitization Scam bluepr...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign uniform securitization scheme

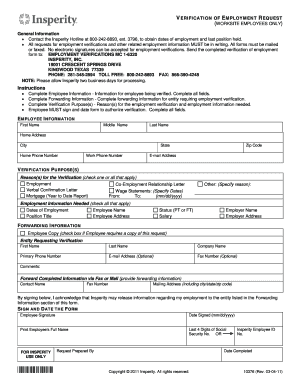

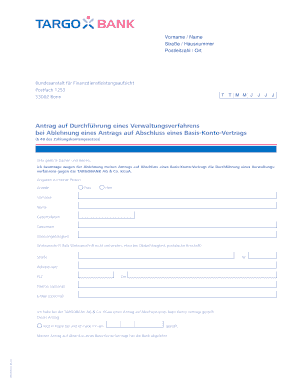

Edit your uniform securitization scheme form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your uniform securitization scheme form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit uniform securitization scheme online

Follow the steps below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit uniform securitization scheme. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

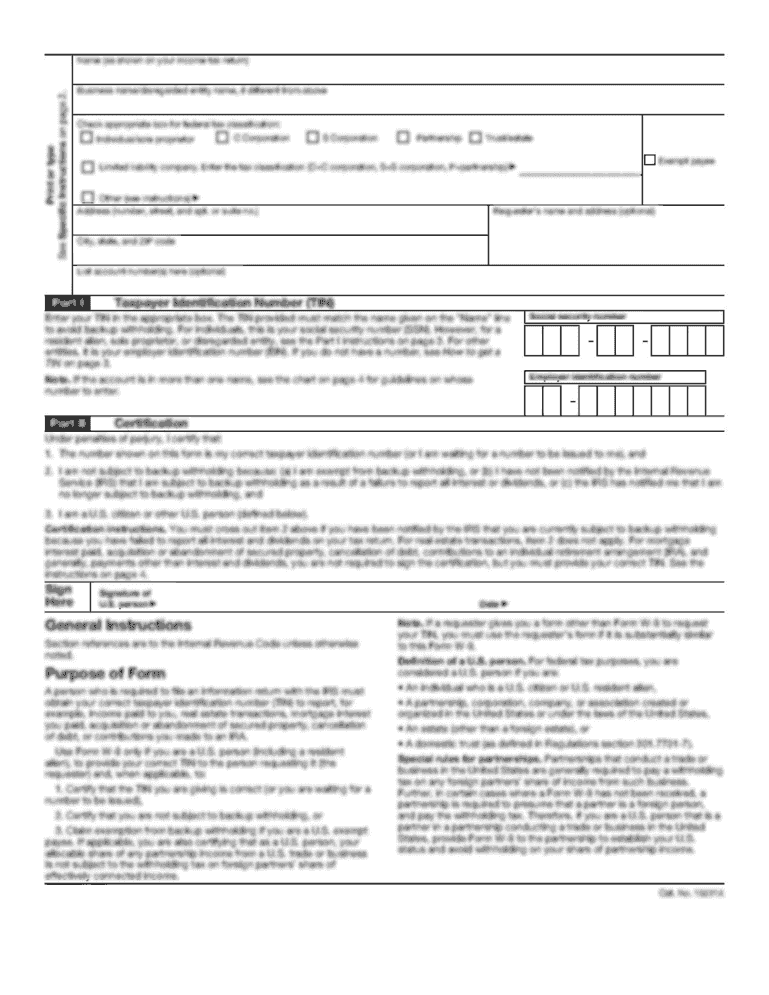

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out uniform securitization scheme

How to fill out uniform securitization scheme?

01

Research and gather all necessary information and documentation related to the assets that will be securitized.

02

Ensure that all required legal and regulatory requirements are met, including any specific guidelines set forth by the relevant authorities.

03

Define the structure of the securitization scheme, including the type of securities to be issued, the cash flow waterfall, and any credit enhancements.

04

Determine the valuation and pricing of the securitized assets, including any necessary modeling or analysis.

05

Prepare the offering memorandum or prospectus, which provides detailed information about the securitization transaction to potential investors.

06

Identify and select the appropriate investors for the securitized assets, considering factors such as risk appetite and investment objectives.

07

Coordinate with legal and accounting teams to ensure all necessary legal and financial disclosures are included in the offering documents.

08

Conduct roadshows or investor presentations to market the securitized assets and generate interest among potential investors.

09

Receive investor subscriptions and allocate the securities accordingly.

10

Work with custodians or trustees to ensure proper administration and servicing of the securitized assets.

Who needs uniform securitization scheme?

01

Financial institutions, such as banks, insurance companies, and asset management firms, often utilize securitization as a means to manage and diversify their portfolios.

02

Investors seeking exposure to specific assets, sectors, or risk profiles may utilize securitization as an investment opportunity.

03

Companies or organizations looking to monetize their illiquid assets or manage their funding requirements may opt for securitization as a financing tool.

04

Governments or regulatory bodies might implement uniform securitization schemes to promote liquidity in specific markets or facilitate economic growth.

05

Rating agencies and credit analysts may utilize uniform securitization schemes to assess the creditworthiness and risk profiles of securitized assets.

Fill

form

: Try Risk Free

People Also Ask about

What is securitization of a loan?

Unlike the more traditional relationship between a borrower and a lender, securitization involves the sale of the loan by the lender to a new owner--the issuer--who then sells securities to investors. The investors are buying 'bonds' that entitle them to a share of the cash paid by the borrowers on their mortgages.

What are the various techniques of securitisation used by banks?

Investors will be free to sell the Bonds or retain them. There are three most common types of securitisations from the perspective of cash flow: Collateralized Debt, Pass-Through and Pay-Trough structures. Collateralized debt is the form most similar to traditional asset-based borrowing.

What is the structure of securitization?

The broad types of securitization structures include: Cash vs. Synthetic Structures: Most transactions world over follow the cash structure in which the originator sells assets and receives cash instead. True Sale vs. Pass Through vs. Discreet Trust vs. Conduit vs.

What are two benefits of securitization?

The major benefit of securitization is: Providing lower interest rate risk. Providing transparency in the markets. The creation of tradable securities with better liquidity.

What is the purpose of securitization?

Securitization is the process in which certain types of assets are pooled so that they can be repackaged into interest-bearing securities. The interest and principal payments from the assets are passed through to the purchasers of the securities.

What is securitisation and its benefits?

Securitization is the process in which certain types of assets are pooled so that they can be repackaged into interest-bearing securities. The interest and principal payments from the assets are passed through to the purchasers of the securities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the uniform securitization scheme electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your uniform securitization scheme in seconds.

How can I fill out uniform securitization scheme on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your uniform securitization scheme. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

How do I edit uniform securitization scheme on an Android device?

The pdfFiller app for Android allows you to edit PDF files like uniform securitization scheme. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is uniform securitization scheme?

The uniform securitization scheme is a standardized framework or set of guidelines used for asset-backed securitization, ensuring consistency and transparency in the issuance of securities backed by various types of assets.

Who is required to file uniform securitization scheme?

Entities engaging in the process of securitization, including financial institutions, issuers, and other organizations that create or sell asset-backed securities, are required to file the uniform securitization scheme.

How to fill out uniform securitization scheme?

To fill out the uniform securitization scheme, filers must provide detailed information about the underlying assets, the security structure, and compliance with regulatory requirements in the prescribed format as set forth by the governing body.

What is the purpose of uniform securitization scheme?

The purpose of the uniform securitization scheme is to enhance investor confidence, improve market efficiency, and facilitate standardization in the securitization process, thereby reducing risks associated with asset-backed securities.

What information must be reported on uniform securitization scheme?

The information that must be reported typically includes details about the underlying assets, data on structured finance transactions, risk assessments, payment structures, and compliance with legal and regulatory requirements.

Fill out your uniform securitization scheme online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Uniform Securitization Scheme is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.