Get the free Variable Universal Life (VUL) Service Request Form

Show details

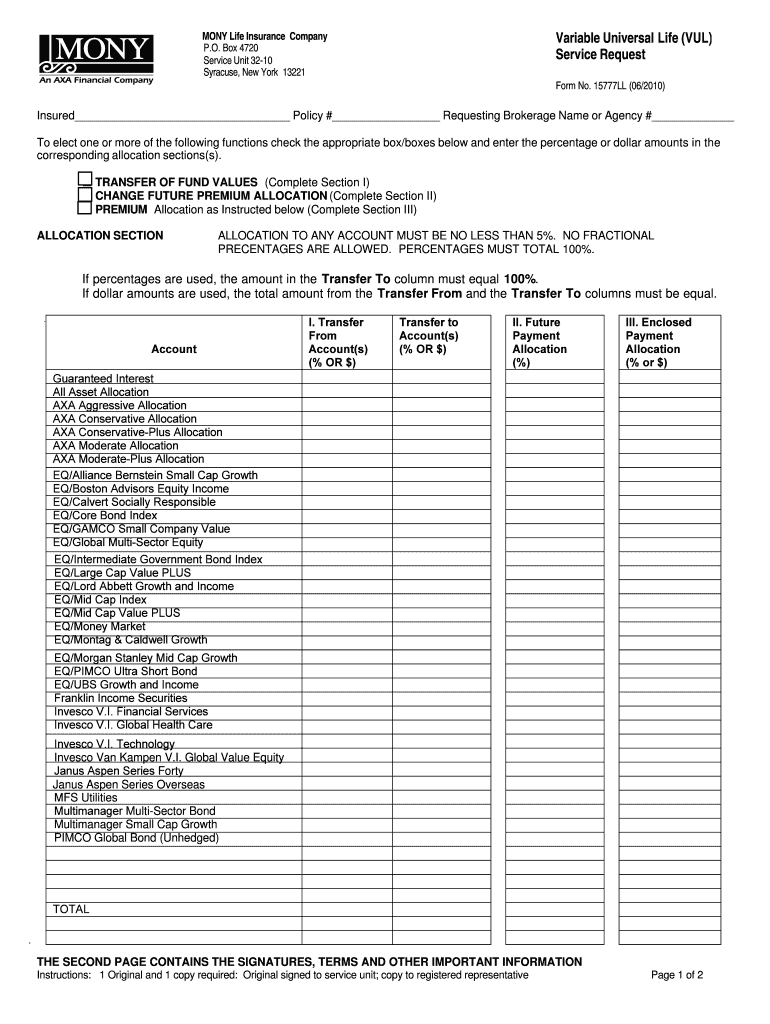

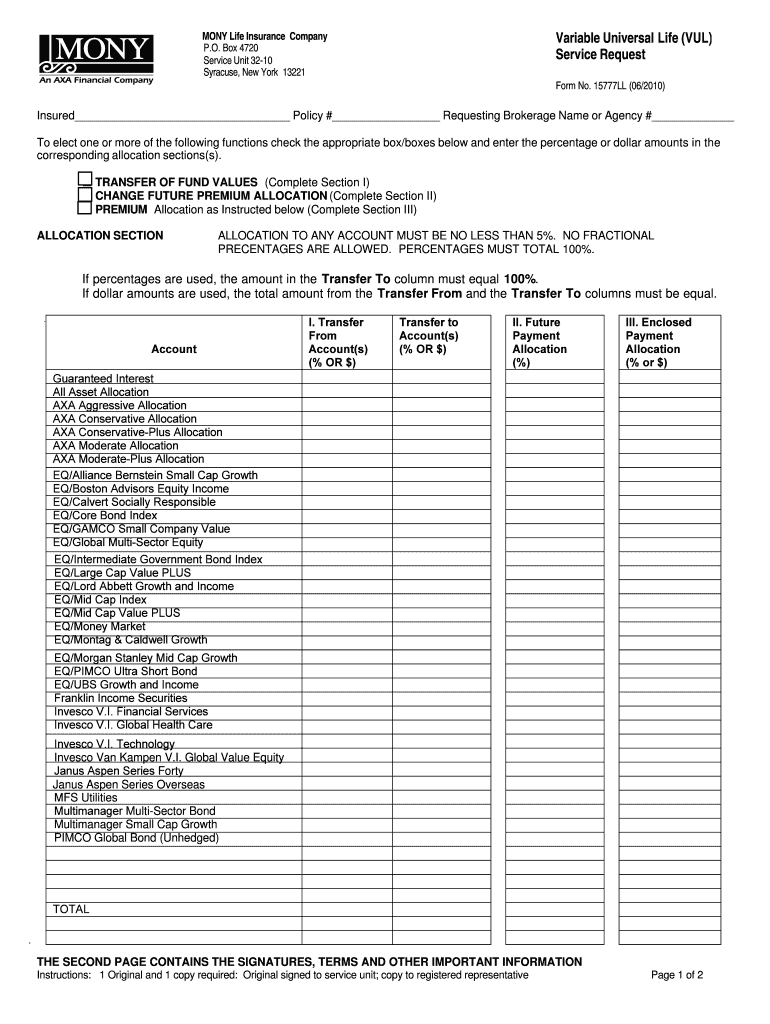

This form is used by policyholders of MONY Life Insurance Company to request changes related to their Variable Universal Life insurance policy, including fund transfers and premium allocations.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign variable universal life vul

Edit your variable universal life vul form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your variable universal life vul form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit variable universal life vul online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit variable universal life vul. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out variable universal life vul

How to fill out Variable Universal Life (VUL) Service Request Form

01

Begin by obtaining the Variable Universal Life (VUL) Service Request Form from your insurance provider's website or office.

02

Fill in the policyholder's full name, address, and contact information at the top of the form.

03

Provide the policy number associated with the VUL policy you are requesting service for.

04

Specify the type of service you are requesting, such as a withdrawal, loan, or change to beneficiaries.

05

If applicable, include any specific instructions or additional details regarding your request in the designated section of the form.

06

Sign and date the form to confirm your request.

07

Submit the completed form to your insurance provider via mail, email, or fax as instructed on the form.

Who needs Variable Universal Life (VUL) Service Request Form?

01

Policyholders of Variable Universal Life (VUL) insurance policies who need to make changes, request withdrawals, or other services related to their policy.

Fill

form

: Try Risk Free

People Also Ask about

What is the penalty for withdrawing from variable universal life insurance?

If you are under age 59½ when you make the withdrawal, you may be subject to surrender charges and assessed a 10% federal income tax penalty. Also, withdrawals will reduce the benefits and value of the contract.

What is the difference between variable life insurance and VUL?

Variable life insurance (VLI) is a type of permanent life insurance that offers a fixed death benefit — the sum paid upon your death. Variable universal life insurance, commonly known as VUL, provides adjustable premium payments and a flexible death benefit.

Is a VUL a good idea?

VUL is an excellent vehicle for a younger person who needs a taxable portfolio that can be constructed and managed much like a 401k or Roth. That is a fixed income, stock mixture.

What is the downside of variable universal life insurance?

Disadvantages of variable universal life insurance While you may experience better than average cash-value growth with a VUL, you could also experience a decrease of your cash-value due to poor performance of your investment options, putting your policy at increased risk of lapse.

How much does VUL cost?

Quick Introduction to Variable Universal Life Insurance Age (yrs)Male ($ per month)Female ($ per month) 25 - 35 $100 - $140 $78 - $120 35 - 45 $140 - $221 $120 - $201 45 - 55 $221 - $364 $201 - $340 55 - 65 $364 - $659 $340 - $571

What are the disadvantages of variable universal life insurance?

Cons: Drawbacks of Variable Universal Life Insurance If your investments perform poorly, there's a potential for loss of principal, which could affect your policy's overall value. Higher fees: VUL policies typically have higher fees than other types of life insurance.

What are the risks of variable life insurance?

Variable life insurance involves investment risks, just like mutual funds do. If the investment options you selected for your policy perform poorly, you could lose money, including your initial investment. The prospectus does not describe the amount of insurance you purchased and the amount of fees you will pay.

What are the drawbacks of universal life insurance?

The Disadvantages of Universal Life Insurance The policyholder may need to pay various fees. Market losses may reduce the cash value. The death benefit may be decreased. The policy will lapse if the premiums are not maintained and there's not sufficient cash value to cover the missed premiums.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Variable Universal Life (VUL) Service Request Form?

The Variable Universal Life (VUL) Service Request Form is a document used by policyholders to request changes or services related to their Variable Universal Life insurance policies, such as changes in premium payments, beneficiary updates, and investment allocation.

Who is required to file Variable Universal Life (VUL) Service Request Form?

The policyholders of Variable Universal Life insurance are required to file the VUL Service Request Form when they need to make requests or changes pertaining to their policy.

How to fill out Variable Universal Life (VUL) Service Request Form?

To fill out the VUL Service Request Form, policyholders should provide their personal information, policy number, the specific request they are making, and any necessary supporting documents, ensuring all fields are completed accurately.

What is the purpose of Variable Universal Life (VUL) Service Request Form?

The purpose of the VUL Service Request Form is to facilitate formal requests from policyholders to their insurance providers for modifications or services related to their Variable Universal Life insurance policies.

What information must be reported on Variable Universal Life (VUL) Service Request Form?

The information that must be reported on the VUL Service Request Form includes the policyholder's name, contact information, policy number, specific request details, and any relevant signatures or authorizations.

Fill out your variable universal life vul online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Variable Universal Life Vul is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.