NY CHAR004 2012 free printable template

Show details

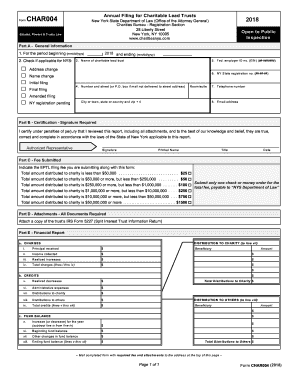

B eginning fund balance O ther changes in fund balance xiii. E nding fund balance lines x thru xii M ail completed form with required fee and attachm ents to the address at the top of this page Page 1 of 1 Form CHAR004 2012. Form Annual Filing for Charitable Lead Trusts CHAR004 New York State Department of Law Office of the Attorney General Charities Bureau - Registration Section 120 Broadway New York NY 10271 www. charitiesnys. com Estates Powers Trusts Law Open to Public Inspection Part A...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY CHAR004

Edit your NY CHAR004 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY CHAR004 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NY CHAR004 online

To use the professional PDF editor, follow these steps:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit NY CHAR004. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY CHAR004 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY CHAR004

How to fill out NY CHAR004

01

Obtain the NY CHAR004 form from the New York State Department of Taxation and Finance website or your local tax office.

02

Fill in your name, address, and other identifying information at the top of the form.

03

Indicate the type of tax return you are submitting (e.g., individual, corporate, etc.).

04

Provide details for each line item as required, including income, deductions, and credits.

05

Double-check all entries for accuracy and completeness.

06

Sign and date the form at the designated area.

07

Submit the form according to the instructions provided, whether electronically or via mail.

Who needs NY CHAR004?

01

Individuals and businesses required to report New York State taxes.

02

Taxpayers seeking to claim specific credits or fulfill their tax obligations.

03

Anyone who has income derived from New York State sources.

Fill

form

: Try Risk Free

People Also Ask about

Can NY CHAR500 be filed electronically?

Annual filing form The Charities Bureau has an online portal for submitting charities' annual financial filings. This interactive version of the CHAR500 offers a streamlined process that allows uploading of all required documents, ePayment, and eSignature.

Can CHAR500 be signed electronically?

Annual filing form The Charities Bureau has an online portal for submitting charities' annual financial filings. This interactive version of the CHAR500 offers a streamlined process that allows uploading of all required documents, ePayment, and eSignature.

How much does it cost to file for CHAR500?

~ $25, if the NET WORTH is less than $50,000 DUAL filers are registered under both 7A and EPTL.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in NY CHAR004?

The editing procedure is simple with pdfFiller. Open your NY CHAR004 in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

Can I create an electronic signature for signing my NY CHAR004 in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your NY CHAR004 and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How can I fill out NY CHAR004 on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your NY CHAR004 from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is NY CHAR004?

NY CHAR004 is a form used by charities in New York State to report specific information about their financial activities and compliance with state laws.

Who is required to file NY CHAR004?

Organizations that are registered as charities in New York State and that meet certain financial thresholds are required to file NY CHAR004 annually.

How to fill out NY CHAR004?

To fill out NY CHAR004, organizations must provide detailed financial information, including income, expenses, and a statement of their charitable activities, following the instructions provided with the form.

What is the purpose of NY CHAR004?

The purpose of NY CHAR004 is to ensure transparency and accountability among charities operating in New York State by requiring them to disclose their financial information and activities.

What information must be reported on NY CHAR004?

NY CHAR004 requires reporting of the organization’s revenue, expenditures, assets, liabilities, and details about its programs and services offered.

Fill out your NY CHAR004 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY char004 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.