Get the free RENEWAL APPLICATION INVESTMENT ADVISERS ERRORS AND OMISSIONS POLICY

Show details

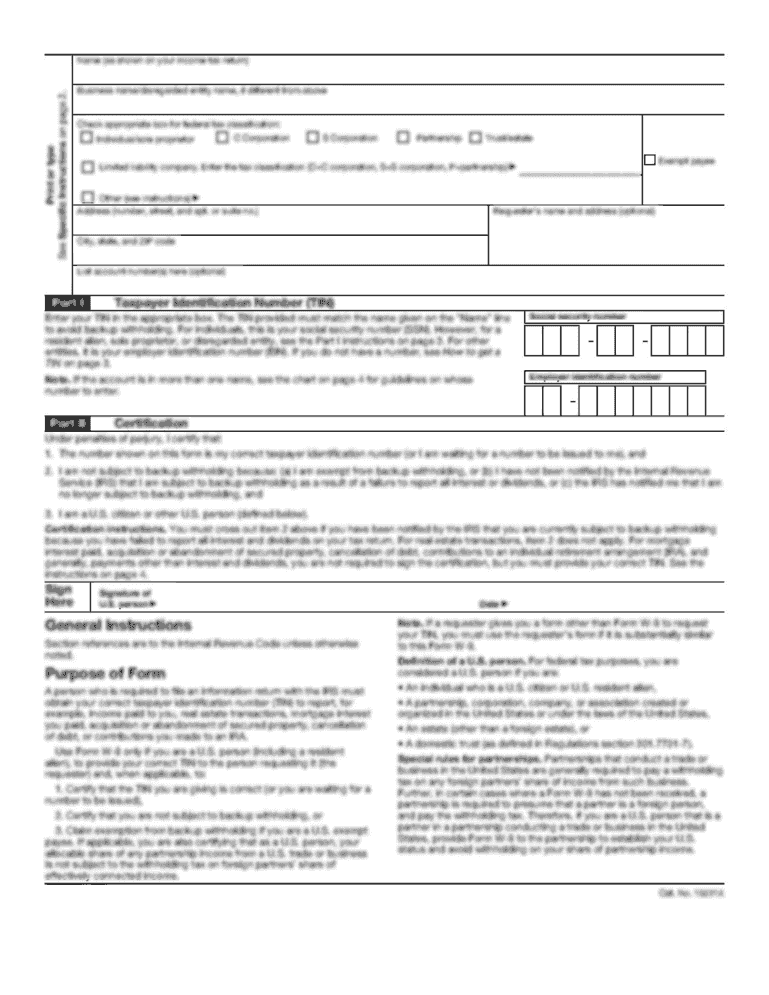

This document serves as a renewal application for Errors and Omissions insurance specifically for investment advisers, detailing coverage provisions, applicant information, client accounts, and compliance

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign renewal application investment advisers

Edit your renewal application investment advisers form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your renewal application investment advisers form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit renewal application investment advisers online

Follow the steps below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit renewal application investment advisers. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

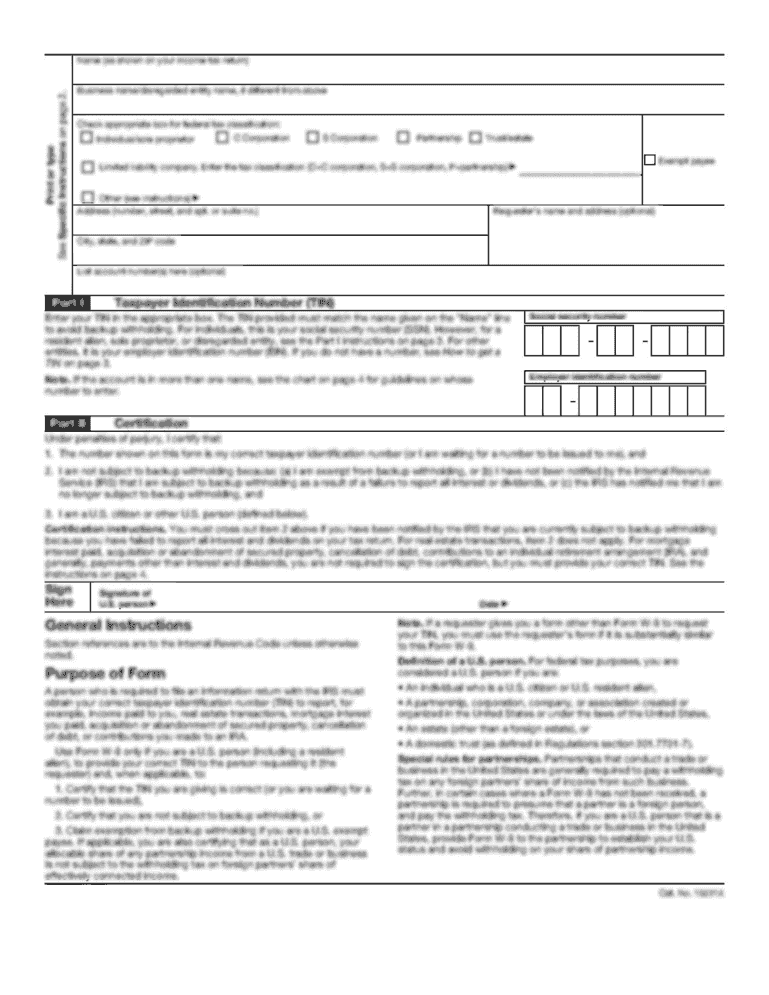

How to fill out renewal application investment advisers

How to fill out RENEWAL APPLICATION INVESTMENT ADVISERS ERRORS AND OMISSIONS POLICY

01

Begin by gathering all necessary documents and information relevant to your business activities as an investment adviser.

02

Review your current Errors and Omissions (E&O) policy to ensure you understand your current coverage and limits.

03

Complete the renewal application form, ensuring all sections are filled out accurately and honestly.

04

Provide detailed information on any claims made against your policy during the previous term.

05

Include any changes in your practice or business structure since the last application, such as new services offered or changes in client demographics.

06

Review your premium payment options and ensure you understand billing cycles and payment methods.

07

Submit the completed application along with any required documentation to your insurance provider before the renewal deadline.

Who needs RENEWAL APPLICATION INVESTMENT ADVISERS ERRORS AND OMISSIONS POLICY?

01

Investment advisers who offer financial advice and services to clients and require protection against potential errors or omissions in their professional services.

02

Individuals or firms that have a fiduciary responsibility and wish to safeguard against legal claims arising from their financial advice.

03

Anyone renewing their insurance coverage to ensure continued protection against liability as they conduct business.

Fill

form

: Try Risk Free

People Also Ask about

What does a typical errors and omissions insurance policy cover?

Most errors and omissions insurance policies cover judgments, attorney fees, court costs and settlements up to the limits of the policy.

What is the rule 206 4 1 the marketing rule under the Investment Advisers Act of 1940?

As referenced above, rule 206(4)-1(c) prohibits an investment adviser from including a third-party rating in an advertisement unless certain conditions are met, including that the adviser must clearly and prominently disclose (or reasonably believe that the third-party rating clearly and prominently discloses): (i) the

What is the SEC rule 4 5?

Section 4(a)(5) of the '33 Act exempts from registration offers and sales of securities to accredited investors when the total offering price is less than $5 million and no public solicitation or advertising is made. However, Regulation D does not address the offering of securities under this section of the '33 Act.

How do I renew my errors and omissions insurance?

It may be time to renew your coverage, which can be done either online in the Insurance & Bonds area or by calling 1-800-US NOTARY (1-800-876-6827).

What is the Rule 206 4 of the Investment Advisers Act?

[13] Rule 206(4)-1(d)(1) prohibits an investment adviser from, directly or indirectly, disseminating any advertisement that includes “any presentation of gross performance, unless the advertisement also presents net performance: (i) with at least equal prominence to, and in a format designed to facilitate comparison

What is the rule 206 4 5 of the investment advisers Act?

Rule 206(4)-5 requires an advisor to a government entity to keep records related to contributions made to officials and candidates and of payments made to state or local political parties or PACs.

What is errors and omissions insurance for registered investment advisors?

What is Errors and Omissions Insurance for RIAs? Errors and Omissions (E&O) insurance (sometimes called professional liability insurance) is a type of professional liability insurance designed to protect financial professionals and their firms from claims of negligence or failure to perform professional duties.

What is the rule 206 4 5 under the Investment Advisers Act?

Rule 206(4)-5 requires an advisor to a government entity to keep records related to contributions made to officials and candidates and of payments made to state or local political parties or PACs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is RENEWAL APPLICATION INVESTMENT ADVISERS ERRORS AND OMISSIONS POLICY?

The RENEWAL APPLICATION INVESTMENT ADVISERS ERRORS AND OMISSIONS POLICY is a form that registered investment advisers must complete to renew their errors and omissions insurance coverage, which protects them against claims of negligence, mistakes, or failures in the provision of professional advice.

Who is required to file RENEWAL APPLICATION INVESTMENT ADVISERS ERRORS AND OMISSIONS POLICY?

Registered investment advisers who wish to maintain their errors and omissions insurance coverage are required to file the RENEWAL APPLICATION.

How to fill out RENEWAL APPLICATION INVESTMENT ADVISERS ERRORS AND OMISSIONS POLICY?

To fill out the RENEWAL APPLICATION, investment advisers should provide accurate and complete information regarding their business operations, clientele, claims history, and any changes in risk factors since the last policy renewal. It is essential to review all information for accuracy and ensure that all required fields are completed.

What is the purpose of RENEWAL APPLICATION INVESTMENT ADVISERS ERRORS AND OMISSIONS POLICY?

The purpose of the RENEWAL APPLICATION is to facilitate the renewal process for errors and omissions insurance, ensuring that investment advisers continue to have coverage against potential liability that may arise from their professional services.

What information must be reported on RENEWAL APPLICATION INVESTMENT ADVISERS ERRORS AND OMISSIONS POLICY?

The information that must be reported includes the adviser’s business details, financial condition, the nature of services provided, any previous claims or litigation history, and any changes in personnel, policies, or practices since the last application.

Fill out your renewal application investment advisers online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Renewal Application Investment Advisers is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.