Get the free Variable Universal Life Service Request

Show details

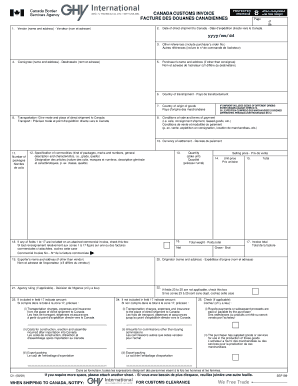

This document is a service request form for policyholders of Variable Universal Life insurance, allowing them to transfer fund values and change premium allocations.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign variable universal life service

Edit your variable universal life service form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your variable universal life service form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit variable universal life service online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit variable universal life service. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out variable universal life service

How to fill out Variable Universal Life Service Request

01

Obtain the Variable Universal Life Service Request form from the insurance provider or their website.

02

Fill in your personal information, including your name, address, and contact details.

03

Provide your policy number and any other relevant identification information.

04

Specify the type of service requested, such as a withdrawal, loan, or change in beneficiaries.

05

Review any terms and conditions associated with your request to ensure understanding.

06

Sign and date the form to authorize processing of your request.

07

Submit the completed form to the insurance provider via the specified method (mail, email, or online portal).

Who needs Variable Universal Life Service Request?

01

Individuals who hold a Variable Universal Life insurance policy and need to make changes or requests regarding their policy.

02

Policyholders seeking to withdraw funds, take a loan against their policy, or update beneficiaries.

03

Clients who want to access or manage the investment components of their Variable Universal Life insurance.

Fill

form

: Try Risk Free

People Also Ask about

How do I get out of variable life insurance?

Can you cash out a variable universal life insurance policy? You can cash out or surrender the policy. Surrender fees and any unpaid premiums will be subtracted, and you may have to pay taxes on the interest and dividends from the policy. The surrender closes out the policy and removes the death benefit payout.

What is the downside of variable universal life insurance?

Disadvantages of variable universal life insurance While you may experience better than average cash-value growth with a VUL, you could also experience a decrease of your cash-value due to poor performance of your investment options, putting your policy at increased risk of lapse.

What are the drawbacks of universal life insurance?

The Disadvantages of Universal Life Insurance The policyholder may need to pay various fees. Market losses may reduce the cash value. The death benefit may be decreased. The policy will lapse if the premiums are not maintained and there's not sufficient cash value to cover the missed premiums.

Is a VUL a good investment?

A VUL policy is not a very efficient place to accumulate wealth if you're investing in equities. That's because the ``surrender gain'' on life insurance is taxed at ordinary income rates, while equity investments in a regular taxable account are taxed when withdrawn at capital gains rates.

What are the risks of variable life insurance?

Variable life insurance involves investment risks, just like mutual funds do. If the investment options you selected for your policy perform poorly, you could lose money, including your initial investment. The prospectus does not describe the amount of insurance you purchased and the amount of fees you will pay.

What are the disadvantages of variable universal life insurance?

Cons: Drawbacks of Variable Universal Life Insurance If your investments perform poorly, there's a potential for loss of principal, which could affect your policy's overall value. Higher fees: VUL policies typically have higher fees than other types of life insurance.

What is the penalty for early withdrawal from VUL?

If the policy is a MEC, all withdrawals or loans are taxed as ordinary income to the extent of gain in the policy, and may also be subject to an additional 10% premature distribution penalty if taken prior to age 59½, unless certain exceptions apply.

Is a VUL a good idea?

VUL is an excellent vehicle for a younger person who needs a taxable portfolio that can be constructed and managed much like a 401k or Roth. That is a fixed income, stock mixture.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Variable Universal Life Service Request?

Variable Universal Life Service Request is a form used by policyholders to request changes or transactions related to their Variable Universal Life insurance policies, such as fund allocation changes, withdrawals, or loan requests.

Who is required to file Variable Universal Life Service Request?

The policyholder or the authorized representative of the policyholder is required to file the Variable Universal Life Service Request to initiate any changes or transactions on the policy.

How to fill out Variable Universal Life Service Request?

To fill out the Variable Universal Life Service Request, the policyholder must provide personal information, policy details, specific requests such as changes or withdrawals, and any required signatures.

What is the purpose of Variable Universal Life Service Request?

The purpose of the Variable Universal Life Service Request is to facilitate and document the policyholder's requests for changes or transactions related to their Variable Universal Life insurance policy.

What information must be reported on Variable Universal Life Service Request?

The information that must be reported on the Variable Universal Life Service Request includes the policy number, the policyholder's personal details, the types of requests being made, and any other information required by the insurance company.

Fill out your variable universal life service online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Variable Universal Life Service is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.