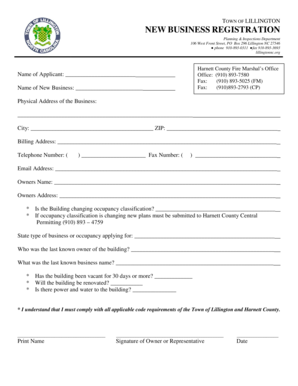

CA T2 SCH 50 2006 free printable template

Show details

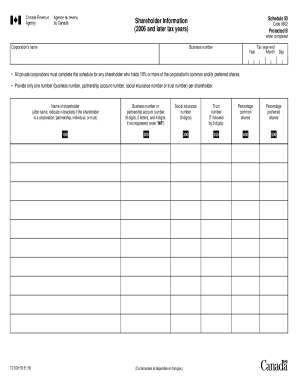

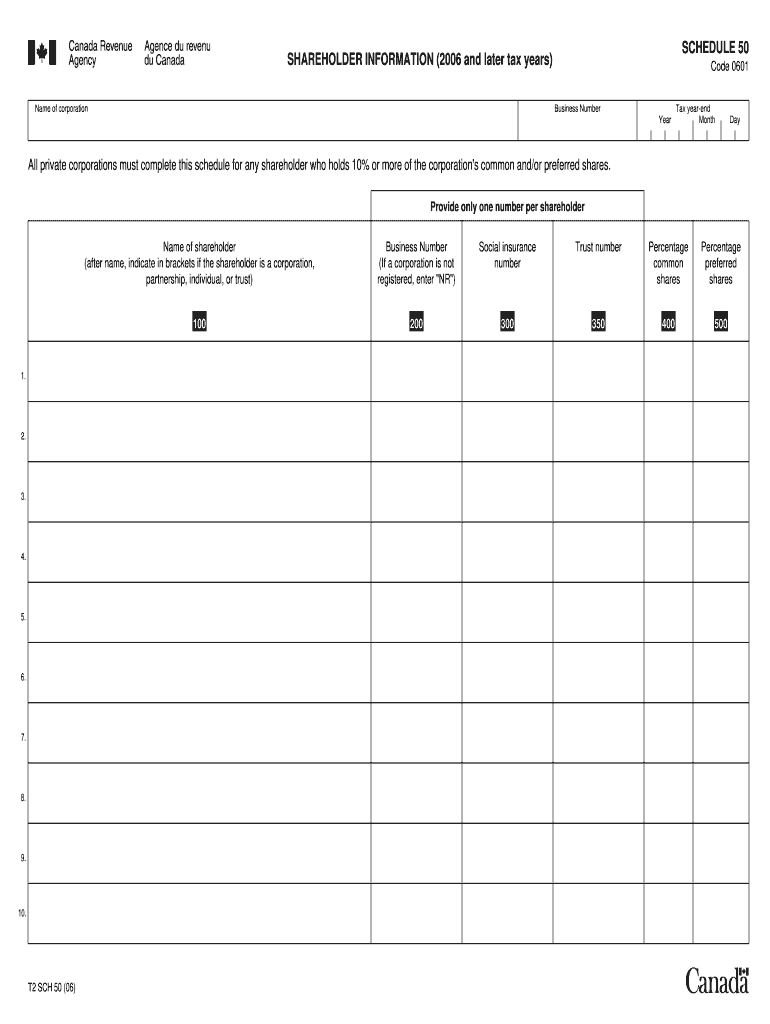

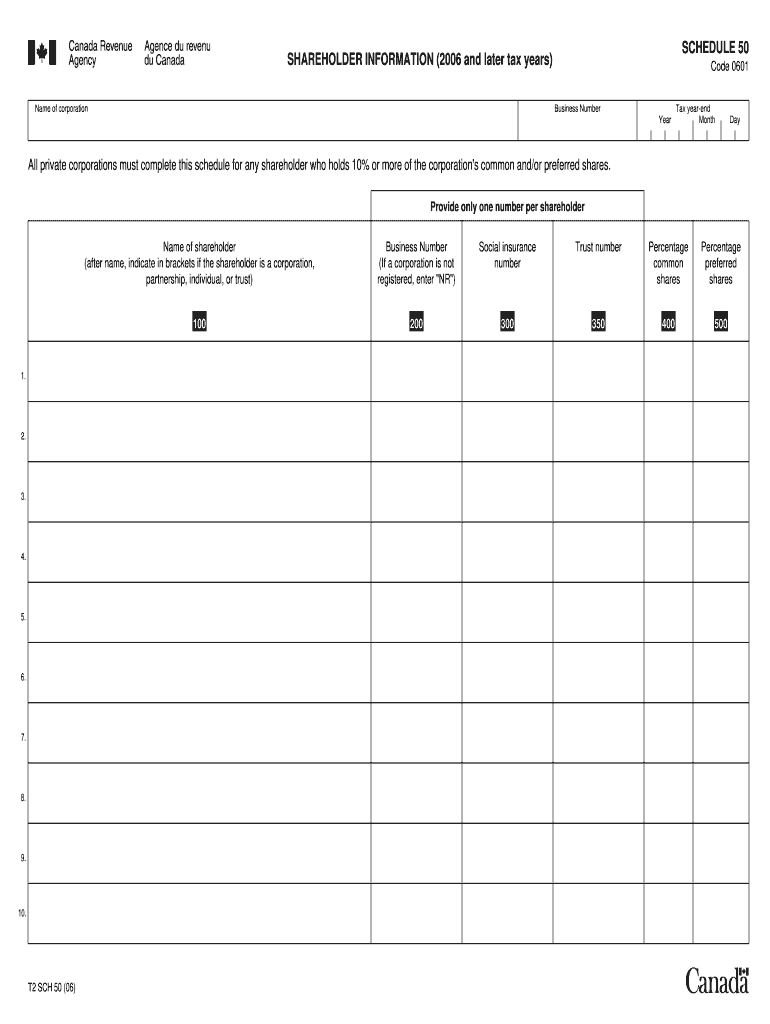

SCHEDULE 50 SHAREHOLDER INFORMATION (2006 and later tax years) Name of corporation Code 0601 Business Number Year Tax year-end Month Day All private corporations must complete this schedule for any

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA T2 SCH 50

Edit your CA T2 SCH 50 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA T2 SCH 50 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing CA T2 SCH 50 online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit CA T2 SCH 50. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA T2 SCH 50 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CA T2 SCH 50

How to fill out CA T2 SCH 50

01

Obtain a copy of the CA T2 Schedule 50 form from the Canada Revenue Agency (CRA) website or relevant sources.

02

Begin by entering your corporation's name and business number at the top of the form.

03

Fill in the tax year period for which you are filing.

04

Complete Part 1 by providing the required financial information, such as total income and expenses.

05

Move to Part 2, where you will indicate the types of income that your corporation earned during the year.

06

In Part 3, list any deductions or losses your corporation is claiming.

07

Review the instructions for any additional schedules that may need to be attached.

08

Check your entries to ensure accuracy, then sign and date the form.

09

Submit the completed form along with your T2 return by the filing deadline.

Who needs CA T2 SCH 50?

01

Corporations operating in Canada that earn income and are required to file a T2 corporate income tax return.

02

Corporate entities that have claimed any tax credits or deductions related to investment income or other specific activities.

Instructions and Help about CA T2 SCH 50

Fill

form

: Try Risk Free

People Also Ask about

What is a corporate tax return?

Your corporate tax return must include details of the company's profits and expenses. The net result determines the amount of tax the company owes to the US government.

What does Schedule 120 mean?

Inside Diameter / Wall Thickness The pipe schedule 120 is a thickness designator that means schedule 120 is thicker than schedule 100. An increase in service pressure can increase the pipe's schedule.

What tax form for C Corp?

A regular corporation (also known as a C corporation) is taxed as a separate entity. The corporation must file a Form 1120 each year to report its income and to claim its deductions and credits.

What is the schedule 50?

T2 Schedule 50 T2SCH50, Shareholder Information, is filled if you are a private corporation and if any shareholder holds 10% or more of your common or preferred shares.

What is Schedule 100?

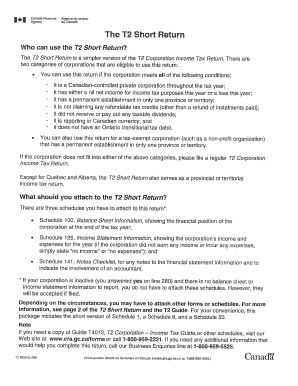

Schedule 100 – Balance Statement Summary Schedule 100 is a summary of the company's balance sheet. Enter the total assets, total liabilities, and equity on this schedule.

What is 100 NB pipe size?

Pipe was originally measured in inches. 100NB pipe works out to be exactly 4.5 inches (4.5(inches) x 25.4(mm/inch) = 114.3mm).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete CA T2 SCH 50 online?

Easy online CA T2 SCH 50 completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

Can I edit CA T2 SCH 50 on an iOS device?

Use the pdfFiller mobile app to create, edit, and share CA T2 SCH 50 from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

How do I complete CA T2 SCH 50 on an Android device?

Use the pdfFiller mobile app to complete your CA T2 SCH 50 on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is CA T2 SCH 50?

CA T2 SCH 50 is a schedule used by Canadian corporations to report their tax calculations for certain tax credits and deductions when filing their corporate income tax return.

Who is required to file CA T2 SCH 50?

Corporations in Canada that are claiming certain tax credits or deductions related to their taxable income are required to file CA T2 SCH 50.

How to fill out CA T2 SCH 50?

To fill out CA T2 SCH 50, corporations must provide specific financial information, indicate the credits they are claiming, and complete any calculations as instructed in the guide provided with the schedule.

What is the purpose of CA T2 SCH 50?

The purpose of CA T2 SCH 50 is to ensure proper reporting and calculation of certain tax credits and deductions which can affect the overall tax liability of the corporation.

What information must be reported on CA T2 SCH 50?

CA T2 SCH 50 requires reporting on the corporation's income, applicable credits, deductions, and any other information necessary for the calculation of the taxes owed or refundable.

Fill out your CA T2 SCH 50 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA t2 SCH 50 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.