Get the free Supplemental Application for Investment Company Professional Liability Insurance

Show details

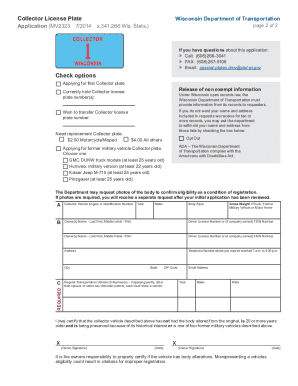

This document is a supplemental application related to professional liability insurance specific to banks sponsoring funds, requiring various disclosures and information about the bank's operations,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign supplemental application for investment

Edit your supplemental application for investment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your supplemental application for investment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit supplemental application for investment online

Use the instructions below to start using our professional PDF editor:

1

Sign into your account. It's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit supplemental application for investment. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out supplemental application for investment

How to fill out Supplemental Application for Investment Company Professional Liability Insurance

01

Gather necessary information about your investment company, including its name, address, and operational details.

02

Review the specific requirements of the Supplemental Application to understand what additional information is needed beyond the standard application.

03

Provide detailed descriptions of your company's investment strategies and services offered.

04

Include information about your organizational structure, such as the number of employees and key management personnel.

05

Disclose any recent claims or potential liabilities that could affect your insurance eligibility.

06

Specify the limits of liability and coverage amount you are seeking.

07

Review all sections of the application to ensure accuracy and completeness.

08

Sign and date the application before submission to the insurance provider.

Who needs Supplemental Application for Investment Company Professional Liability Insurance?

01

Investment firms and companies that provide investment-related services and require professional liability protection against potential claims.

02

Financial advisors, broker-dealers, investment managers, and mutual fund companies.

03

Businesses involved in managing investment portfolios or offering financial advice and services.

Fill

form

: Try Risk Free

People Also Ask about

What are the two types of liability in law?

What Are Liability Laws in California? Type of Liability ClaimExampleCommon Outcome Premises Liability A customer slips and falls on a wet floor at a store Business owner compensates medical bills Strict Liability A dog bites someone Owner liable regardless of dog's history2 more rows

What are the two types of professional liability?

In most cases, professional liability insurance isn't required by law. However, you may need this type of business insurance if your: Client requires it as part of a contract before work starts. State has a law that requires it.

What is professional liability E & O?

Professional Liability insurance, also known as Errors and Omissions (E&O) coverage, is designed to protect your business against claims that professional advice or services you provided caused a customer financial harm due to actual or alleged mistakes or a failure to perform a service.

What are the two types of professional liabilities?

There are two types of professional liability polices: claims-made and occurrence. Most professional liability insurance policies are “claims-made,” meaning that the policy must be in effect both when the event took place and when a lawsuit is filed for a claim to be paid.

What are the two most common liability coverage?

It's important to note there are two types of liability coverage: bodily injury and property damage.

What is a supplemental application for insurance?

The two types of professional liability insurance are claims-made and occurrence. Claims-made means the policy must have been active when the event and lawsuit happened, while occurrence means that the policy covers any qualified claim resulting from an incident while the policy was active (even if it has expired).

Do I need professional liability insurance if I work for a company?

Individual professional liability insurance helps provide legal representation, claim investigation, and other costs associated with defending a malpractice case on your own. The liability insurance you receive from an employer may typically only cover allegations of malpractice.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Supplemental Application for Investment Company Professional Liability Insurance?

The Supplemental Application for Investment Company Professional Liability Insurance is a document that provides additional information required by insurers to evaluate the risk associated with underwriting professional liability insurance for investment companies.

Who is required to file Supplemental Application for Investment Company Professional Liability Insurance?

Investment companies, including mutual funds and other entities that manage investments, are typically required to file this Supplemental Application when seeking professional liability insurance coverage.

How to fill out Supplemental Application for Investment Company Professional Liability Insurance?

To fill out the Supplemental Application, applicants should provide detailed information about the investment company's operations, management, types of services offered, financial performance, risk management practices, and any past claims or incidents.

What is the purpose of Supplemental Application for Investment Company Professional Liability Insurance?

The purpose of the Supplemental Application is to gather necessary information that helps insurers assess the risk profile of the investment company and determine the appropriate coverage terms and premiums.

What information must be reported on Supplemental Application for Investment Company Professional Liability Insurance?

The application typically requires reporting information such as company history, ownership structure, relevant financial data, types of funds managed, compliance history, and any past litigation or claims against the company.

Fill out your supplemental application for investment online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Supplemental Application For Investment is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.