Get the free Dollar Cost Averaging Plus Application

Show details

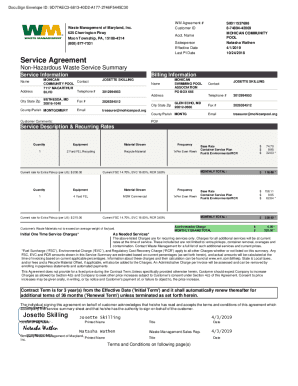

This document serves as an application for the Dollar Cost Averaging Plus program offered by MONY Life Insurance Company, allowing contractholders to allocate funds from a specified account over time.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign dollar cost averaging plus

Edit your dollar cost averaging plus form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your dollar cost averaging plus form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing dollar cost averaging plus online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit dollar cost averaging plus. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out dollar cost averaging plus

How to fill out Dollar Cost Averaging Plus Application

01

Gather necessary financial information such as your income, expenses, and investment goals.

02

Visit the Dollar Cost Averaging Plus Application website or platform.

03

Create an account or log in if you already have one.

04

Locate the application form for Dollar Cost Averaging Plus.

05

Fill in your personal information, including name, address, and contact details.

06

Provide your financial information, such as your current investment accounts and portfolio.

07

Specify the amount you plan to invest regularly through dollar cost averaging.

08

Select the frequency of your investments (e.g., weekly, bi-weekly, monthly).

09

Review the terms and conditions and agree to them.

10

Submit the application and keep a copy of the confirmation for your records.

Who needs Dollar Cost Averaging Plus Application?

01

Individuals looking to invest in the market with a systematic approach.

02

Investors who want to reduce the impact of volatility by averaging out the purchase price of investments.

03

Beginners seeking a structured method for regular investing.

04

People with irregular income who prefer a flexible investment strategy.

05

Anyone aiming to build wealth over time without needing to time the market.

Fill

form

: Try Risk Free

People Also Ask about

What does Warren Buffett say about dollar-cost averaging?

Common Mistakes to Avoid with DCA Stopping During Market Dips. The whole point of DCA is to continue investing during downturns to take advantage of lower prices. Choosing Unreliable Assets. Avoid applying DCA to highly speculative or lesser-known stocks without proper research. Lack of a Clear Exit Plan.

What are common DCA mistakes to avoid?

Dollar-cost averaging is a strategy you can use to smooth out volatility and lower your cost basis for investments. Basically, this approach is the exact opposite of trying to "time the market," as it typically involves investing the same amount at regular intervals, regardless of whether prices are up or down.

What is the best DCA strategy?

The best DCA strategy with $700 p/month is the 1-2-1-3 strategy. That's $100 week 1, $200 week 2, $100 week 3, $300 week 4. Due to quantum mechanics and the law of compounding in coordination with the law of average and bitcoin exemplary force, this formula will allow for the best DCA in 2024.

What does Warren Buffett say about dollar-cost averaging?

Key takeaways Dollar-cost averaging may be a better option if you would like to reduce volatility in your portfolio. Talk with a financial advisor to figure out which strategy makes most sense for you. It'll depend on things like your investment timeline, risk tolerance and financial goals.

What is the best frequency for dollar-cost averaging?

The more frequent you make it then the less you have to worry about huge price swings. Weekly or bi-weekly is my personal choice for DCA.

What is the best dollar-cost averaging strategy?

Lump sum usually beats DCA, because the money has had more time to grow. So usually lump sum is the way to go. If you DCA, the money you are using later is more likely to be buying at higher prices.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Dollar Cost Averaging Plus Application?

The Dollar Cost Averaging Plus Application is a financial tool that allows investors to invest a fixed amount of money at regular intervals, which can help reduce the impact of market volatility on their investment.

Who is required to file Dollar Cost Averaging Plus Application?

Investors who wish to take advantage of the Dollar Cost Averaging strategy typically need to file the application to formalize their investment plan with a financial institution or investment platform.

How to fill out Dollar Cost Averaging Plus Application?

To fill out the Dollar Cost Averaging Plus Application, investors must provide their personal information, specify the amount to invest, select the frequency of transactions, and provide any other required financial details as requested by the institution.

What is the purpose of Dollar Cost Averaging Plus Application?

The purpose of the Dollar Cost Averaging Plus Application is to automate the investment process, allowing investors to regularly purchase assets, thereby minimizing the effects of price volatility and making investing more manageable.

What information must be reported on Dollar Cost Averaging Plus Application?

Information that must be reported on the Dollar Cost Averaging Plus Application typically includes the investor's personal identification details, investment goals, chosen investment amount, frequency of transactions, and any other specific requirements set by the financial institution.

Fill out your dollar cost averaging plus online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Dollar Cost Averaging Plus is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.