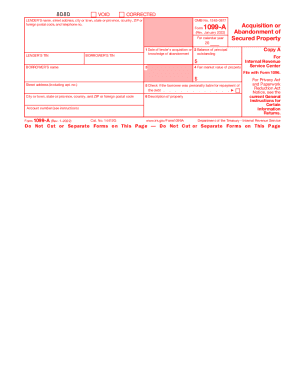

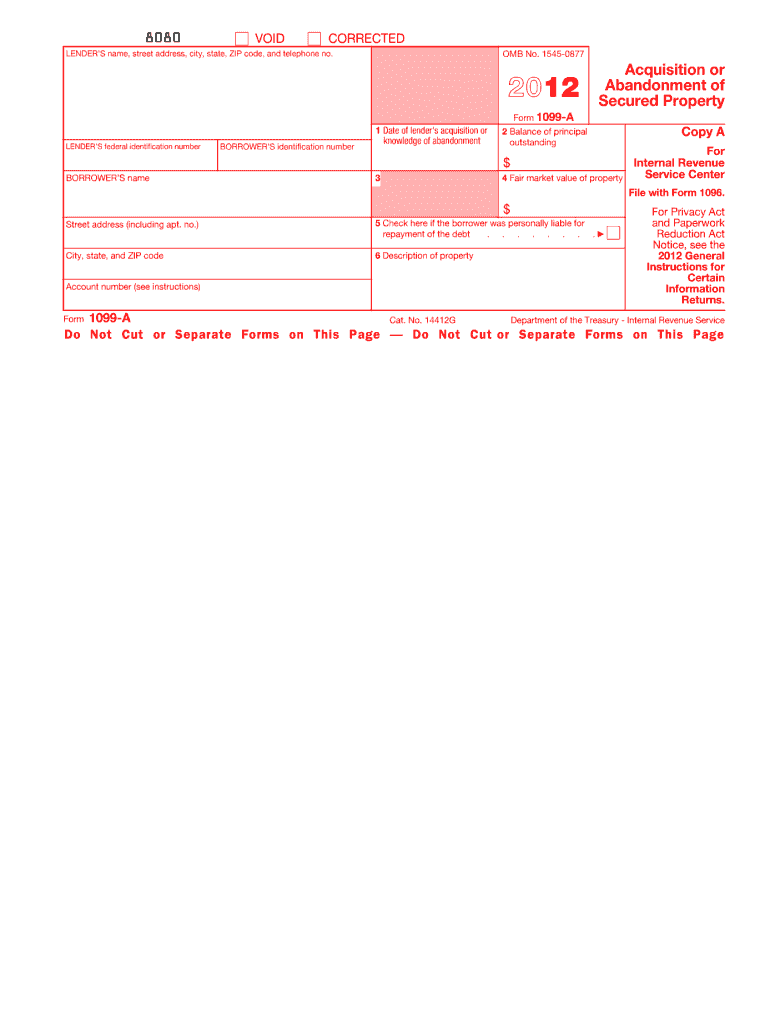

IRS 1099-A 2012 free printable template

Instructions and Help about IRS 1099-A

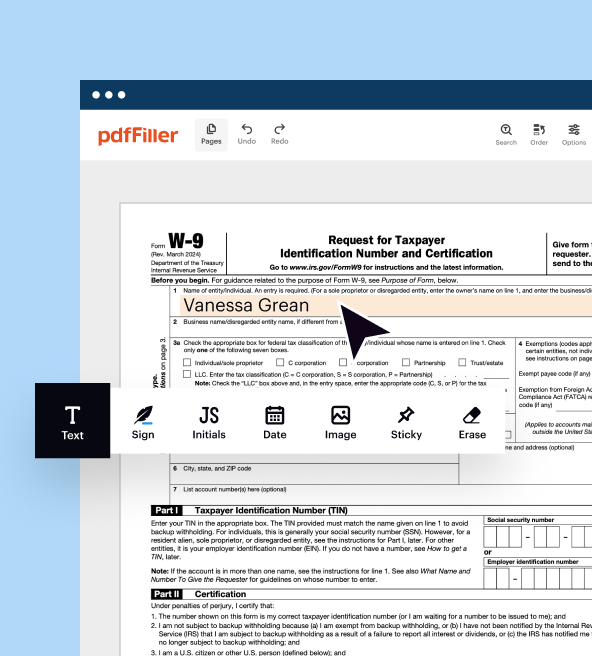

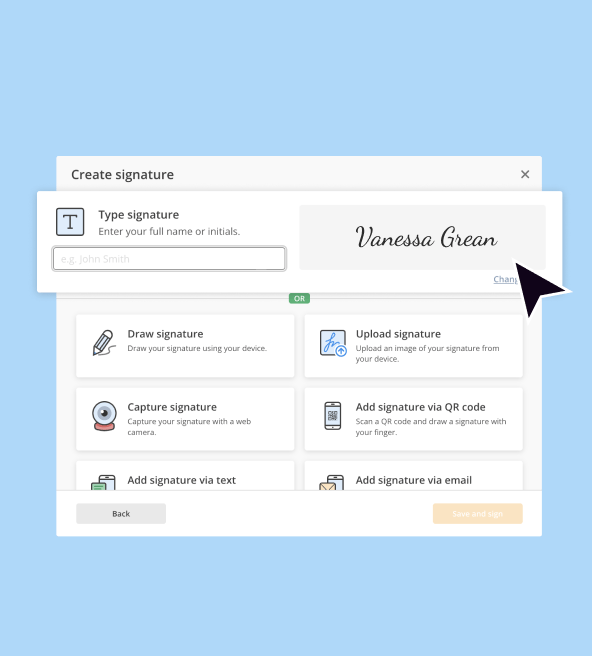

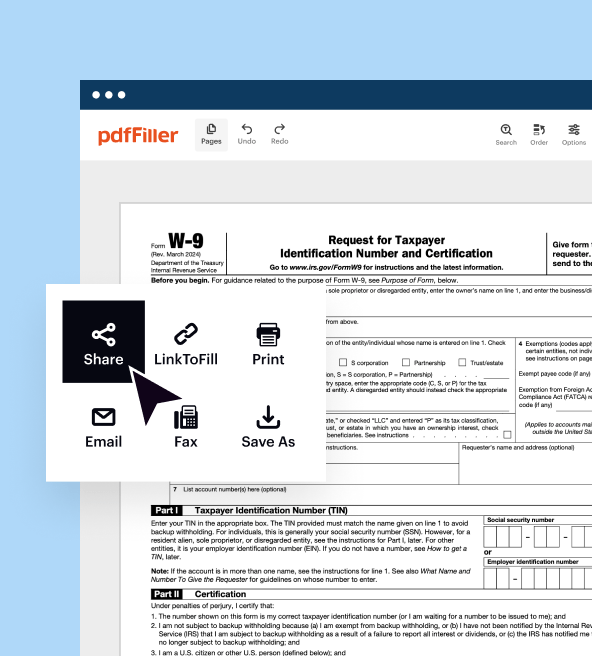

How to edit IRS 1099-A

How to fill out IRS 1099-A

About IRS 1099-A 2012 previous version

What is IRS 1099-A?

What is the purpose of this form?

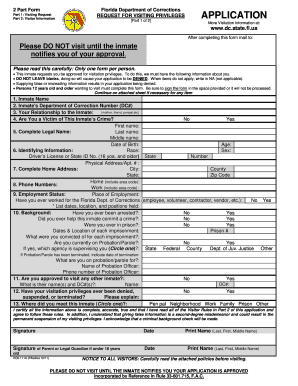

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1099-A

How can I correct a mistake on a submitted 1099 a 2012 form?

To correct a mistake on your 1099 a 2012 form, you need to file a corrected form. This involves completing a new form with the correct information and checking the box indicating it is a correction. Once submitted, keep a copy for your records and note the context of the changes made.

How can I verify the receipt of my 1099 a 2012 form after filing?

To verify the receipt of your 1099 a 2012 form, you can contact the IRS or your e-filing provider to request confirmation. They can provide information regarding the processing status, and it’s advisable to keep any confirmation emails or receipts as proof of submission.

What should I do if I receive a notice from the IRS after filing my 1099 a 2012 form?

If you receive a notice from the IRS, promptly read the correspondence to understand the issue. Gather any necessary documentation related to your 1099 a 2012 form submission and ensure you submit a response or the required adjustments by the specified deadline to avoid further penalties.

Are there any specific e-filing requirements for the 1099 a 2012 form?

Yes, e-filing the 1099 a 2012 form requires that your software be compatible with IRS specifications. Ensure your software allows for the inclusion of all necessary information and check for any technical requirements such as file formats and electronic signature capability to ensure successful submission.

What common errors should I watch out for when filing my 1099 a 2012 form?

Common errors when filing the 1099 a 2012 form include incorrect taxpayer identification numbers, missing information, and inaccuracies in payment amounts. Double-check all entries for completeness and accuracy, and utilize software that can flag common mistakes to minimize errors before submission.

See what our users say