Get the free 2012 birt ez form - phila

Show details

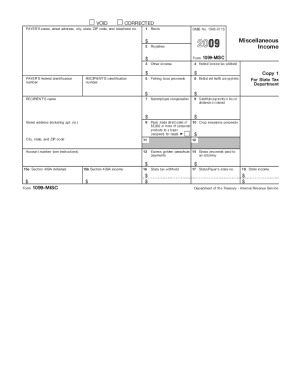

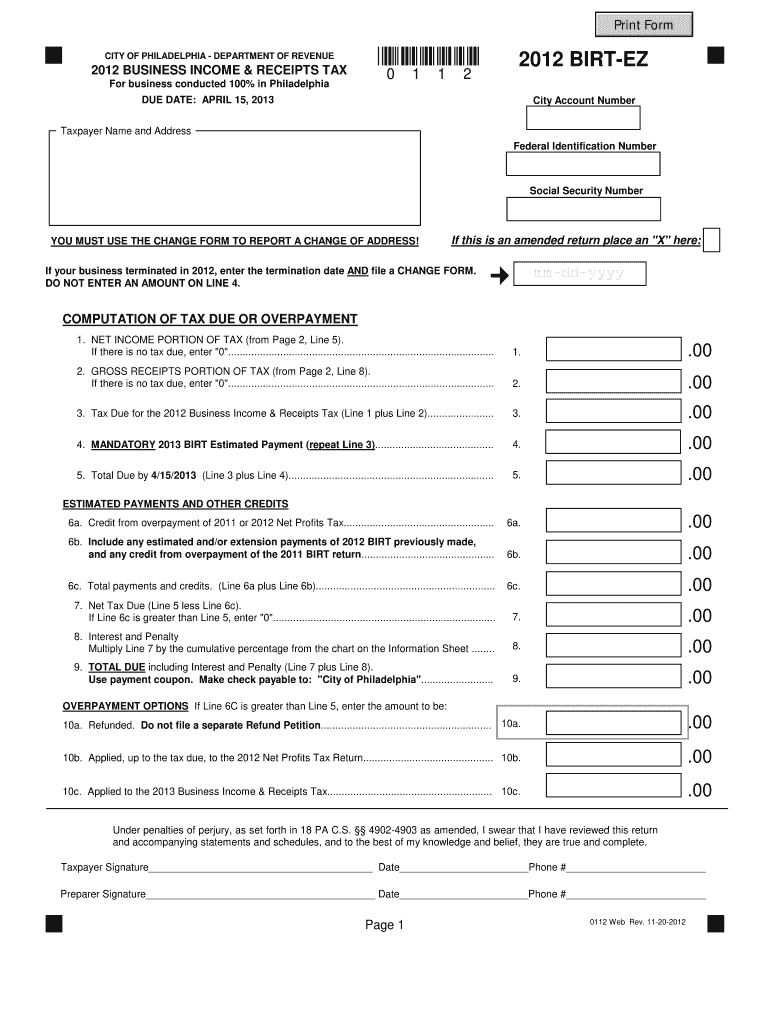

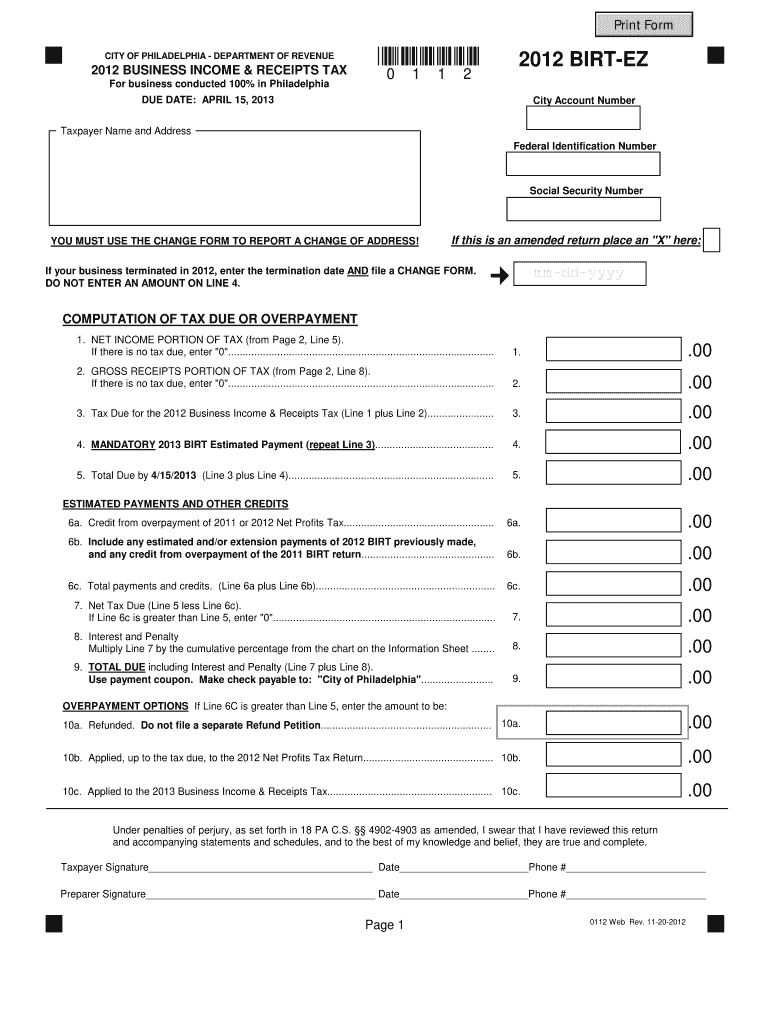

Print Form CITY OF PHILADELPHIA - DEPARTMENT OF REVENUE 2012 BUSINESS INCOME RECEIPTS TAX For business conducted 100 in Philadelphia 2012 BIRT-EZ DUE DATE APRIL 15 2013 City Account Number Taxpayer Name and Address Federal Identification Number Social Security Number YOU MUST USE THE CHANGE FORM TO REPORT A CHANGE OF ADDRESS If this is an amended return place an X here If your business terminated in 2012 enter the termination date AND file a CHAN...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2012 birt ez form

Edit your 2012 birt ez form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2012 birt ez form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2012 birt ez form online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 2012 birt ez form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

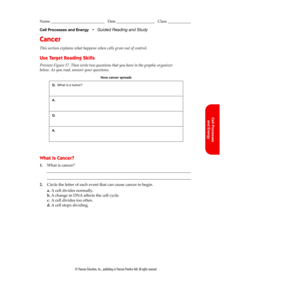

How to fill out 2012 birt ez form

How to fill out 2012 birt ez form:

01

Start by gathering all the necessary information. You will need the personal details of the person whose birth information is being recorded, such as their full name, date of birth, and place of birth.

02

Next, find the appropriate section on the form to fill out the birth information. Look for fields that ask for the individual's name, date of birth, and place of birth. Fill in the required details accurately and clearly.

03

Double-check all the information you have entered to ensure accuracy. Any mistakes or incorrect information can lead to issues later on.

04

Once you have filled out the birth information section, review the rest of the form for any additional details that may need to be included. Some forms may require additional information such as the parents' names or any special circumstances related to the birth.

05

Fill in all the additional requested information as necessary, making sure to provide accurate details.

06

After completing all the required sections of the form, review it once more to ensure everything is filled out correctly and there are no errors or missing information.

07

Finally, sign and date the form as required. Make sure your signature is legible and matches any previous signatures you may have used for official documents.

Who needs 2012 birt ez form:

01

Individuals born in 2012 or their legal guardians who need to officially record their birth information.

02

Government agencies or institutions that require official birth records for individuals born in 2012 for various administrative purposes.

03

Individuals or organizations conducting research or gathering statistical data related to births in 2012, where the form may be used to collect the necessary information.

Fill

form

: Try Risk Free

People Also Ask about

Who is exempt from Philadelphia Wage Tax?

All Philadelphia residents owe the City Wage Tax, regardless of where they work. Non-residents who work in Philadelphia must also pay the Wage Tax. Effective July 1, 2021, the rate for residents is 3.8398 percent, and the rate for non-residents is 3.4481 percent.

Do I need to file Philadelphia birt?

Every individual, partnership, association, limited liability company (LLC), and corporation engaged in a business, profession, or other activity for profit within the City of Philadelphia must file a Business Income & Receipts Tax (BIRT) return.

What is the income tax rate in Philadelphia for birt?

The City of Philadelphia has reduced the tax rate for the net income portion of its Business Income and Receipts Tax (BIRT) from 6.20% to 5.99%. The BIRT applies to gross receipts and taxable net income for business activities conducted in Philadelphia. The new rate is effective for tax year 2022.

How do I get a BIRT number in Philadelphia?

The application for the Commercial Activity License (CAL) and Business Tax Account number (BIRT) is a combination application. You can apply online or in person in the basement of the Municipal Services building. If you apply online, it will take time for the city to process your application.

Do I have to file a Philadelphia Wage Tax return?

All employed Philadelphia residents owe the Wage Tax, regardless of where they work. Non-residents who work in Philadelphia must also pay the Wage Tax.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 2012 birt ez form to be eSigned by others?

Once you are ready to share your 2012 birt ez form, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I make edits in 2012 birt ez form without leaving Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing 2012 birt ez form and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

How do I edit 2012 birt ez form on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign 2012 birt ez form. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

What is birt ez form?

BIRT EZ Form is a simplified version of the Business Income and Receipts Tax (BIRT) form for small businesses.

Who is required to file birt ez form?

Small businesses that meet certain eligibility criteria are required to file BIRT EZ Form.

How to fill out birt ez form?

BIRT EZ Form can be filled out online or manually, following the instructions provided on the form.

What is the purpose of birt ez form?

The purpose of BIRT EZ Form is to simplify the tax filing process for small businesses and make it easier for them to comply with tax regulations.

What information must be reported on birt ez form?

BIRT EZ Form requires businesses to report their income and receipts for the tax year, as well as any other relevant financial information.

Fill out your 2012 birt ez form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2012 Birt Ez Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.