Get the free Disclosure of a Financial Interest in the Sale of Health Insurance Policies

Show details

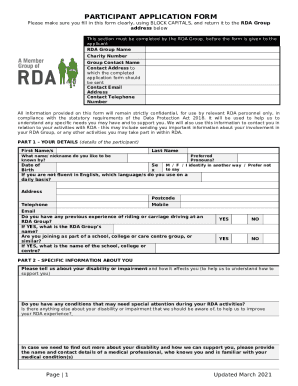

This document discloses the compensation structure for agents or brokers involved in the sale and renewal of health insurance policies, as mandated by New Jersey law, specifically for groups of 2

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign disclosure of a financial

Edit your disclosure of a financial form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your disclosure of a financial form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit disclosure of a financial online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit disclosure of a financial. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out disclosure of a financial

How to fill out Disclosure of a Financial Interest in the Sale of Health Insurance Policies

01

Gather all necessary financial information related to your interests in health insurance policies.

02

Obtain the Disclosure of a Financial Interest form from your regulatory authority or relevant organization.

03

Carefully read the instructions provided with the form to understand the required information.

04

Fill out personal details including your name, address, and contact information accurately.

05

List your financial interests in health insurance policies, including any commissions or incentivized payments.

06

Indicate the relationships you have with any insurance companies or agencies.

07

Review the completed form for accuracy and completeness.

08

Sign and date the form to certify that the information provided is true and accurate.

09

Submit the form to the appropriate authority as per the guidelines.

Who needs Disclosure of a Financial Interest in the Sale of Health Insurance Policies?

01

Insurance agents and brokers who earn commissions or fees from selling health insurance policies.

02

Financial advisors who recommend health insurance products to clients.

03

Organizations or individuals involved in marketing or distributing health insurance.

04

Regulatory professionals ensuring compliance with laws regarding financial disclosures.

Fill

form

: Try Risk Free

People Also Ask about

Why is my insurance company asking for a statement?

Getting formal statements is a very normal part of investigating a claim. Insurers get statements from their insureds in order to help the insured satisfy their obligation of proving that a loss occurred and that the cause of loss was an insured peril.

What is the disclosure rule in insurance?

Disclosure mandatory. An insurer must disclose the coverage and limits of an insurance policy within 30 days after the information is requested in writing by a claimant.

What triggers an insurance investigation?

Inconsistencies and delayed claims can trigger alarm bells, leading the insurance company to closely scrutinize the legitimacy of your case. The duration of your recovery is not only critical for calculating the compensation but also for evaluating the credibility of your claim.

Why do insurance companies ask for financials?

Some insurance companies believe there is a direct statistical relationship between financial stability and losses. They believe, as a group, consumers who show more financial responsibility have fewer and less costly losses and, therefore, should pay less for their insurance.

Why do insurance companies ask for recorded statements?

Insurance companies often use these statements to protect their bottom line, not your best interests. They'll ask about the accident, your injuries, or even past medical issues. Your words could later be twisted or compared to other statements you've made. Sometimes, they'll even use your recording in court.

What is the disclosure statement of an insurance policy?

A Product Disclosure Statement (PDS) explains the terms and conditions of the policy, including what's covered, what's not, and how claims work. A Supplementary Product Disclosure Statement (SPDS) informs you about any changes to the terms and conditions of the PDS. If applicable, always read this with your PDS.

Why do insurance companies request financial statements?

Underwriters frequently request financial statements when they provide both new business and renewal quotations. This is because an insured's financial condition is an important factor in assessing its insurability, commitment to loss control programs, and ability to pay premiums.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Disclosure of a Financial Interest in the Sale of Health Insurance Policies?

The Disclosure of a Financial Interest in the Sale of Health Insurance Policies is a legal requirement that mandates individuals or entities involved in the sale of health insurance to disclose any financial interests they have related to the insurance products being sold. This includes commissions, bonuses, and other financial incentives.

Who is required to file Disclosure of a Financial Interest in the Sale of Health Insurance Policies?

Individuals and entities such as insurance agents, brokers, and companies that sell health insurance policies are required to file a Disclosure of a Financial Interest. This requirement usually applies to anyone who earns compensation from selling health insurance.

How to fill out Disclosure of a Financial Interest in the Sale of Health Insurance Policies?

To fill out the Disclosure of a Financial Interest form, you typically need to provide your personal or company information, details of the health insurance policies being sold, and a clear statement of any financial interests you have in those policies, including the nature and amount of compensation.

What is the purpose of Disclosure of a Financial Interest in the Sale of Health Insurance Policies?

The purpose of the Disclosure of a Financial Interest is to promote transparency and protect consumers by ensuring they are informed about potential conflicts of interest that may affect the recommendations made by insurance agents or brokers regarding health insurance policies.

What information must be reported on Disclosure of a Financial Interest in the Sale of Health Insurance Policies?

The information that must be reported typically includes the name and contact information of the individual or entity, a description of the health insurance policies sold, details of any financial interest or compensation received, and the nature of the relationship between the seller and the insurance carrier.

Fill out your disclosure of a financial online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Disclosure Of A Financial is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.