FL DoR DR-228 2011 free printable template

Show details

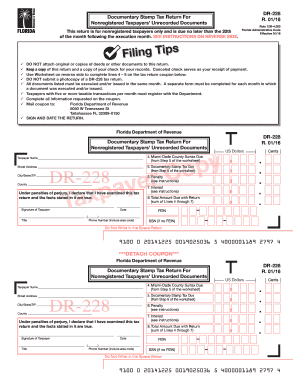

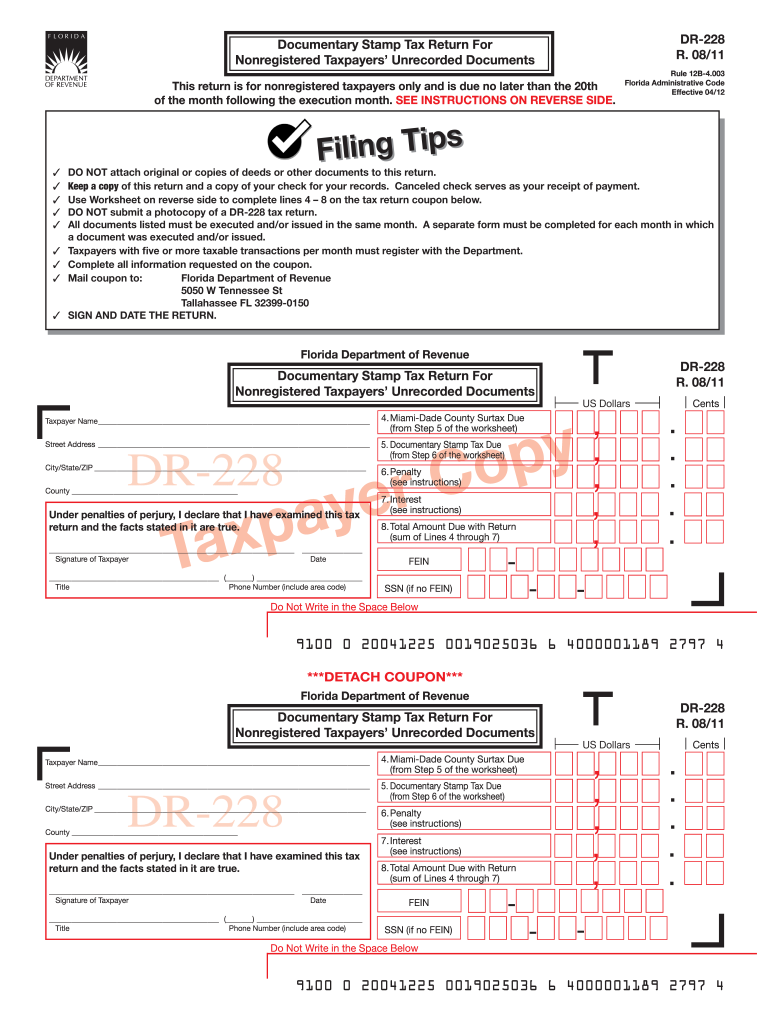

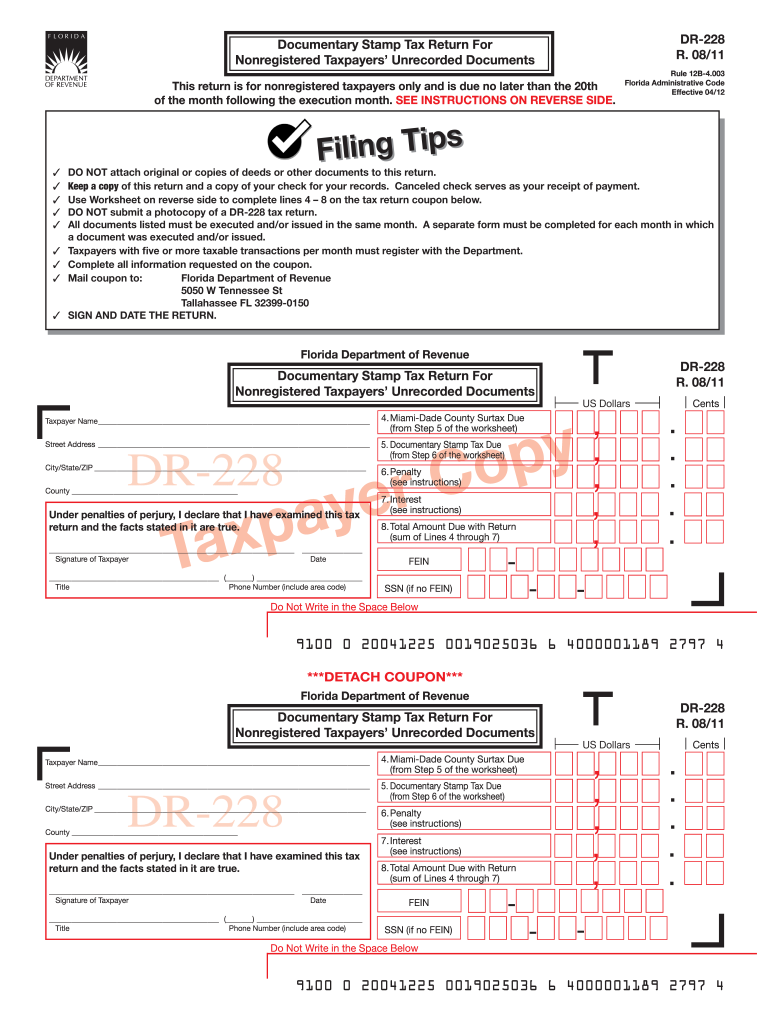

DO NOT submit a photocopy of a DR-228 tax return. All documents listed must be executed and/or issued in the same month. A separate form must be completed for each month in which a document was executed and/or issued. Taxpayers with five or more taxable transactions per month must register with the Department. Complete all information requested on the coupon. Mail coupon to Florida Department of Revenue 5050 W Tennessee St Tallahassee FL 32399-0150 SIGN AND DATE THE RETURN. Taxpayer Name...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign form dr 228 2011

Edit your form dr 228 2011 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form dr 228 2011 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form dr 228 2011 online

Follow the steps below to use a professional PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit form dr 228 2011. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

FL DoR DR-228 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out form dr 228 2011

How to fill out FL DoR DR-228

01

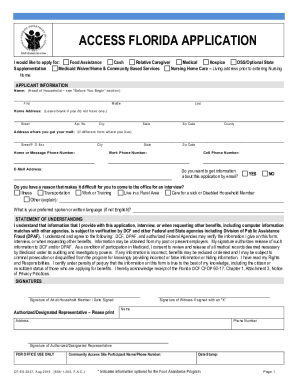

Obtain the FL DoR DR-228 form from the Florida Department of Revenue website or local office.

02

Begin by filling in your personal information, including your name, address, and contact information at the top of the form.

03

Provide the details of the tax period for which you are filing the return.

04

Complete the sections related to income and deductions as instructed in the form guidelines.

05

Calculate the totals for your income and deductions, and enter these amounts in the designated fields.

06

Review the form for any missing information or errors.

07

Sign and date the form to certify that the information provided is accurate.

08

Submit the completed form to the appropriate Florida Department of Revenue office by the specified deadline.

Who needs FL DoR DR-228?

01

Taxpayers in Florida who are reporting their tax information for the specified tax period.

02

Individuals or businesses seeking to claim reductions or exemptions on their taxes.

03

Anyone required to file a tax return with the Florida Department of Revenue.

Fill

form

: Try Risk Free

People Also Ask about

How do I avoid documentary stamp tax in Florida?

Documentary stamp tax is payable by any of the parties to a taxable transaction. If one party is exempt, the tax is required of the nonexempt party. United States government agencies; Florida government agencies; and Florida's counties, municipalities, and political subdivisions are exempt from documentary stamp tax.

Who is exempt from Florida documentary stamp tax?

United States government agencies; Florida government agencies; and Florida's counties, municipalities, and political subdivisions are exempt from documentary stamp tax.

How do I get a documentary stamp?

Mandatory Photocopy of the document to which the documentary stamp shall be affixed. Proof of exemption under special laws, if applicable; Proof of payment of documentary stamp tax paid upon the original issue of the stock, if applicable.

What is a DR 228 form?

This form is for nonregistered taxpayers reporting documentary stamp tax on unrecorded documents. Every person who executes or issues instruments described below and has less than five taxable transactions per month may report documentary stamp tax using this tax return.

How is the documentary stamp tax rate usually calculated?

The tax is based on the full amount of the indebtedness secured by the mortgage or lien regardless of whether the indebtedness is contingent or absolute. The rate of tax is 35 cents per $100 or portion thereof of the amount secured thereby.

What is the minimum tax for Florida documentary stamp taxes?

The Florida documentary stamp tax is a real estate transfer tax. The Florida documentary stamp tax is applied at a rate of $0.70 per $100 paid for the property in every county except Miami Dade, where it is $0.60 per $100.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my form dr 228 2011 directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your form dr 228 2011 as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How can I modify form dr 228 2011 without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like form dr 228 2011, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I fill out form dr 228 2011 using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign form dr 228 2011 and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is FL DoR DR-228?

FL DoR DR-228 is a form used by the Florida Department of Revenue for reporting and documenting certain tax-related information.

Who is required to file FL DoR DR-228?

Individuals or businesses that meet specific criteria set by the Florida Department of Revenue, such as those involved in certain financial transactions or industries, are required to file FL DoR DR-228.

How to fill out FL DoR DR-228?

To fill out FL DoR DR-228, complete the required fields with the necessary information as specified by the Florida Department of Revenue instructions, ensuring accuracy and completeness before submission.

What is the purpose of FL DoR DR-228?

The purpose of FL DoR DR-228 is to provide the Florida Department of Revenue with crucial financial information that aids in tax assessment and compliance.

What information must be reported on FL DoR DR-228?

The information reported on FL DoR DR-228 includes details about income, deductions, credits, and any other financial data as required by the form's guidelines.

Fill out your form dr 228 2011 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form Dr 228 2011 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.