Get the free HSA Employee Deposit/Contribution Form

Show details

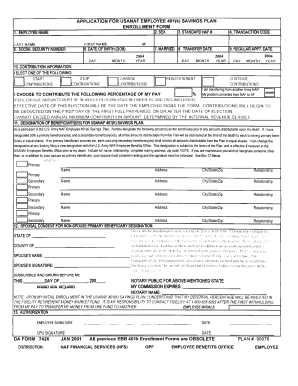

This form is used by individuals to submit contributions or repayments to their Health Savings Account (HSA), including manual contributions and rollovers from other accounts.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign hsa employee depositcontribution form

Edit your hsa employee depositcontribution form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your hsa employee depositcontribution form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit hsa employee depositcontribution form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit hsa employee depositcontribution form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out hsa employee depositcontribution form

How to fill out HSA Employee Deposit/Contribution Form

01

Obtain the HSA Employee Deposit/Contribution Form from your employer or their benefits administrator.

02

Fill out your personal information at the top of the form, including your name, employee ID, and department.

03

Specify the contribution amount you wish to make to your HSA for the specified pay period.

04

Indicate the contribution frequency (e.g., bi-weekly, monthly) if required.

05

Review the form for accuracy and completeness to ensure all necessary fields are filled out.

06

Sign and date the form to authorize the contribution.

07

Submit the completed form to your employer's HR or benefits department as instructed.

Who needs HSA Employee Deposit/Contribution Form?

01

Employees who wish to make pre-tax contributions to their Health Savings Account (HSA).

02

Individuals who are covered by a High Deductible Health Plan (HDHP) and want to take advantage of tax-advantaged savings for medical expenses.

03

Employees who want to set up or modify their HSA contributions through payroll deduction.

Fill

form

: Try Risk Free

People Also Ask about

What is form 5498 SA used for?

The purpose of Form 5498-SA is to report how much money is contributed to an HSA, Archer MSA or MA MSA over the course of a tax year. In the case of HSAs and Archer MSAs, the tax year extends to April 15 of the following year.

Is there a form for HSA contributions?

File Form 8889 to: Report health savings account (HSA) contributions (including those made on your behalf and employer contributions).

How do I contribute to an HSA?

The rule of thumb is that the employer must make the HSA deposit as of the earliest date on which such contributions can reasonably be segregated from the employer's general assets, and in no event later than 90 days after the amount is withheld in payroll.

How do I report employee contributions to HSA?

How Does an HSA Work for Employees? Employees covered under a qualified HDHP contribute their HSA via pre-tax deductions from each paycheck, and the HSA can be used to pay for eligible medical expenses.

How do I contribute to my employee HSA?

Employers may make pre-tax contributions to their employees' HSAs either through a Section 125 Plan or through direct contribution. Deposited funds belong to the employee. The combination of employer and employee contributions cannot exceed the IRS annual limits.

How do I contribute to a federal HSA employee?

File Form 8889 to: Report health savings account (HSA) contributions (including those made on your behalf and employer contributions). Figure your HSA deduction.

Can I make HSA contributions outside of payroll?

Health Savings Account (HSA) You have the option to make additional, voluntary tax–free contributions to your account, up to the maximum established by law. Federal employees who are enrolled in HDHPs can make pre–tax allotments to their HSAs through their payroll provider or through their health plan's HSA trustee..

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is HSA Employee Deposit/Contribution Form?

The HSA Employee Deposit/Contribution Form is a document used by employees to authorize contributions to their Health Savings Accounts (HSAs) directly from their payroll or to report contributions made.

Who is required to file HSA Employee Deposit/Contribution Form?

Employees who wish to make contributions to their Health Savings Accounts through payroll deductions or need to report their contributions for tax purposes are required to file the HSA Employee Deposit/Contribution Form.

How to fill out HSA Employee Deposit/Contribution Form?

To fill out the HSA Employee Deposit/Contribution Form, employees must provide personal information, specify the contribution amount, indicate the frequency of contributions, and submit it to their employer's HR or payroll department.

What is the purpose of HSA Employee Deposit/Contribution Form?

The purpose of the HSA Employee Deposit/Contribution Form is to facilitate employees' contributions to their Health Savings Accounts, ensure proper payroll deductions, and maintain accurate records for tax reporting.

What information must be reported on HSA Employee Deposit/Contribution Form?

The information that must be reported on the HSA Employee Deposit/Contribution Form includes the employee's name, Social Security number, contribution amount, contribution frequency, and any other required details set by the employer or financial institution.

Fill out your hsa employee depositcontribution form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Hsa Employee Depositcontribution Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.