NE 96-158-99 free printable template

Show details

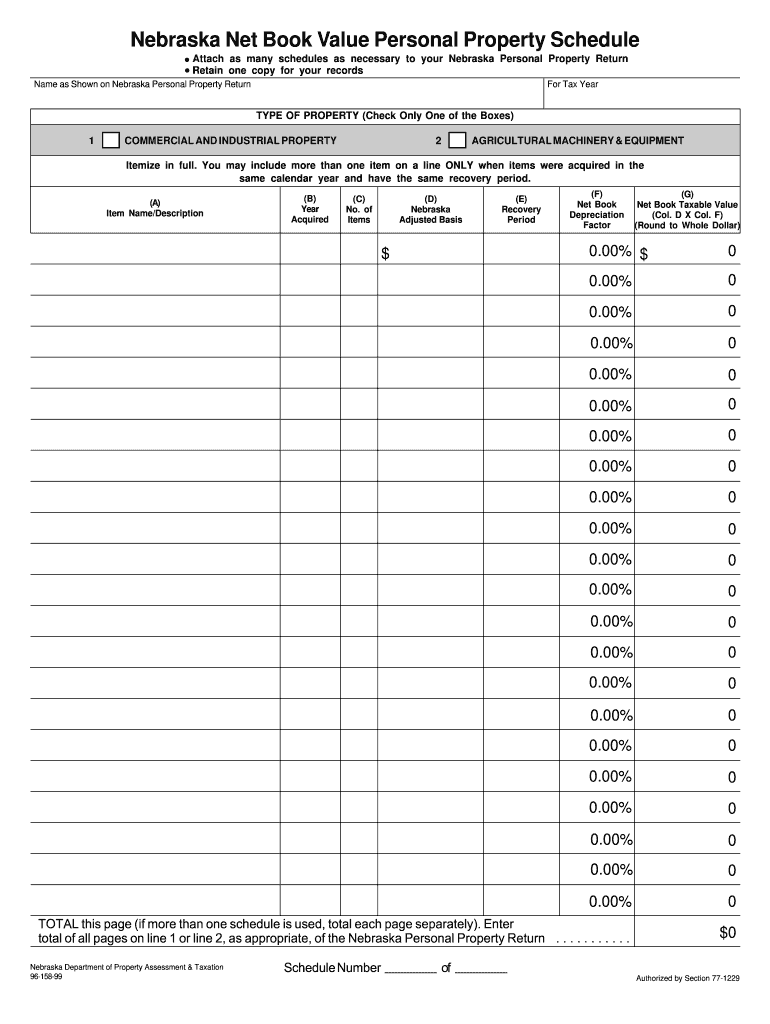

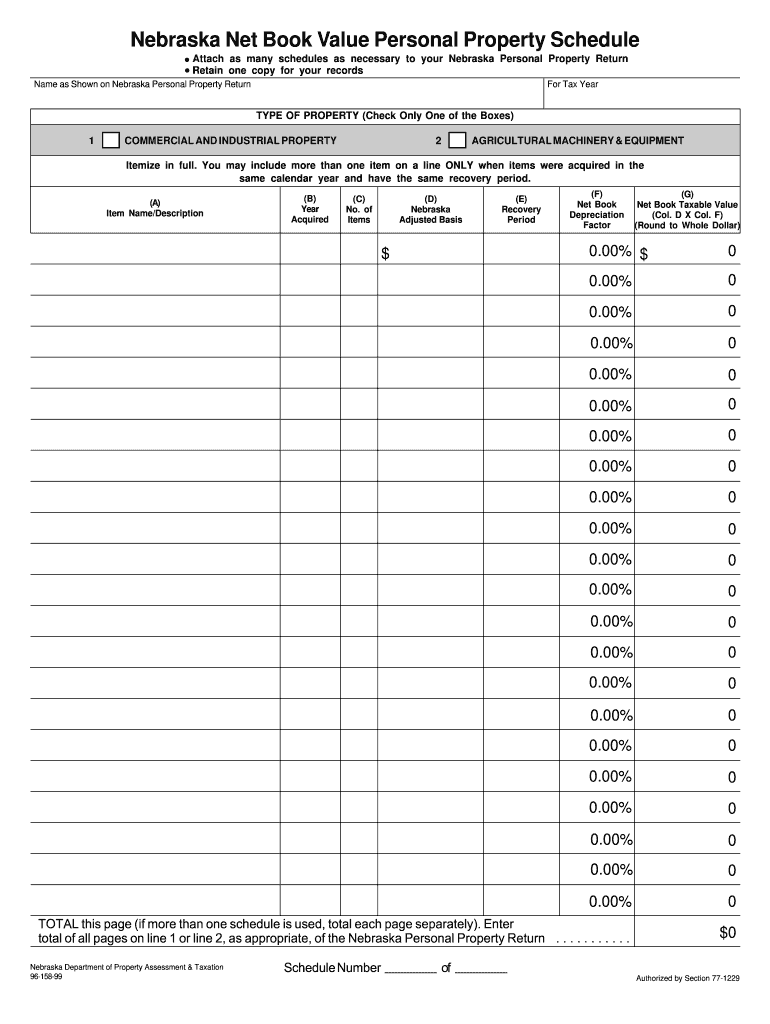

Go To Degree. Factors Nebraska Net Book Value Personal Property Schedule Attach as many schedules as necessary to your Nebraska Personal Property Return Retain one copy for your records Name as Shown

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NE 96-158-99

Edit your NE 96-158-99 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NE 96-158-99 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NE 96-158-99 online

To use the services of a skilled PDF editor, follow these steps:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit NE 96-158-99. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out NE 96-158-99

How to fill out NE 96-158-99

01

Gather the necessary personal information, including name, address, date of birth, and Social Security number.

02

Obtain relevant financial documents that may be required, such as income statements or tax returns.

03

Carefully read the instructions included with the NE 96-158-99 form to understand the sections you need to complete.

04

Fill out Section 1 with your personal information accurately.

05

Complete any applicable sections regarding income, expenses, or other financial details.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form where indicated.

08

Submit the form according to the provided instructions, whether by mail or electronically.

Who needs NE 96-158-99?

01

Individuals applying for financial assistance or benefits that require reporting personal and financial information.

02

Residents who need to provide documentation for eligibility verification for certain programs.

Fill

form

: Try Risk Free

People Also Ask about

What is a Form 706N in Nebraska?

When a resident or nonresident dies in the state of Nebraska, the estate tax owed can be filed using a form 706N. This form is found on the website of the Nebraska Department of Revenue.

What is considered personal property in Nebraska?

Personal property is all property other than real property and franchises. Recovery Period. The recovery period is the federal Modified Accelerated Cost Recovery System (MACRS) recovery period over which the Nebraska adjusted basis of property will be depreciated for property tax purposes.

Where do I file my personal property tax return in Nebraska?

Nebraska Personal Property Return must be filed with the County Assessor on or before May 1. County Assessor address and contact information. DO NOT mail personal property returns to the Department of Revenue.

Do I have to pay inheritance tax in Nebraska?

Nebraska imposes an inheritance tax on a beneficiary's right to receive property from a deceased individual (a “decedent”). With certain exceptions discussed below, Nebraska's inheritance tax applies to all the assets owned by a decedent who is a Nebraska resident at the time of his or her death.

What is the personal property tax relief in Nebraska?

The Personal Property Tax Relief Act allows for an exemption of the first $10,000 of value of taxable tangible personal property in each tax district in which a Personal Property Return is filed.

How do I avoid inheritance tax in Nebraska?

Nebraska Inheritance and Gift Tax If you leave money to your spouse, there is no inheritance tax. For other relationships, the following rates apply: Class 1: Parents, siblings, children, grandparents and any spouses/descendants of these relatives. These individuals pay 1% on any value over $40,000.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify NE 96-158-99 without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your NE 96-158-99 into a dynamic fillable form that you can manage and eSign from anywhere.

How do I complete NE 96-158-99 online?

With pdfFiller, you may easily complete and sign NE 96-158-99 online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I edit NE 96-158-99 on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign NE 96-158-99 on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

What is NE 96-158-99?

NE 96-158-99 is a specific form or document used in a regulatory context, typically related to environmental or economic reporting requirements.

Who is required to file NE 96-158-99?

Entities or individuals that meet particular criteria set out by the relevant regulatory body are required to file NE 96-158-99, often including businesses operating in certain sectors.

How to fill out NE 96-158-99?

To fill out NE 96-158-99, you need to follow the instructions provided in the form itself, including completing all required fields accurately, and submitting it to the appropriate authority.

What is the purpose of NE 96-158-99?

The purpose of NE 96-158-99 is to collect specific data that helps regulatory authorities monitor compliance with laws and regulations, and ensure proper environmental or economic stewardship.

What information must be reported on NE 96-158-99?

The information that must be reported on NE 96-158-99 typically includes identification details of the reporting entity, operational metrics, compliance data, and any other information required by the relevant authority.

Fill out your NE 96-158-99 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NE 96-158-99 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.