Get the free local service tax employee listing sheet

Show details

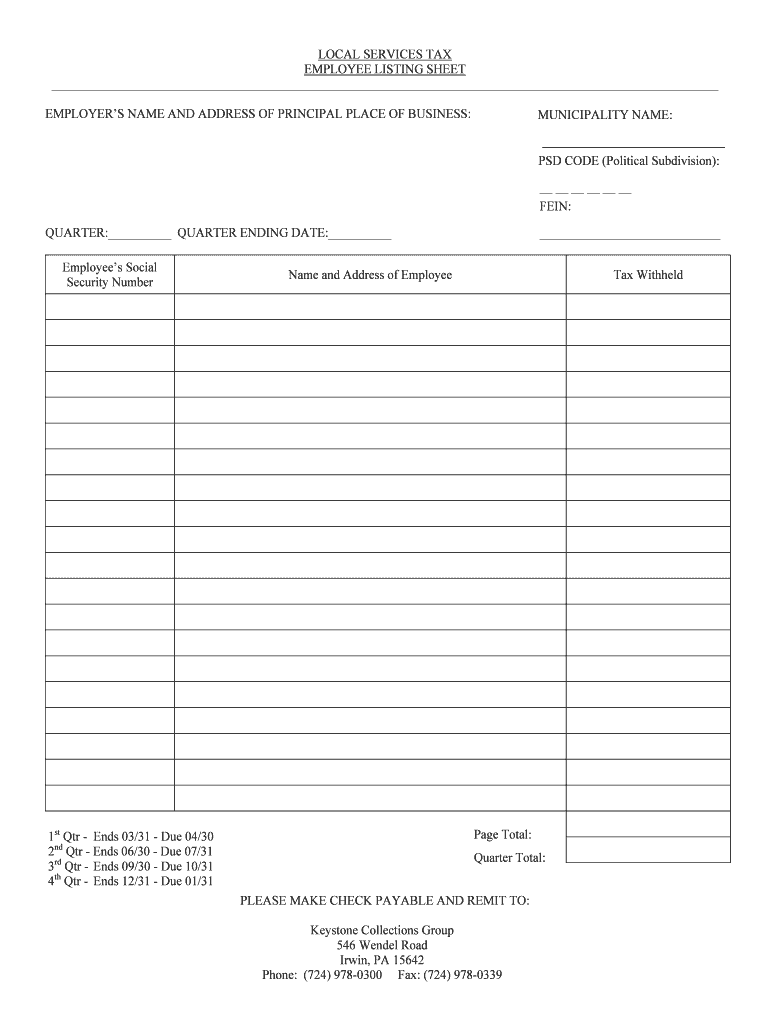

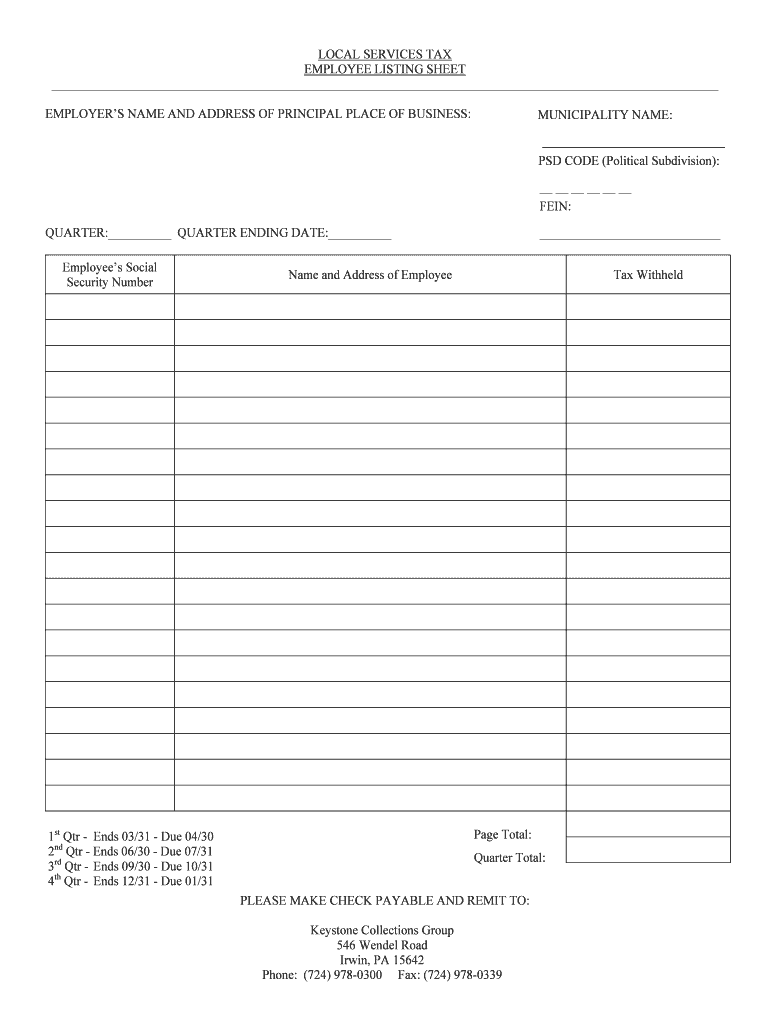

LOCAL SERVICES TAX EMPLOYEE LISTING SHEET MUNICIPALITY NAME EMPLOYER S NAME AND ADDRESS OF PRINCIPAL PLACE OF BUSINESS PSD CODE Political Subdivision FEIN QUARTER QUARTER ENDING DATE Employee s Social Security Number 1st Qtr - Ends 03/31 - Due 04/30 2nd Qtr - Ends 06/30 - Due 07/31 3rd Qtr - Ends 09/30 - Due 10/31 4th Qtr - Ends 12/31 - Due 01/31 Name and Address of Employee Tax Withheld Page Total Quarter Total PLEASE MAKE CHECK PAYABLE AND REMI...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign local service tax employee

Edit your local service tax employee form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your local service tax employee form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing local service tax employee online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit local service tax employee. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out local service tax employee

Point by point instructions for filling out local service tax employee:

01

Gather all necessary information including the employee's personal details (name, address, social security number), employment details (position, start date, wages), and any special circumstances (exemptions, allowances).

02

Obtain the local service tax employee form from your local tax authority or download it from their website.

03

Start by entering the employee's personal information accurately into the designated sections of the form.

04

Provide the employee's employment details in the appropriate sections, making sure to include their position, start date, and wages as specified.

05

If there are any special circumstances such as exemptions or allowances, indicate them clearly on the form by following the instructions provided.

06

Double-check all the information entered for accuracy and completeness.

07

Sign and date the form as required.

08

Submit the completed form to the appropriate local tax authority by the specified deadline.

Who needs local service tax employee?

01

Employers who have employees working within the jurisdiction of a local tax authority that imposes a local service tax.

02

Businesses or organizations that deduct local service tax from their employees' wages and are required to report and remit the tax to the local tax authority.

03

Individuals or entities responsible for ensuring compliance with local tax laws and regulations regarding local service tax.

Fill

form

: Try Risk Free

People Also Ask about

Who has to pay local services tax in PA?

The Local Services Tax is a local tax payable by all individuals who hold a job or profession in the Commonwealth of Pennsylvania. Indiana Borough assesses a total of $52.00 per employee and is deducted in an equal amount per paycheck.

What is LST on PA w2?

The Local Services Tax (LST) for cities in Pennsylvania is withheld on a mandatory basis from the salaries of employees whose duty stations are located in the cities listed below: City. State/City Codes.

What is local service tax?

This is a tax levied on salaries, wages and incomes of all persons in gainful employment and its purpose is to raise additional revenue service delivery in the Capital City.

What is the exemption for local services tax in PA?

The municipality is required by law to exempt from the LST employees whose earned income from all sources (employers and self-employment) in their municipality is less than $12,000 when the combined rate exceeds $10.00.

Who has to pay LST tax in PA?

The Local Services Tax is a local tax payable by all individuals who hold a job or profession within a taxing jurisdiction imposing the tax. It is due quarterly on a prorated basis determined by the number of pay periods for a calendar year.

Who is exempt from Pennsylvania local services tax?

Political subdivisions must exempt from the LST: (1) members of a reserve component of the armed forces called to duty and (2) honorably discharged veterans who served in any war or armed conflict who are blind, paraplegic, or a double or quadruple amputee as a result of military service or who are 100% disabled from a

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the local service tax employee in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your local service tax employee and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I fill out the local service tax employee form on my smartphone?

Use the pdfFiller mobile app to fill out and sign local service tax employee on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

How do I complete local service tax employee on an Android device?

On an Android device, use the pdfFiller mobile app to finish your local service tax employee. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is local service tax employee?

A local service tax employee refers to an individual who is subject to local service tax obligations based on their employment within a specific municipality or local jurisdiction.

Who is required to file local service tax employee?

Employers with employees who perform work or services within a local jurisdiction that imposes a service tax are required to file local service tax employee returns.

How to fill out local service tax employee?

To fill out local service tax employee forms, an employer must provide employee information, wages paid, and the applicable service tax calculations based on the locality's regulations.

What is the purpose of local service tax employee?

The purpose of local service tax employee is to collect revenue for local governments to fund public services and infrastructure projects that benefit the community.

What information must be reported on local service tax employee?

The information that must be reported includes employee identification details, total wages, local service tax withheld, and any exemptions or credits applicable.

Fill out your local service tax employee online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Local Service Tax Employee is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.