Get the free Single Premium Deferred Annuity Claim to Annuity Benefits Form

Show details

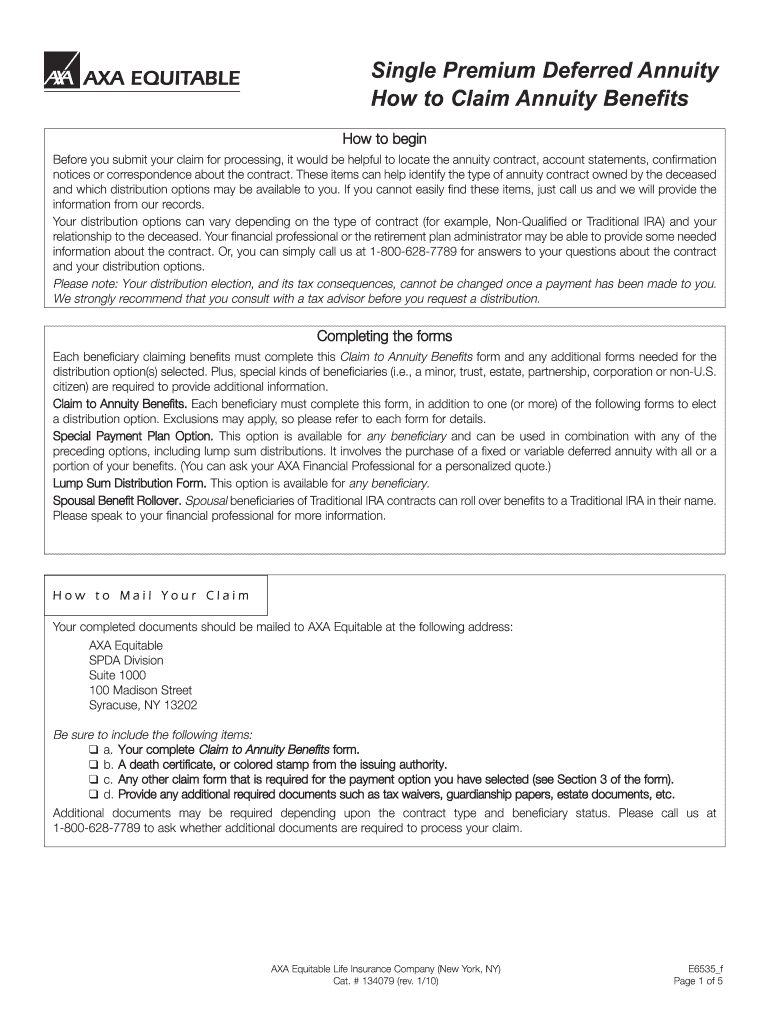

This form is required for beneficiaries to claim death benefits from an AXA Equitable annuity contract, detailing how to submit claims and what documents are needed.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign single premium deferred annuity

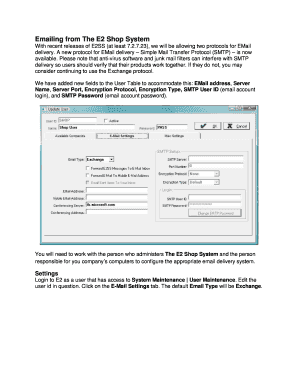

Edit your single premium deferred annuity form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your single premium deferred annuity form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit single premium deferred annuity online

To use the services of a skilled PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit single premium deferred annuity. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out single premium deferred annuity

How to fill out Single Premium Deferred Annuity Claim to Annuity Benefits Form

01

Obtain the Single Premium Deferred Annuity Claim to Annuity Benefits Form from your insurance provider or their website.

02

Fill in your personal information, including your name, address, and contact details in the designated fields.

03

Provide your policy number and any other required identifiers related to your annuity.

04

Indicate the reason for the claim in the appropriate section of the form.

05

Specify the amount you wish to withdraw or the benefits you wish to claim.

06

Include any necessary supporting documents, such as identification or proof of death if applicable.

07

Sign and date the form to validate your request.

08

Submit the completed form and supporting documents to your insurance company via mail, email, or through their online portal, following their specified submission guidelines.

Who needs Single Premium Deferred Annuity Claim to Annuity Benefits Form?

01

Individuals who have a Single Premium Deferred Annuity and wish to access their annuity benefits.

02

Beneficiaries of the annuity holder in the event of the holder's death.

03

Anyone seeking to withdraw funds from their deferred annuity policy.

Fill

form

: Try Risk Free

People Also Ask about

What distinguishes a deferred annuity from an immediate annuity?

Difference between immediate annuity and deferred annuity In the case of an immediate annuity plan, you start receiving a regular income immediately after investing your money. However, in the case of a deferred annuity plan, the payouts begin after the deferment period comes to an end.

What does English is a deferred annuity from an immediate annuity?

Deferred annuity -- Annuity payments that will begin at some future date. Flexible premium deferred annuity -- An annuity contract that permits varying premium payments from year to year, and which is often used for IRAs. Immediate annuity -- Annuity payments that begin immediately or within about a year.

What is an annuitant in a single premium deferred annuity?

Key Takeaways. A deferred annuity is a contract between an individual and an insurance company that guarantees income upon maturation, often until the annuitant dies. Single-premium deferred annuities (SPDAs) require only one lump-sum payment to fund the product.

What is a single premium deferred annuity?

A single premium deferred annuity (SPDA) is a purchase in which you pay a lump sum to an insurance company and, in return, receive income payments starting at a future date. For example, you could purchase $50,000 in an SPDA at age 50 and receive monthly payments when you turn 65.

What are the disadvantages of a deferred annuity?

Tax treatment of a deferred annuity If your investment grows during the accumulation phase, the earnings are tax deferred. This means you won't owe federal income tax on them until you receive payouts. Tax-deferred gains allow your earnings to grow more efficiently.

Which is better, an immediate or deferred annuity?

A deferred annuity can fit into your plan if you're a few years from retirement and want to leave an inheritance. Immediate annuities could be the better option if you need to cover your living expenses in retirement or simply want a predictable income.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Single Premium Deferred Annuity Claim to Annuity Benefits Form?

The Single Premium Deferred Annuity Claim to Annuity Benefits Form is a document used by policyholders to request benefits from a single premium deferred annuity, allowing for the withdrawal of funds or the initiation of income payments.

Who is required to file Single Premium Deferred Annuity Claim to Annuity Benefits Form?

The policyholder or the beneficiary of the annuity contract is required to file the Single Premium Deferred Annuity Claim to Annuity Benefits Form in order to claim the benefits.

How to fill out Single Premium Deferred Annuity Claim to Annuity Benefits Form?

To fill out the form, the claimant must provide personal information, details about the annuity contract, the desired benefit amount, and any required signatures. Additional supporting documentation may also be needed.

What is the purpose of Single Premium Deferred Annuity Claim to Annuity Benefits Form?

The purpose of the form is to formally request the payout of benefits from a single premium deferred annuity, ensuring that the request is processed by the insurance company.

What information must be reported on Single Premium Deferred Annuity Claim to Annuity Benefits Form?

The information that must be reported includes the policy number, the claimant's name and contact information, the amount being requested, the payment method, and any applicable tax information.

Fill out your single premium deferred annuity online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Single Premium Deferred Annuity is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.