Get the free Trustee Transfer Request Form

Show details

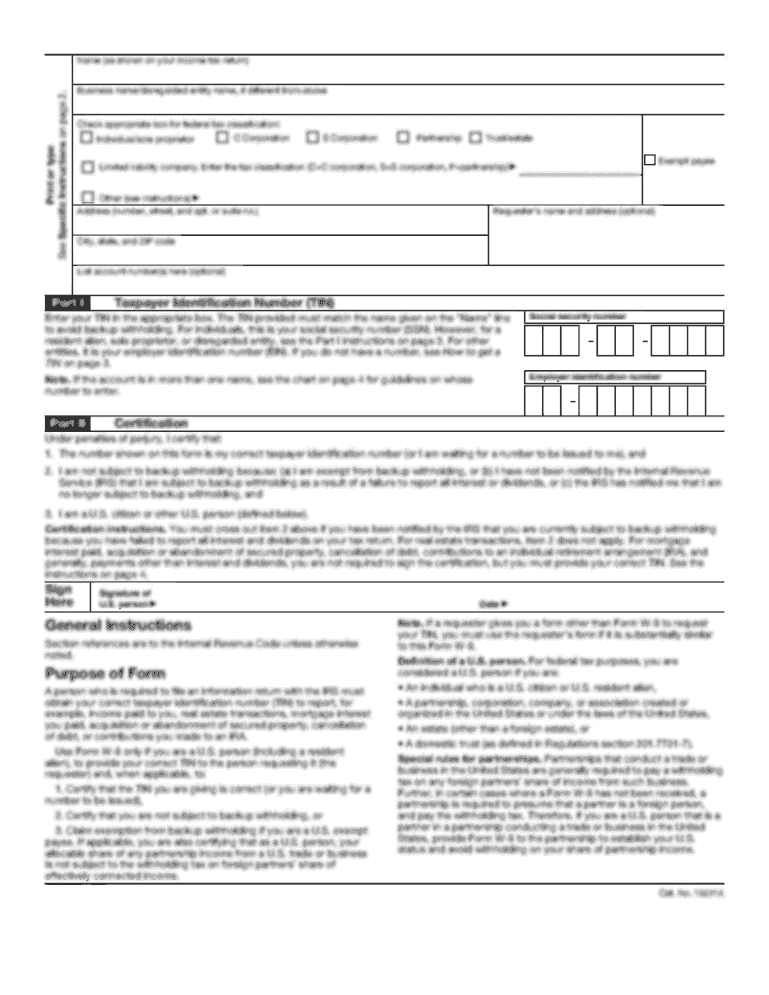

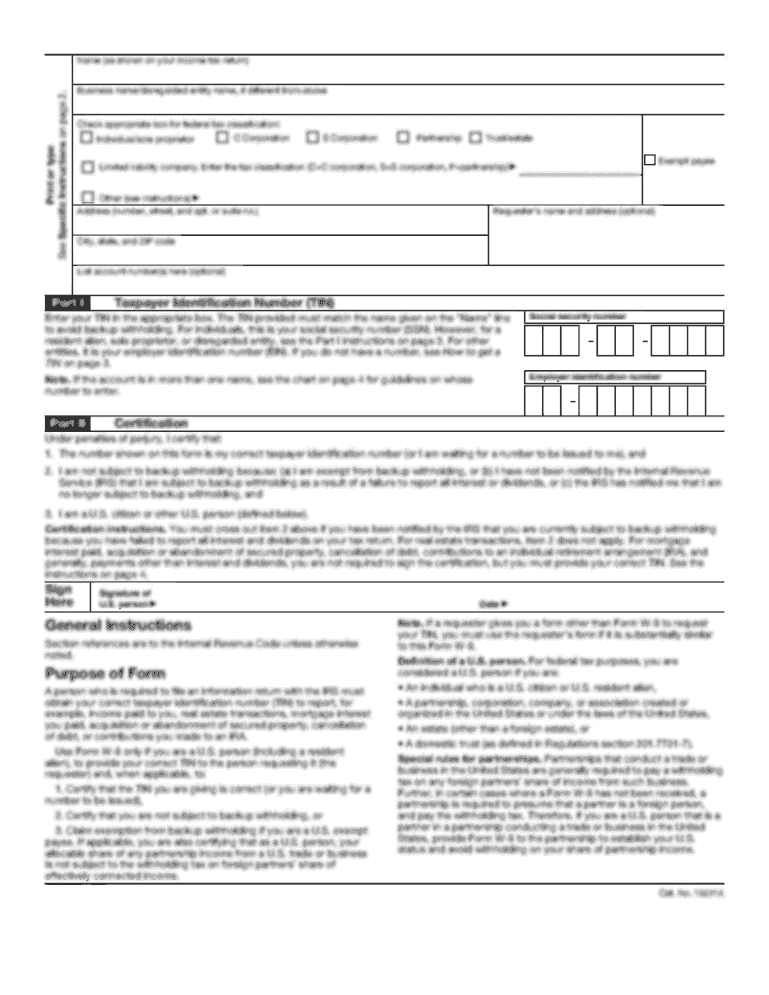

This form is used to request a transfer of retirement assets to American General Life Insurance Company for the establishment of a Single Premium Immediate Annuity.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign trustee transfer request form

Edit your trustee transfer request form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your trustee transfer request form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing trustee transfer request form online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit trustee transfer request form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out trustee transfer request form

How to fill out Trustee Transfer Request Form

01

Obtain the Trustee Transfer Request Form from your trustee or their website.

02

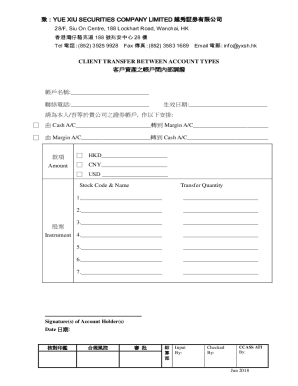

Fill out your personal information at the top of the form, including your name, address, and account number.

03

Specify the type of account you wish to transfer.

04

Indicate the trustee or financial institution you are transferring the account to.

05

Provide any additional required documentation, such as identification or account statements.

06

Review the form for accuracy and completeness.

07

Sign and date the form.

08

Submit the form to your trustee or the designated financial institution.

Who needs Trustee Transfer Request Form?

01

Individuals who wish to transfer assets from one trustee to another.

02

Beneficiaries looking to move their trust assets to a new financial institution.

03

Trustholders needing to consolidate accounts or change trustees.

Fill

form

: Try Risk Free

People Also Ask about

How much is a trustee-to-trustee transfer fee?

Trustee-to-trustee transfers aren't limited in frequency but HSA providers usually charge a fee to the tune of $20 to $30. It's not worth it if your HSA provider charges a fee for trustee-to-trustee transfers. Just do the rollover on your own.

How do you transfer a trustee?

How to change trustees on a trust. Beneficiaries looking to change trustees may petition the California Probate Court if internal resolution fails, so that a resignation of their current trustee and appointment of another one can be managed ing to its terms and the beneficiaries' interests.

What is the difference between a rollover and a trustee-to-trustee transfer?

A transfer occurs when you instruct your custodian to move your assets from your current IRA to an IRA at another institution. A rollover, on the other hand, involves transmitting retirement assets to an IRA from a different type of account, like a 401(k) or 403(b). The IRS also treats them differently.

What is the minimum trustee fee?

For example, it's not unusual for trustees to charge a minimum of 1% when dealing with larger trusts that have substantial assets. So for a trust with $5 million in assets, the fee would work out to $50,000 a year. With smaller trusts that use a flat fee model, the numbers can look very different.

What is the trusteeship fee?

What Are Trustee Fees? Trustee fees are the payments that'll be made to your appointed Trustee in exchange for the service they'll provide as they fulfill their duties in the role. A Trustee doesn't have to be a person - you can appoint a bank or professional wealth management company as Trustee if you want to.

Are trustee fees subject to 2%?

Whether a cost is subject to the 2% floor depends on the nature of the expense. For instance, trustee fees are deductible in full because these fees are by definition incurred only when assets are held in trust. Other types of fiduciary expenses – most notably, investment advisory fees – can be subject to the 2% floor.

How to make a trustee-to-trustee transfer?

If you want to move your individual retirement account (IRA) balance from one provider to another, you can simply call your current provider and request a “trustee-to-trustee” transfer. This moves money directly from one financial institution to another, and it won't trigger taxes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Trustee Transfer Request Form?

The Trustee Transfer Request Form is a document used to request the transfer of assets from one trustee to another within a trust arrangement.

Who is required to file Trustee Transfer Request Form?

Typically, the current trustee or the individual authorized by the trust agreement is required to file the Trustee Transfer Request Form.

How to fill out Trustee Transfer Request Form?

To fill out the Trustee Transfer Request Form, provide accurate details such as the names of the current and new trustees, the assets to be transferred, and signatures of all relevant parties.

What is the purpose of Trustee Transfer Request Form?

The purpose of the Trustee Transfer Request Form is to formalize the request to transfer the management of trust assets from one trustee to another, ensuring a clear record of the change.

What information must be reported on Trustee Transfer Request Form?

The information that must be reported includes the names and contact information of the current trustee and the new trustee, details of the trust, descriptions of the assets to be transferred, and signatures of the involved parties.

Fill out your trustee transfer request form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Trustee Transfer Request Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.