Get the free Fact Sheet on Refunds for Combat Veterans - kofc

Show details

This document outlines the provisions of the National Defense Authorization Act of 2008 pertaining to enhanced enrollment eligibility and refunds for combat veterans by the Department of Veterans

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fact sheet on refunds

Edit your fact sheet on refunds form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fact sheet on refunds form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit fact sheet on refunds online

Follow the guidelines below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit fact sheet on refunds. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fact sheet on refunds

How to fill out Fact Sheet on Refunds for Combat Veterans

01

Gather all necessary personal information, including your service details and contact information.

02

Obtain the relevant documents that support your refund claim, such as proof of expenses and military records.

03

Visit the appropriate official website or office to download or request the Fact Sheet on Refunds for Combat Veterans.

04

Fill out the Fact Sheet accurately, providing all required information in the designated sections.

05

Double-check all entries for accuracy and completeness before submission.

06

Submit the completed Fact Sheet along with the supporting documents to the designated office that handles the refunds.

Who needs Fact Sheet on Refunds for Combat Veterans?

01

Combat veterans who have incurred expenses related to their service.

02

Veterans seeking reimbursement for particular costs or fees associated with their military service.

03

Individuals eligible for refunds under specific military or governmental programs.

Fill

form

: Try Risk Free

People Also Ask about

What do veterans have after war?

Post-traumatic stress disorder, traumatic brain injury, hearing loss, illnesses caused by toxic exposure and other injuries can show up years later and affect any stage of life. Veterans may lose jobs or face crises. New veteran populations—women, minorities, LGBTQ+ and others—may face inequities.

Do combat Veterans get free healthcare?

If you're an OEF/OIF/OND combat Veteran who has just returned from service, you can receive free medical care for any condition related to your service in Iraq or Afghanistan for 10 years after discharge.

Does a 100% disabled Veteran pay federal taxes?

Tax benefits as a Veteran: Disability benefits received from VA should not be counted as part of a Veteran's gross income. Payments from compensation, pension, Veteran Readiness & Employment (VR&E), and education—including the G.I. Bill—are exempt from taxation.

What is the difference between a war Veteran and a combat Veteran?

A wartime veteran is different from a combat veteran. To be considered a wartime veteran, you must have served active duty during a period of war. Unlike a combat veteran, a wartime veteran may or may not have seen combat.

How were veterans treated when they returned from the war why?

Many Vietnam veterans claim that most people treated them with indifference and seemed uncomfortable listening to their stories from battle. Some people, however, saw returning soldiers as dangerous, violent symbols of an increasingly futile and terrible war—much like the individual Wowwk encountered.

What were the effects of veterans returning home from war?

Some veterans struggled with physical and psychological injuries often felt isolated from family and friends. Some veterans blamed the antiwar protesters for the poor reception they received coming home, claiming protestors blamed the troops instead of the government.

What do soldiers have when they come back from war?

Many of the common reactions to experience in a war zone are also symptoms of more serious problems such as PTSD. In PTSD, however, they're much more intense and troubling, and they don't go away.

What do Veterans have when they come back from war?

The Changing Needs of Veterans Post-traumatic stress disorder, traumatic brain injury, hearing loss, illnesses caused by toxic exposure and other injuries can show up years later and affect any stage of life. Veterans may lose jobs or face crises.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Fact Sheet on Refunds for Combat Veterans?

The Fact Sheet on Refunds for Combat Veterans is a document that provides information about the process and eligibility of combat veterans to receive refunds on certain fees and taxes.

Who is required to file Fact Sheet on Refunds for Combat Veterans?

Combat veterans who believe they qualify for refunds due to their military service are required to file the Fact Sheet.

How to fill out Fact Sheet on Refunds for Combat Veterans?

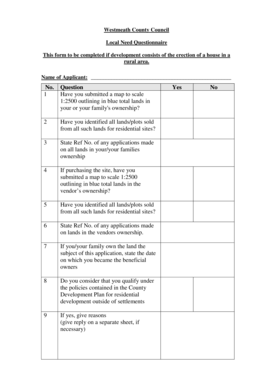

To fill out the Fact Sheet, veterans need to provide personal identification details, service information, and specifics regarding the fees or taxes they seek refunds for.

What is the purpose of Fact Sheet on Refunds for Combat Veterans?

The purpose of the Fact Sheet is to guide combat veterans through the refund process and ensure they understand their rights and options.

What information must be reported on Fact Sheet on Refunds for Combat Veterans?

Information that must be reported includes the veteran's name, contact information, military service details, and any pertinent financial information related to the fees or taxes eligible for refund.

Fill out your fact sheet on refunds online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fact Sheet On Refunds is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.