Get the free Underwriting Guidelines for Groups with 2 to 50 Eligible Employees

Show details

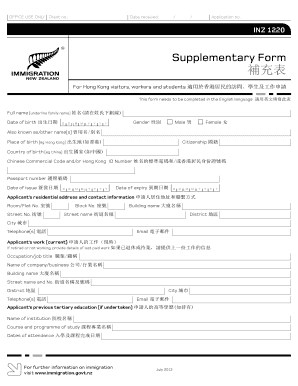

This document outlines the underwriting guidelines for small group employee health coverage, including eligibility criteria, dependent coverage, COBRA requirements, cut-off dates, and necessary documentation

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign underwriting guidelines for groups

Edit your underwriting guidelines for groups form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your underwriting guidelines for groups form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing underwriting guidelines for groups online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit underwriting guidelines for groups. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out underwriting guidelines for groups

How to fill out Underwriting Guidelines for Groups with 2 to 50 Eligible Employees

01

Gather all necessary employee information, including names, ages, and any pre-existing health conditions.

02

Determine the total number of eligible employees within the group (between 2 to 50).

03

Review the underwriting guidelines to understand specific criteria related to risk assessment.

04

Fill out the application form accurately based on the collected employee data.

05

Provide supporting documents as required, such as proof of employee eligibility and any relevant financial records.

06

Submit the completed application form along with the additional documents to the underwriting department.

07

Await feedback or additional requests for information from the underwriters.

Who needs Underwriting Guidelines for Groups with 2 to 50 Eligible Employees?

01

Small business owners with employee groups between 2 to 50 who are seeking health insurance or other coverage.

02

Human resources professionals managing employee benefits for small to mid-sized companies.

03

Insurance agents or brokers representing groups looking to understand their underwriting requirements.

Fill

form

: Try Risk Free

People Also Ask about

What are the participation requirements for group insurance?

Most insurers typically require you to enroll at least 70% of your uninsured, full-time employees. If some of your employees have self-only coverage, they won't count toward the participation requirement. The same is true if you have employees covered by their spouse's insurance plan.

What is one of the differences between group underwriting and individual underwriting?

Group life insurance, commonly offered as part of employment benefits, simplifies the process by eliminating individual underwriting for their base policy option. This means all eligible group members receive coverage without needing to disclose their health history or undergo medical examinations.

What is the minimum number of people an employer can have to insure with a group policy?

To be eligible for small business health insurance, a company must have between one and 50 employees. That is considered a small business for purposes of purchasing group health insurance. If you have more than 50 employees, you'll need to: apply for large group coverage.

What is the reason for requiring a minimum group size when underwriting group health insurance?

Minimum participation requirements determine the minimum percentage of eligible employees who must enroll in a group health insurance plan to be valid. Insurers typically set these requirements to ensure a health plan covers enough employees to spread the risk and maintain financial viability.

What is the difference between group underwriting and individual underwriting?

When an insurer agrees to provide insurance, they underwrite the risks involved and price the premiums ingly. In the case of an individual policy, it is the policyholder and their family whose risks get assessed. However, with group plans, the group's overall risk is assessed rather than the individual.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Underwriting Guidelines for Groups with 2 to 50 Eligible Employees?

Underwriting Guidelines for Groups with 2 to 50 Eligible Employees are a set of criteria and standards that insurance providers use to assess the risk associated with insuring small employer groups. These guidelines help determine coverage options, premiums, and eligibility for insurance products.

Who is required to file Underwriting Guidelines for Groups with 2 to 50 Eligible Employees?

Insurance companies offering group insurance to employers with 2 to 50 eligible employees are required to file Underwriting Guidelines. This includes health insurance providers who must adhere to state regulations regarding small group coverage.

How to fill out Underwriting Guidelines for Groups with 2 to 50 Eligible Employees?

To fill out Underwriting Guidelines, insurers need to gather detailed information regarding the group, including the number of eligible employees, age distribution, claims history, and any pre-existing conditions. This information must be accurately reported as per the prescribed format provided by the regulatory authority.

What is the purpose of Underwriting Guidelines for Groups with 2 to 50 Eligible Employees?

The purpose of Underwriting Guidelines is to standardize the evaluation process for small group health insurance, ensuring insurers can assess risk appropriately. This promotes fair pricing, consistency in underwriting decisions, and protects both insurers and policyholders.

What information must be reported on Underwriting Guidelines for Groups with 2 to 50 Eligible Employees?

Information that must be reported includes the number of eligible employees, demographic details (ages and genders), the health status of employees, prior claims history, and any existing health conditions that may affect coverage risk. Additional details required by state regulations may also apply.

Fill out your underwriting guidelines for groups online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Underwriting Guidelines For Groups is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.