Get the free APPLICATION FIDUCIARY LIABILITY POLICY

Show details

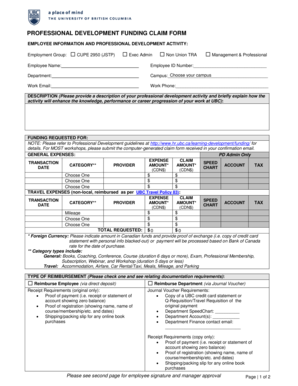

This document serves as an application for Fiduciary Liability Insurance, detailing information about the sponsor organization, requested coverage limits, plan information, past activities, and continuity

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application fiduciary liability policy

Edit your application fiduciary liability policy form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application fiduciary liability policy form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit application fiduciary liability policy online

Follow the steps down below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit application fiduciary liability policy. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application fiduciary liability policy

How to fill out APPLICATION FIDUCIARY LIABILITY POLICY

01

Step 1: Gather all necessary documentation regarding your organization, including its structure, financial data, and employee information.

02

Step 2: Identify the specific fiduciary responsibilities that your organization holds.

03

Step 3: Choose the correct coverage limits based on potential risks and exposures.

04

Step 4: Fill out the application form with accurate information about your organization and its fiduciaries.

05

Step 5: Provide details about any past claims or incidents related to fiduciary duties.

06

Step 6: Review the completed application for any errors or omissions.

07

Step 7: Submit the application to the chosen insurance provider along with any required supporting documentation.

Who needs APPLICATION FIDUCIARY LIABILITY POLICY?

01

Organizations that offer employee benefit plans, including retirement accounts, health insurance, and other benefits.

02

Trustees or fiduciaries managing pension plans and other financial assets.

03

Nonprofit organizations that manage funds on behalf of their members or beneficiaries.

04

Companies seeking protection against claims arising from breaches of fiduciary duty.

Fill

form

: Try Risk Free

People Also Ask about

What does a fiduciary liability policy cover?

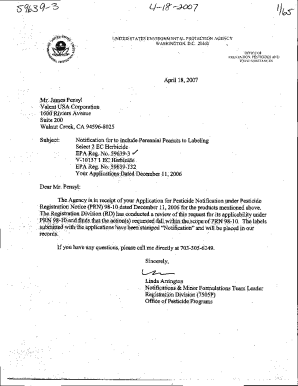

ERISA fidelity bonds protect plan participants from loss due to fraud or dishonesty, while fiduciary liability insurance protects companies from legal liability arising from plan sponsorship.

What is a fiduciary liability policy?

What does fiduciary liability insurance cost? Fiduciary liability insurance costs vary by company size, plan assets and more. Most companies can get a fiduciary liability plan for $500 to $2,500 per year, with up to $10 million in coverage.

What is the difference between a bond and a fiduciary liability insurance?

A fiduciary is someone who manages money or property for someone else. When you're named a fiduciary and accept the role, you must – by law – manage the person's money and property for their benefit, not yours.

Is fiduciary liability coverage the same as a fidelity bond?

A fiduciary insurance policy protects employers and their plan fiduciaries from fiduciary-related claims for the alleged mismanagement of plan assets or failure to follow ERISA rules in the control or management of plan assets and payment of benefits. The coverage is not required but is highly recommended.

How much does fiduciary liability insurance cost?

As you may be aware, Employee Retirement Income Security Act (ERISA) fidelity bonds and fiduciary liability insurance are not the same. Both serve to mitigate risk for fiduciaries, and are critical aspects of an employee benefits plan. The difference between the two lies in the risks that they cover.

What is a fiduciary in simple terms?

Fiduciary liability insurance provides coverage for risk or loss resulting from negligence, mismanagement, or errors. Intentional acts like fraud or theft causing loss to a benefits plan or its assets are not covered; that is the domain of a specific crime coverage policy.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is APPLICATION FIDUCIARY LIABILITY POLICY?

An Application Fiduciary Liability Policy is an insurance policy that provides coverage for fiduciaries against claims arising from their management of employee benefit plans, ensuring protection against potential legal liabilities.

Who is required to file APPLICATION FIDUCIARY LIABILITY POLICY?

Typically, fiduciaries of employee benefit plans, including plan administrators, trustees, and other parties responsible for the management of these plans, are required to file an Application Fiduciary Liability Policy to protect against potential liabilities.

How to fill out APPLICATION FIDUCIARY LIABILITY POLICY?

To fill out an Application Fiduciary Liability Policy, you need to provide relevant details about the organization, the fiduciaries involved, the type of employee benefits managed, any previous claims, and any other pertinent information requested by the insurer.

What is the purpose of APPLICATION FIDUCIARY LIABILITY POLICY?

The purpose of an Application Fiduciary Liability Policy is to protect fiduciaries from legal claims or lawsuits related to breaches of fiduciary duty in managing employee benefit plans, thereby safeguarding their financial assets and reputation.

What information must be reported on APPLICATION FIDUCIARY LIABILITY POLICY?

Information that must be reported typically includes details of the fiduciaries, description of the plans managed, financial statements, prior claim history, and any specific risks associated with the fiduciaries' duties.

Fill out your application fiduciary liability policy online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application Fiduciary Liability Policy is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.