Get the free Supplemental Application for Insurance Coverage

Show details

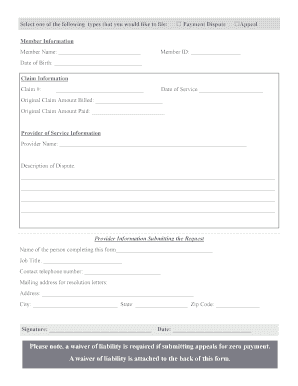

This document serves as a supplemental application for obtaining insurance coverage for agents, servicing contractors, and third-party administrators, detailing required information and conditions

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign supplemental application for insurance

Edit your supplemental application for insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your supplemental application for insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing supplemental application for insurance online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit supplemental application for insurance. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out supplemental application for insurance

How to fill out Supplemental Application for Insurance Coverage

01

Read the guidelines provided by your insurance provider.

02

Gather necessary personal information including your name, address, and contact details.

03

List all relevant assets that require coverage, such as property or vehicles.

04

Provide details of any previous insurance claims or coverage history.

05

Fill out risk assessment questions honestly to determine your eligibility.

06

Review the application for accuracy and completeness.

07

Submit the application either online or by mail as per the insurance company's instructions.

Who needs Supplemental Application for Insurance Coverage?

01

Individuals seeking additional coverage beyond their primary insurance policy.

02

Businesses requiring specific coverage for unique risks or assets.

03

Homeowners wanting to insure high-value items or properties in high-risk areas.

04

Professionals such as contractors needing liability coverage for specific projects.

05

Anyone who has had changes in their risk profile, like acquiring new assets or changes in operations.

Fill

form

: Try Risk Free

People Also Ask about

How to submit a supplemental claim?

(b) 'Supplemental claim' means a claim for additional loss or damage from the same peril which the insurer has previously adjusted or for which costs have been incurred while completing repairs or replacement pursuant to an open claim for which timely notice was previously provided to the insurer.

How do I submit a supplemental claim to my insurance company?

The purpose of an insurance supplement form is to provide additional information about a claim or policy to the insurance company. This form is typically used to request additional coverage, provide details about an incident or accident, or to report any changes or updates to the existing policy.

What is a supplemental application in insurance?

A supplemental application facilitates better interaction between businesses and insurers. It opens up a dialogue on coverage options, risk factors, and loss prevention, enhancing risk management and decision-making accuracy.

How to submit a supplemental insurance claim?

For any kind of supplemental claim, you must contact your insurance company and give them your original claim number. The best way to notify the company is in writing, sent Certified Mail. That way, you'll know who signed for the letter. The insurer will have to re-open the claim.

What is supplemental insurance coverage?

For any kind of supplemental claim, you must contact your insurance company and give them your original claim number. The best way to notify the company is in writing, sent Certified Mail. That way, you'll know who signed for the letter. The insurer will have to re-open the claim.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Supplemental Application for Insurance Coverage?

The Supplemental Application for Insurance Coverage is a form used to collect additional information from applicants seeking insurance. It provides insurers with necessary details to assess the risk and determine the terms of coverage.

Who is required to file Supplemental Application for Insurance Coverage?

Individuals or businesses seeking insurance coverage that requires more detailed information beyond the standard application are typically required to file a Supplemental Application for Insurance Coverage.

How to fill out Supplemental Application for Insurance Coverage?

To fill out the Supplemental Application for Insurance Coverage, applicants should carefully read the instructions provided, complete all required fields accurately, provide additional information as prompted, and review the application for completeness before submission.

What is the purpose of Supplemental Application for Insurance Coverage?

The purpose of the Supplemental Application for Insurance Coverage is to gather detailed information about specific risks associated with the applicant, which helps insurance providers make informed decisions regarding coverage options and pricing.

What information must be reported on Supplemental Application for Insurance Coverage?

Information that must be reported typically includes details about the applicant's business operations, risks involved, prior insurance claims, financial records, and any other specifics that may affect coverage assessment.

Fill out your supplemental application for insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Supplemental Application For Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.