Get the free AG Select-a-Term Insurance

Show details

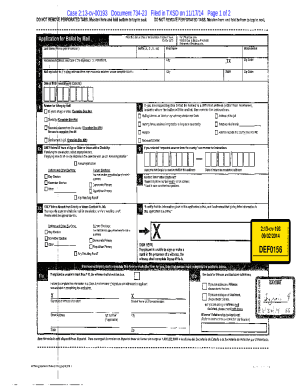

This document provides updated premium rates for the AG Select-a-Term life insurance product from American General Life Companies, highlighting rate reductions based on different age and class categories.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ag select-a-term insurance

Edit your ag select-a-term insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ag select-a-term insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ag select-a-term insurance online

To use the services of a skilled PDF editor, follow these steps below:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit ag select-a-term insurance. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ag select-a-term insurance

How to fill out AG Select-a-Term Insurance

01

Gather personal information: Collect details such as your name, address, date of birth, and Social Security number.

02

Determine your coverage needs: Decide how long you need the insurance and the amount of coverage required.

03

Choose a term length: Select from the available term options (e.g., 10, 20, or 30 years).

04

Complete the application form: Fill out the insurance application with the gathered information.

05

Answer health questions: Provide accurate information regarding your health history and lifestyle habits.

06

Review and submit your application: Double-check all entered information for accuracy and submit the application.

07

Await underwriting: The insurance company will review your application and may request additional information.

08

Receive your policy: If approved, you’ll receive your policy documents outlining the coverage and terms.

Who needs AG Select-a-Term Insurance?

01

Individuals with dependents who need financial protection in case of untimely death.

02

Homeowners wanting to ensure mortgage obligations are met.

03

Parents planning for their children's future education expenses.

04

Young professionals seeking low-cost coverage while still healthy.

05

Individuals looking for temporary coverage during a specific financial obligation period.

Fill

form

: Try Risk Free

People Also Ask about

How does select term life insurance work?

Term life insurance guarantees payment of a stated death benefit to the insured's beneficiaries if the insured person dies during the specified term. These policies have no value other than the guaranteed death benefit and don't feature a savings component (as is found in permanent life insurance products).

How to select a term insurance plan?

Term insurance provides a financial safety net for unexpected events such as accidents, illness, or death. It ensures that beneficiaries have access to necessary funds during difficult times. A term plan offers financial protection by providing a lump sum payout.

Can you cash out select term life insurance?

Term Life Insurance Does Not Have a Cash Surrender Value It doesn't accrue value over time, but rather expires once you've paid the value of the policy in premiums. This means that if a policyowner outlives the end of a policy, they won't receive any payout when it expires.

What happens to term life insurance at the end of the term?

Choose term life if you: Only want coverage for a specific period of time. A term life policy can replace your income if you die while you still have major financial obligations, such as raising children or paying off your mortgage. Want the most affordable coverage.

What does select term life insurance mean?

When choosing a term insurance plan, it is important to consider your current income, job stability, future earning potential and financial liabilities like loans. It is advised to opt for a coverage amount that adequately replaces your income and ensures your family's financial stability in your absence.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is AG Select-a-Term Insurance?

AG Select-a-Term Insurance is a type of life insurance that offers flexible coverage options for a specific term length, allowing policyholders to choose the duration of coverage that best fits their needs.

Who is required to file AG Select-a-Term Insurance?

Individuals who wish to obtain AG Select-a-Term Insurance must complete the application process, which typically includes answering health questions and disclosing any relevant personal information.

How to fill out AG Select-a-Term Insurance?

To fill out AG Select-a-Term Insurance, applicants should carefully complete the application form by providing personal information, selecting the desired term length, and answering health-related questions accurately.

What is the purpose of AG Select-a-Term Insurance?

The purpose of AG Select-a-Term Insurance is to provide financial protection to beneficiaries in the event of the policyholder's death during the selected term, ensuring peace of mind and financial security.

What information must be reported on AG Select-a-Term Insurance?

Applicants must report personal details such as age, gender, health history, lifestyle factors, and the amount of coverage desired when applying for AG Select-a-Term Insurance.

Fill out your ag select-a-term insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ag Select-A-Term Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.