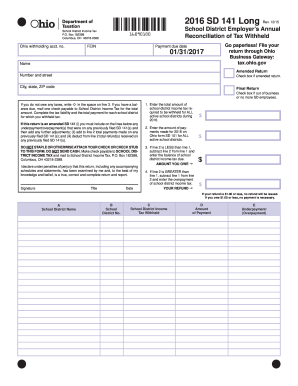

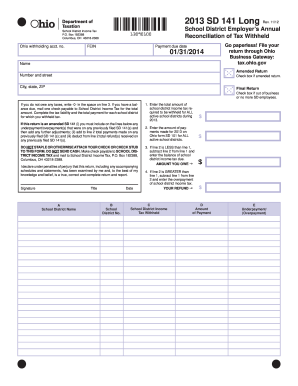

What is SD 141 Form?

SD 141 Form is called the Ohio School District Employer’s Annual Reconciliation of Tax Withheld. It a long form. The form must be filed by taxpayers in the state of Ohio. You may find this document on our site and complete it online using all filling, editing, signing and sharing tools that PDFfiller offers.

What is the Purpose of SD 141 Form?

This form is designed for taxpayers to report file either their amended or final return. Depending on the type of return you file, the form will be completed differently.

When is SD 141 Form Due?

The due date of the payment is indicated on the top part of the form. If you are going to report the current year, the due date will be February 2nd, 2017. File the return in time to avoid penalties.

Is SD 141 Form Accompanied by Other Documents?

You must attach the check that confirms the payment you have made. It is the only document required to be attached to the Ohio School District Employer’s Annual Reconciliation of Tax Withheld.

What Information do I Include in SD 141 Form?

In the first block of the form you must provide the following information: Ohio withholding account number, FEIN, payment due date, name and full address. After that you must enter the total amount of school district income tax, amount of payments made for 2017 and the amount you owe. Then you will see the table. It includes the following prompts: school district name, school district number, school district income tax withheld, amount of payment and under- or overpayment.

Where do I Send SD 141 Form?

Send your return to the following address:

School District Income Tax

P.O. Box 182388

Columbus, OH 43218-2388