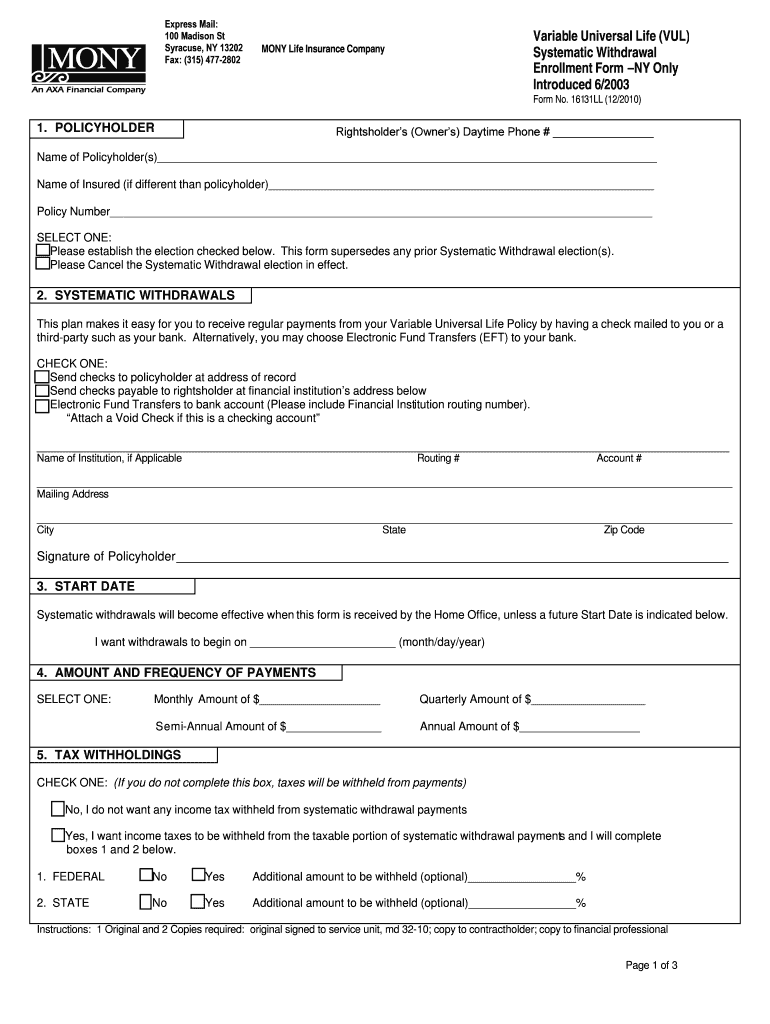

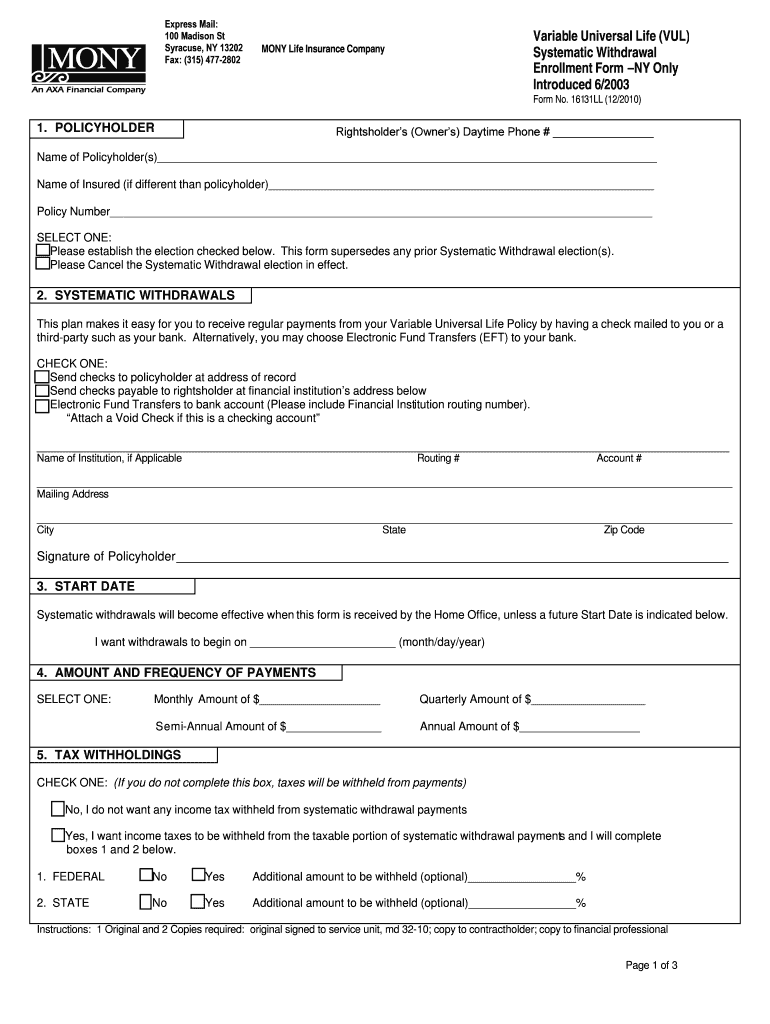

Get the free Variable Universal Life (VUL) Systematic Withdrawal Enrollment Form – NY Only

Show details

This form is used to establish or cancel systematic withdrawals from a Variable Universal Life insurance policy, allowing policyholders to receive regular payments either via checks or electronic

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign variable universal life vul

Edit your variable universal life vul form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your variable universal life vul form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit variable universal life vul online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit variable universal life vul. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out variable universal life vul

How to fill out Variable Universal Life (VUL) Systematic Withdrawal Enrollment Form – NY Only

01

Obtain the Variable Universal Life (VUL) Systematic Withdrawal Enrollment Form for New York.

02

Carefully read the instructions provided on the form to understand the requirements.

03

Fill out your personal information, including your name, address, and policy number.

04

Indicate the amount you wish to withdraw and the frequency of withdrawals (e.g., monthly, quarterly).

05

Provide any additional required details, such as bank account information for deposits.

06

Sign and date the form to certify your request.

07

Submit the completed form to your insurance provider as instructed.

Who needs Variable Universal Life (VUL) Systematic Withdrawal Enrollment Form – NY Only?

01

Policyholders who have a Variable Universal Life (VUL) insurance policy.

02

Individuals seeking to access cash value through systematic withdrawals.

03

Those who need a structured withdrawal plan for regular income from their VUL policy.

04

Residents of New York who meet the eligibility criteria set forth by their insurance provider.

Fill

form

: Try Risk Free

People Also Ask about

What are the drawbacks of universal life insurance?

The Disadvantages of Universal Life Insurance The policyholder may need to pay various fees. Market losses may reduce the cash value. The death benefit may be decreased. The policy will lapse if the premiums are not maintained and there's not sufficient cash value to cover the missed premiums.

What is meant by variable universal life insurance?

Variable universal life (VUL) combines lifelong insurance protection with flexible premiums and cash value you can access while alive. VUL insurance lets you invest and grow the cash value through subaccounts that operate like mutual funds.

Can you withdraw from a variable universal life policy?

Like some other permanent life insurance options, a variable universal life policy allows you to withdraw funds or take out a loan against the cash value. The downside is that a withdrawal or a loan can reduce your death benefit or result in a tax liability if you don't follow guidelines on repayment.

Is a VUL a good idea?

VUL is an excellent vehicle for a younger person who needs a taxable portfolio that can be constructed and managed much like a 401k or Roth. That is a fixed income, stock mixture.

What are the risks of variable life insurance?

Variable life insurance involves investment risks, just like mutual funds do. If the investment options you selected for your policy perform poorly, you could lose money, including your initial investment. The prospectus does not describe the amount of insurance you purchased and the amount of fees you will pay.

What is the downside of variable universal life insurance?

Disadvantages of variable universal life insurance While you may experience better than average cash-value growth with a VUL, you could also experience a decrease of your cash-value due to poor performance of your investment options, putting your policy at increased risk of lapse.

What are the disadvantages of variable universal life insurance?

Cons: Drawbacks of Variable Universal Life Insurance If your investments perform poorly, there's a potential for loss of principal, which could affect your policy's overall value. Higher fees: VUL policies typically have higher fees than other types of life insurance.

What is the disadvantage of universal life insurance?

Universal policies typically don't have fixed interest rates, so they are less predictable than whole life insurance policies. If you miss a payment on a universal life policy or don't contribute enough to the cash value, you may end up making several large payments to keep the coverage.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Variable Universal Life (VUL) Systematic Withdrawal Enrollment Form – NY Only?

The Variable Universal Life (VUL) Systematic Withdrawal Enrollment Form – NY Only is a document that allows policyholders in New York to initiate systematic withdrawals from their Variable Universal Life insurance policy. It outlines the process and requirements for setting up these withdrawals.

Who is required to file Variable Universal Life (VUL) Systematic Withdrawal Enrollment Form – NY Only?

Policyholders of Variable Universal Life insurance in New York who wish to establish systematic withdrawal plans from their policies are required to file this form.

How to fill out Variable Universal Life (VUL) Systematic Withdrawal Enrollment Form – NY Only?

To fill out the Variable Universal Life (VUL) Systematic Withdrawal Enrollment Form – NY Only, policyholders must provide personal information, policy details, the amount and frequency of withdrawals, and any additional required signatures or acknowledgments as outlined in the form.

What is the purpose of Variable Universal Life (VUL) Systematic Withdrawal Enrollment Form – NY Only?

The purpose of the Variable Universal Life (VUL) Systematic Withdrawal Enrollment Form – NY Only is to facilitate regular withdrawals from a policyholder's life insurance policy to access cash value while maintaining the policy's benefits.

What information must be reported on Variable Universal Life (VUL) Systematic Withdrawal Enrollment Form – NY Only?

The information that must be reported on the Variable Universal Life (VUL) Systematic Withdrawal Enrollment Form – NY Only includes the policyholder's contact information, policy number, desired withdrawal amounts, frequency of withdrawals, and any relevant tax information or beneficiary designations.

Fill out your variable universal life vul online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Variable Universal Life Vul is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.