Get the free Auto Re-Balancing Enrollment-NY Only

Show details

This form authorizes MONY Life Insurance Company to enroll a policyholder in the Auto Re-Balancing/Asset Reallocation program that facilitates the automatic transfer of fund values among various subaccounts

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign auto re-balancing enrollment-ny only

Edit your auto re-balancing enrollment-ny only form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your auto re-balancing enrollment-ny only form via URL. You can also download, print, or export forms to your preferred cloud storage service.

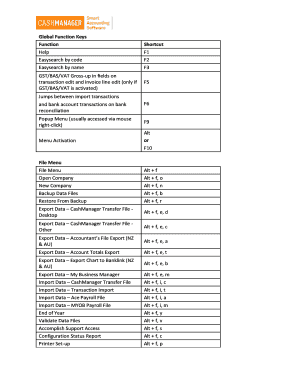

Editing auto re-balancing enrollment-ny only online

To use the services of a skilled PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit auto re-balancing enrollment-ny only. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out auto re-balancing enrollment-ny only

How to fill out Auto Re-Balancing Enrollment-NY Only

01

Visit the Auto Re-Balancing Enrollment page for New York.

02

Log in to your account using your credentials.

03

Navigate to the enrollment section of your account.

04

Select the Auto Re-Balancing Enrollment option.

05

Review the terms and conditions of the service.

06

Fill in the required personal and financial information.

07

Choose your preferred investment options if applicable.

08

Review your selections and ensure all information is accurate.

09

Submit the enrollment application.

10

Monitor your email for confirmation of acceptance into the program.

Who needs Auto Re-Balancing Enrollment-NY Only?

01

Investors who want to automate the rebalancing of their investment portfolio.

02

Individuals looking for a hands-off approach to managing their investments.

03

Participants in retirement plans or investment accounts that allow auto-rebalancing.

04

People who seek to maintain their target asset allocation without constant manual adjustments.

Fill

form

: Try Risk Free

People Also Ask about

Can I change my investments in my 401K?

You can also change your contribution percentage throughout the year by logging into and adjusting your percentage. If you make changes to your 401K contribution amount, it can take up to an additional pay cycle or two to reflect the changes on your paycheck.

Should I automatically rebalance my fund holdings?

Yes, you should do it. Besides keeping your risk profile where you want it, re-balancing also has the potential to make re-balancing returns, on top of any returns from the underlying assets, if the market is volatile enough, by 'automatically' selling high and buying low.

How do I change my contributions on ?

Roll it over to a new account. You can keep all of your old investments and you have a drastically larger array of investment options. Make sure it's a direct rollover so you don't end up paying taxes on the money during transfer.

How to change investments in 401k?

You can call us at 800-344-1029 to enroll in phone transfer authorization over the phone and elect to make a transfer. Use this form to make investment option transfers on a one-time basis or to change how your future premium payments will be allocated to your variable annuity.

Should I rebalance my 403b?

Based on their analysis, there is no observable benefit to rebalancing during retirement. In fact, the best-performing withdrawal strategy during retirement is to perform no rebalancing at all and to withdraw bonds first (in effect increasing your stock allocation over time).

What does automatic rebalancing mean?

Automatic Account Rebalancing is an account management feature that automatically keeps your asset allocation in balance ing to your most recent investment elections.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Auto Re-Balancing Enrollment-NY Only?

Auto Re-Balancing Enrollment-NY Only is a program in New York that automatically adjusts and balances enrollment across different participating plans to ensure equitable distribution and access to resources for members.

Who is required to file Auto Re-Balancing Enrollment-NY Only?

Entities that participate in the enrollment programs within New York, such as health plans or organizations managing member enrollments, are required to file Auto Re-Balancing Enrollment-NY Only.

How to fill out Auto Re-Balancing Enrollment-NY Only?

To fill out the Auto Re-Balancing Enrollment-NY Only, you must provide accurate enrollment data, specify your organization details, and follow any guidelines provided by the New York state agency overseeing the enrollment.

What is the purpose of Auto Re-Balancing Enrollment-NY Only?

The purpose of Auto Re-Balancing Enrollment-NY Only is to maintain a balanced distribution of enrollees among available plans, improve access to services, and enhance the overall efficiency of the healthcare system in New York.

What information must be reported on Auto Re-Balancing Enrollment-NY Only?

The information that must be reported includes total enrollment numbers, types of services provided, demographic information of enrollees, and any adjustments made during the re-balancing process.

Fill out your auto re-balancing enrollment-ny only online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Auto Re-Balancing Enrollment-Ny Only is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.